If you took a look at the gains from the stock market, one could conclude that investors are optimistic of the future. Afterall, markets are forward looking and they use stock prices as a way to reflect both corporate and economic growth expectations.

However, equity investors are not always the most prudent bunch. At times they can fall subject to a speculative fever and the market can become the wild west. So, is there another indicator that investors can use to check whether this level of optimism can be supported? We suggest looking at corporate bond spreads.

First, what is a corporate bond spread? A corporation normally pays investors a higher interest rate to issue a bond than the government treasury does. This is because the treasury is seen as ‘risk free’ and corporate issuers have a higher level risk on a relative basis.

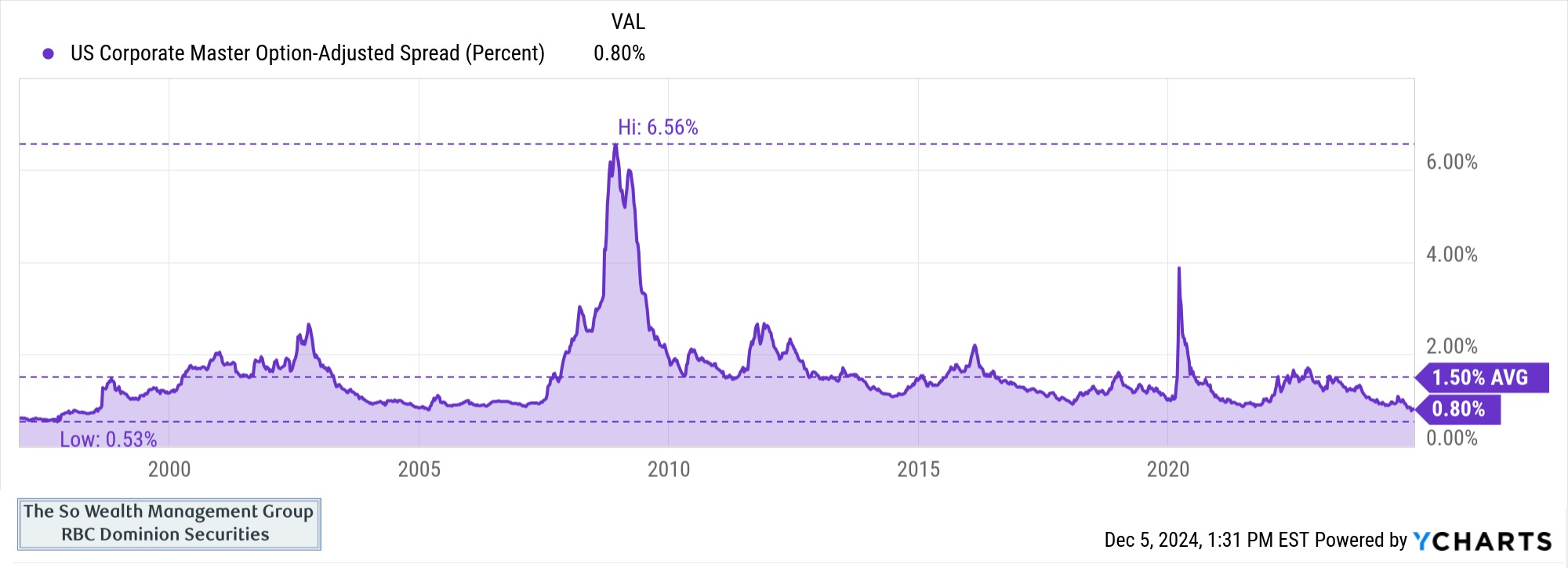

In the chart below you can see the history of spreads for high quality corporate bonds. As the chart indicates, corporate bonds have on average paid 1.5% more than a treasury bond. It is now well below this historical average at 0.80%. Investors have not seen spreads this low since the mid 1990s. This implies a lot of confidence in corporate balance sheets, cash flows and earnings. Moreover, this reflects a level of optimism that goes beyond just 1 or 2 years. The average duration of these bonds is 8-9 years, which implies a long tail projection of good news.

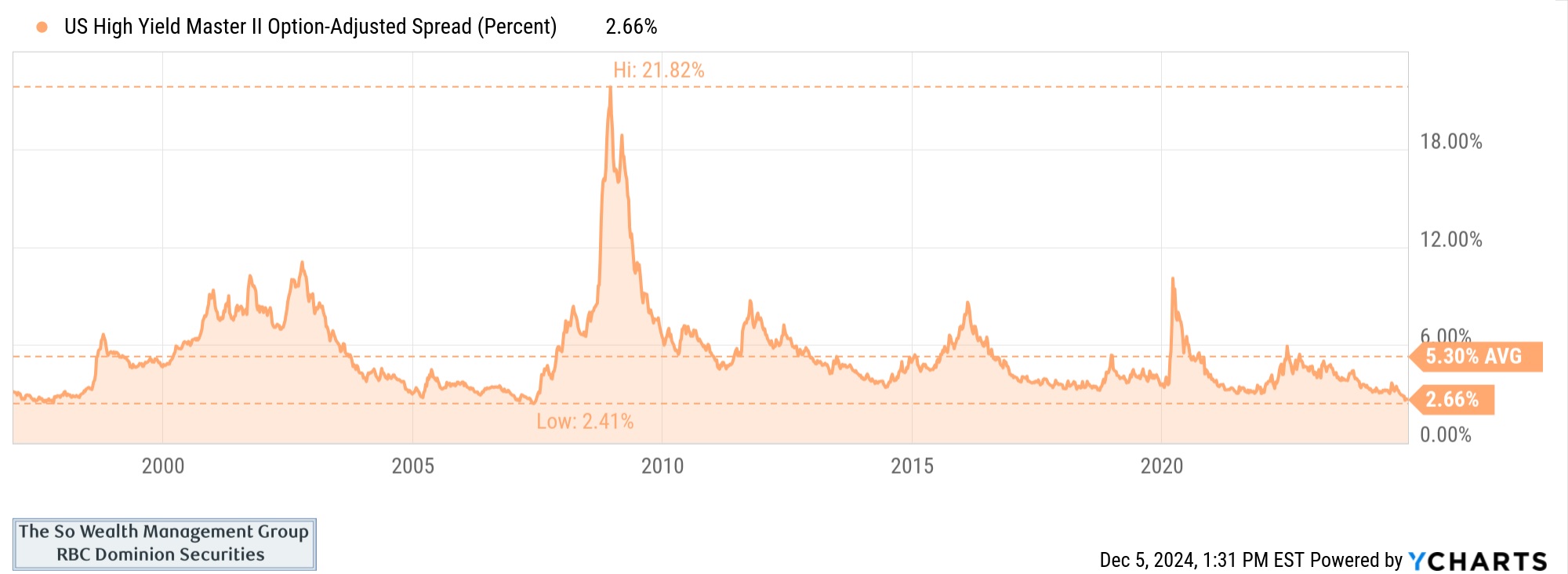

High yield bonds are telling the same story - a current spread of 2.66% versus the long term average of 5.30%. “High Yield” bonds are considered debt from lower quality corporations and therefore command even higher interest spreads above the treasury to compensate for the risk. However, these spreads are at record lows, back to levels we did not even see during the economic booms of the mid-90s and 2010s. You have to go back a long way to see spreads this low.

The bond market is supposed to be a more risk averse cohort that is fixated on the health and viability of a company’s ability to pay their debt. These spreads are indicating to investors that they see blue skies ahead for profits, margins and the economy.

Could the bond market be wrong? Of course. It’s possible that the bond market’s optimism has been influenced by the roaring stock market and its narratives of AI and increased productivity. However, the bond market is not as skewed to technology as the stock market. Rather, the biggest corporate bond issuers are traditionally companies from these sectors: financials, industrials, consumer staples and consumer discretionary. This is a more classic mix of economically sensitive groups and therefore, at the minimum, these low bond spreads do reflect a general pervasive level of optimism for the economy.