On November 5, 2024, Americans voted for Donald J. Trump as the 47th President of the United States of America. Contrary to the polls leading up to the election, it wasn’t a tight race. He had a clean sweep. The strong election results have resolved uncertainty among investors and sent the stock market higher on the next trading day.

RBC’s Chief Economist, Eric Lascelles shares his thoughts on the post-election day landscape and provides some highlights on what to expect next. Watch the video: 2024 U.S. Election Highlights. Here are some of Eric’s comments:

“…(under) a Republican sweep of the white House and House of Representatives and Senate, … it's easier just to do things and to spend money or to cut taxes and so on."

“Historically, Republican sweeps have been fairly positive for the stock market."

“We're not anticipating large scale deportations in the US. We're not anticipating the full set of threatened Trump tariffs to be implemented.”

“We're not convinced that the Federal Reserve or the civil service will be sharply undermined…”

“…deregulation do stand to be an economic positive, friendlier policy toward the oil sector is also something that could prove economically supportive…”

“We don't think that the deficit leaps higher here.”

“… it …remains a higher stock market, higher bond yields, and a stronger U.S. dollar.”

RBC Global Asset Management's investment philosophy:

“We are long term investors. We invest over the span of multiple election cycles, and presidents are temporary.”

“…there are plenty of other things that matter…to investors beyond election outcomes. Historically, elections aren't the dominant driver of markets….whether we pull off this soft landing, it's looking pretty good. That's actually a tailwind for the moment.”

“…much of our investing is based on how corporations do, and some of that is influenced by policy, but most of it is actually influenced by simply their own innovation and their own decision making.”

Thoughts from other major news and media sources:

The Economist

The return of Trumponomics excites markets but frightens the world. It may bring stronger growth, higher inflation and a global trade war.

The New York Times

Nobel Prize Laureate Paul Krugman argues that the new president-elect’s economic plan “is the most inflationary program probably that any American president has ever tried to implement.”

There are a few big reasons why Trump’s plan looks seriously inflationary. One is he is going to explode the deficit. Second thing, tariffs. Third thing is crackdown on undocumented immigrants. And finally, there’s what he wants to do with the Federal Reserve.

The Wall Street Journal

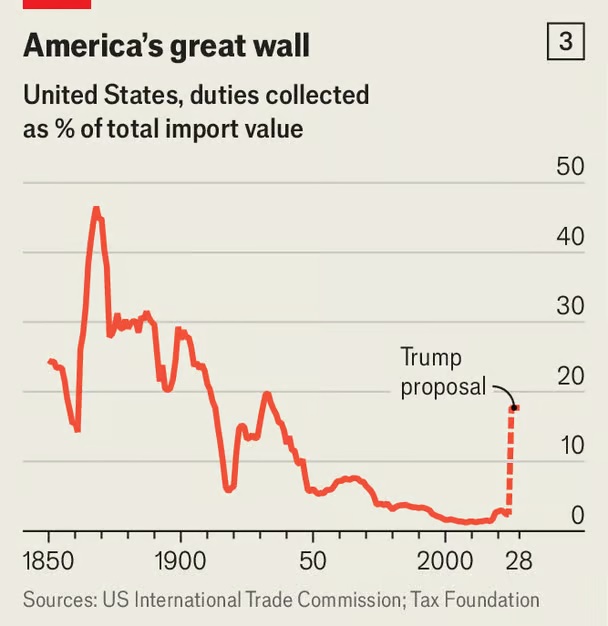

Trump’s Tariffs Would Smother His Economic Successes

A minimum 10% levy on all goods would hike domestic prices, reduce wages and invite foreign retaliation.

Donald Trump hopes to supercharge economic growth, restore manufacturing employment, and raise wages by imposing across-the-board tariffs of at least 10%, with even higher duties (60%) on Chinese goods.

The Financial Times

The Trump challenge for Europe: An isolationist US will force the continent to rethink its defense and economy.

GZERO Media (Ian Bremmer)

America has spoken. Donald Trump will become president of the United States again. And I can’t say that I’m surprised.

This election comes at a time when people all over the world are unhappy with where their countries are going, and they don’t trust their political institutions to right the ship. Some of that is a product of the deepening geopolitical recession, which is in part driven by a backlash against globalization and the globalist elites who promoted their own economic and political interests at the expense of their populations. Some of it has to do with the economic and social disruption caused by post-pandemic surges in inflation and immigration.