Later this week, the US Fed is expected to lower interest rates and embark on a new fed cutting cycle. The Fed Fund rate of 5.25-5.50% has been held steady since July of 2023. This has become one of the longest stretches between the last rate increase and the first rate cut. Clearly, this tracks the Fed’s intention to leave rates “higher for longer”.

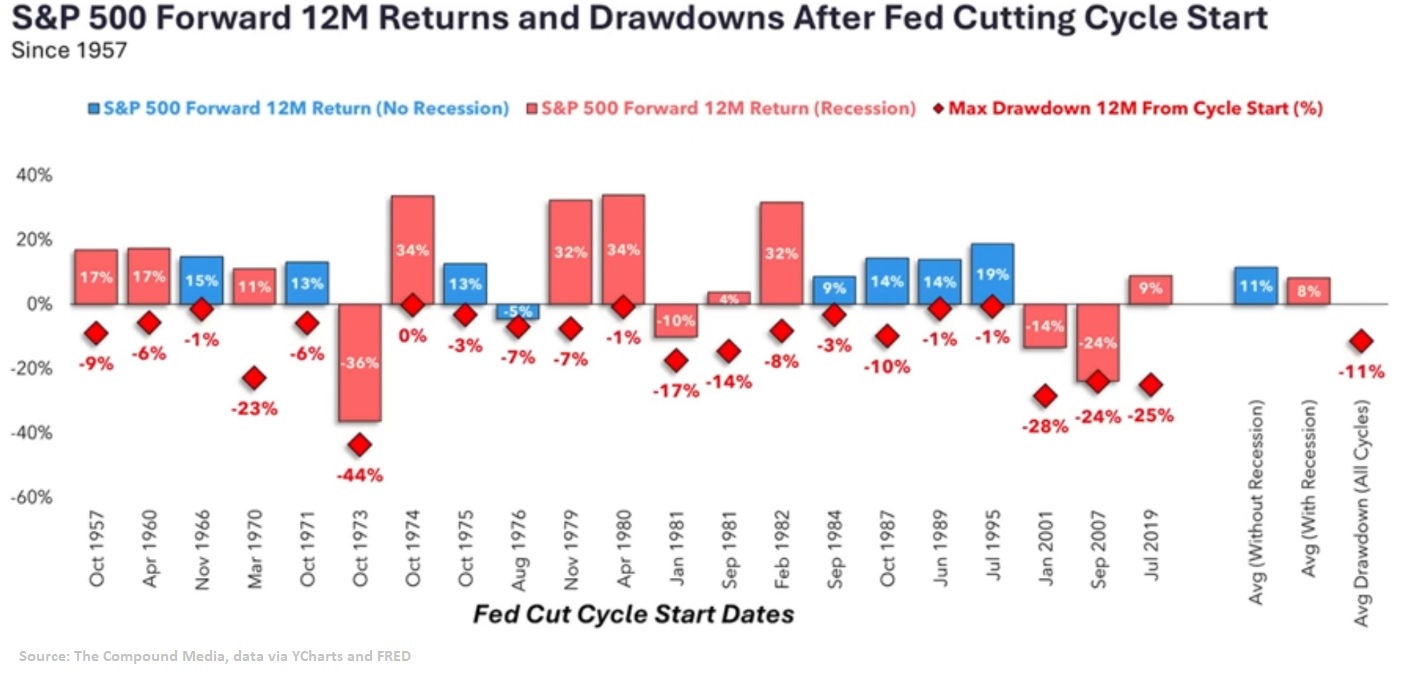

The idea of lower interest rates and less pressure on consumers and borrowers are welcome to many. However, in the short term, some investors recall historically poor stock market performance at the commencement of a cutting cycle. Since 1958 there has been 21 rate cutting cycles; And within the twelve months after the start of a rate cutting cycle, markets have experienced an average drawdown of -11%.

That said, further segmentation of this data is required. The chart below separates interest cutting cycles that have occurred during a recession (red bars) or during a no-recession environment (blue bars). The red diamonds show the max drawdown within 12 months of the first rate cut.

The insight gained from this chart is that it is extremely important to distinguish the reason for rate cuts. If rate cuts are used to fight a recession, the weaker environment has led to less favorable returns and greater drawdowns. However, if interest rate cuts occur within a resilient economy, results are more favorable. Afterall, the Fed may be simply right-sizing interest rates and getting closer to what they perceive as the neutral rate.

In rate cutting cycles with a recession, average 12 month forward returns were still +8%; however investors had to first get through an average drawdown of -16%. In the cutting cycles with no-recession, average 12 month forward returns were +11% with an average drawdown of -4%. The two key takeaways are that markets rose in both scenarios and rate cuts without a recession provided favorable risk and return outcomes.

Although profit taking on outsized positions is always prudent for diversified long term investors, we believe portfolios can maintain their target equity weight. In our view, the Fed is embarking on a rate cutting cycle outside of a recessionary scenario as GDP, unemployment, consumer spending data continues to show resilience.