As the Federal Reserve approaches the beginning of a rate-cutting cycle, history suggests that both stocks and bonds have performed well after the onset of monetary easing. However, the performance of equities has shown greater variability compared to bonds. Given the current mixed economic signals, it is prudent for investors to adopt a cautious approach, focusing on high-quality assets in their portfolios.

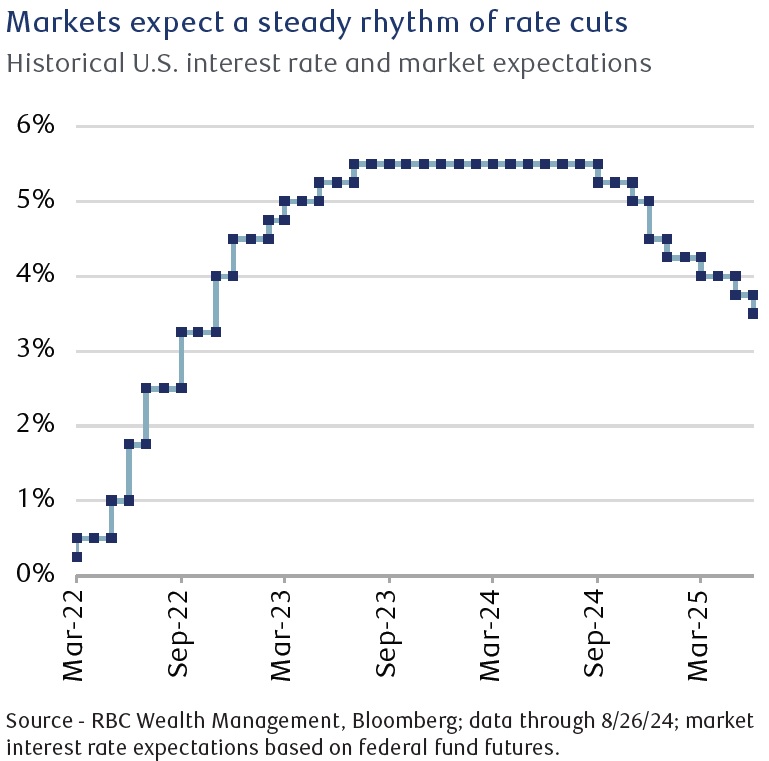

The anticipation of rate cuts is driven by a growing confidence that inflation is on track to stabilize near the Fed’s 2% target, coupled with signs that labor market conditions have achieved a more balanced state. This has allowed the Federal Reserve to clearly signal that rate cuts are imminent. Markets are broadly expecting the Fed to deliver a 25 basis point (bps) cut in September, with an additional 175 bps of cuts priced in through June 2025. This series of cuts would lower the upper bound of the policy rate to 3.50% from the current 5.50% over the next 10 months.

However, whether this expected easing materializes depends largely on incoming economic data, particularly inflation figures. Historically, rate cuts of more than 150 bps year over year are rare outside of recessionary periods. Despite a disappointing jobs report in early August, subsequent data—including figures on inflation, income, and consumer spending—indicate that the U.S. economy is transitioning into a phase of slower but steady growth. Notably, wage gains have outpaced inflation since the first quarter of 2023, bolstering household spending, which accounts for approximately 70% of U.S. GDP. The Atlanta Fed’s GDPNow model is currently forecasting 2.0% growth in U.S. real GDP for the third quarter of 2024, aligning closely with the average growth rate of the first two quarters of the year.

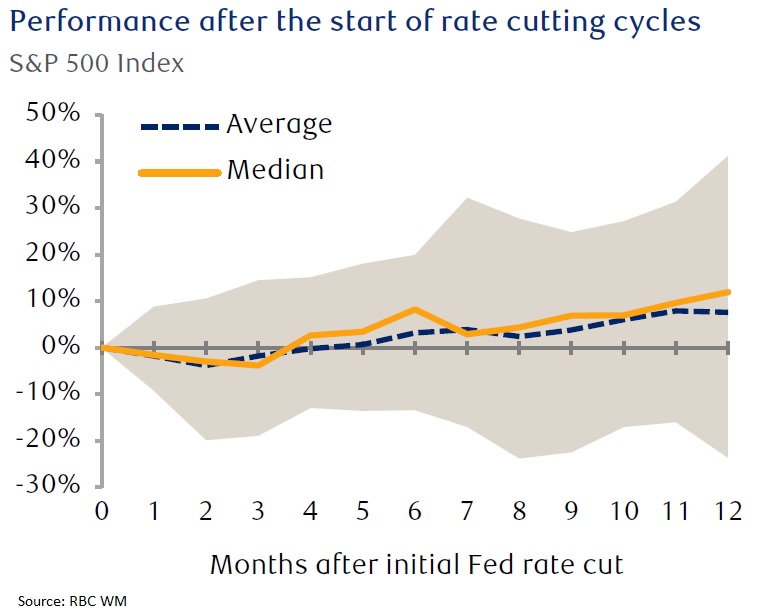

Equities after the first rate cut

When examining the performance of equities following the first rate cut in previous easing cycles, data from the past 11 such instances since 1970 reveal that the S&P 500 has often delivered positive returns in the 12 months following the initial rate cut, with a median price return of 11.9%. However, the economic context surrounding the rate cuts is crucial in determining the outcomes. In cases where rate cuts successfully prolonged economic expansion and supported corporate earnings growth, equities have generally performed well. Conversely, when monetary easing was insufficient to avert an economic downturn, equities have typically suffered losses in the 12 months after the first rate cut as corporate profits came under pressure.

It is important to note that no two Fed easing cycles are identical, and the conditions at the start of each cycle likely play a significant role in shaping market trajectories. If the Fed initiates the rate cut cycle in September, it may do so when the S&P 500 is near all-time highs, with elevated valuations, and just two months before a presidential election. On the other hand, the recent economic data suggests that the U.S. economy is on relatively solid footing, which, if sustained, could support continued corporate profit growth—a positive signal for equities in the coming quarters.

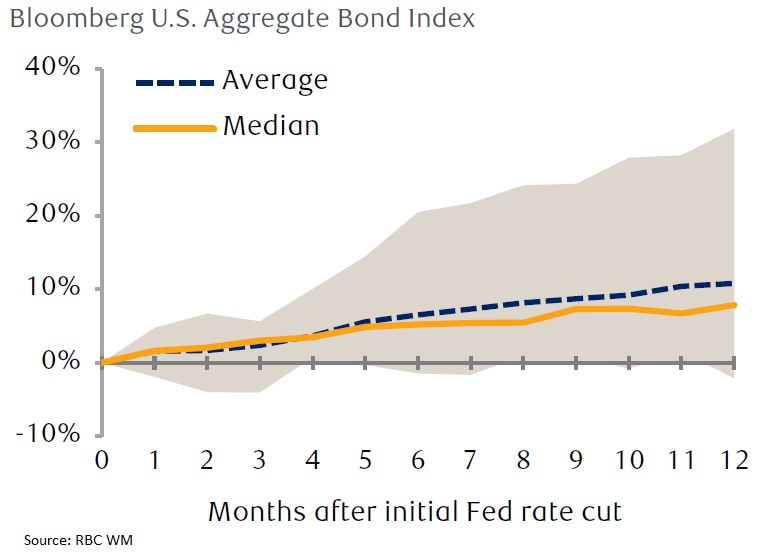

Bonds after the first rate cut

In contrast, the performance of high-quality bonds during past Fed easing cycles has been more consistent. Data from the nine instances since 1980, for which bond index returns are available, show that high-quality bonds have historically delivered a median total return of 7.9% in the 12 months following the first rate cut. While the upside potential for bonds is generally more moderate compared to equities, their performance has tended to be more positive, with fewer instances of negative returns. In three of these nine cycles—specifically in 1981, 2001, and 2007—bonds outperformed the S&P 500, coinciding with U.S. recessions and equity bear markets. On average, however, bonds underperformed the S&P 500 by 4.2% in the 12 months after the start of rate cuts, and by 0.4% on a median basis.

Given these observations, it is clear that navigating the shift to monetary easing requires a nuanced approach, with a focus on the specific economic conditions driving each cycle. While the balance of evidence currently aligns with market expectations of a “soft landing”—characterized by resilient economic growth, steady inflation near target levels, and a Fed that begins cutting rates—the precise number of rate cuts may be less important than the overall direction of interest rates. The visibility that rates are heading lower should provide a constructive backdrop for both stocks and bonds.

However, it is essential to monitor conflicting signals about the strength of the U.S. labor market closely. Distinguishing between an economy experiencing a mid-cycle slowdown and one gradually slipping into recession is challenging in real-time. With valuations across asset classes appearing to price in a “soft landing” as the base case, focusing on quality remains a prudent strategy. In equities, this means prioritizing companies with strong fundamentals that are better positioned to withstand a slowing economy. In fixed income, emphasizing higher-quality corporate and government bonds, along with extending duration, can enhance the defensive qualities of portfolios, providing a buffer during periods of market volatility.