In a previous blog, Afraid of All Time Highs?, we reviewed the historical data that dispels the notion that investing at all-time highs inherently leads to corrections and lower returns. Rather, all-time highs occur more often than most believe and have provided strong returns as they typically occur within strong corporate and economic environments. With that in mind, we believe all-time highs should be evaluated under the lens of valuations. Looking at prices simply tells you how much something costs. Looking at valuations tells you whether something is expensive.

Since the market lows of October 2022, the forward P/E multiple of the S&P500 went from 15.2X to 20.2X. This compares to an average of ≈17X over the past 30 years. Hence, some investors worry about investing at both a premium valuation and all-time highs. However, it is important to note that the rise of tech-related companies have skewed valuations higher. In 1994 this segment made up only 8% of the index, but now accounts for almost 45%! Due to the skew towards mega cap technology companies, one can adjust for this distortion by focusing on an equal-weighted S&P500 index and looking at the median P/E. From this angle, we see a multiple of 17.1X , which is still below the 1 standard deviation band of 18.2X. In our view, only crossing meaningfully above this band would signal an unsustainable condition. At this point, we are not there.

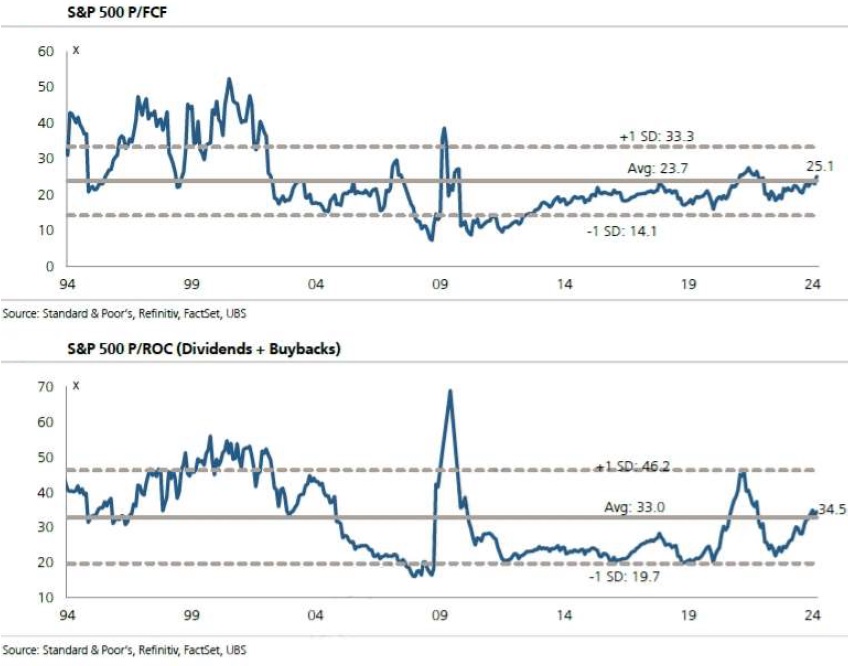

Although P/E multiples garner the most headlines, Price to Free Cash Flow (P/FCF) and Price to Return of Capital (P/ROC) can act as further indicators of value. From the charts below, one can see that P/FCF and P/ROC multiples are essentially at their long term average. In other words, from these angles, valuations still look reasonable.

Ultimately, some investors will prefer to stick with the traditional measure of P/E. Using an equal weight P/E or Free Cash Flow or Return of Capital metrics may be out of their comfort zone. If that is the case, investors are unquestionably faced with the fact that the the P/E is over 1 standard deviation above its long term average. To stay invested, one needs to justify owning stocks at a premium. Should equity prices continue to rise, we offer the following potential explanation.

Making the Case

Although stocks are at all-time highs, corporate earnings and free cash flows are also at all-time highs. Since stocks tend to follow the direction of corporate profits, prices can continue to rise with corporate earnings. To further build confidence , expectations in 2025 are for every sector to post positive earnings growth.

Furthermore, the demand for stocks should continue with the fed about to embark on interest rate cuts, high yield bond spreads still below their historical average and $6 Trillion of cash on the sidelines; And given that stock multiples tend to expand during recoveries and drift higher through to mid-cycle, the S&P500’s multiple may have room to rise or at least be maintained along strong earnings. Finally, we think it is reasonable to suggest that the companies that exist today are simply better managed and higher quality businesses than those of the past. The ones left standing have survived financial crises, sovereign debt crises, oil booms and busts, trade wars, a pandemic, hyperinflation, and an unprecedented rate hiking cycle. With the above in mind, one must decide for themselves whether they can justify owning stocks at these levels.