With higher interest rates, it should be expected for consumers to feel stretched and question their ability to maintain their spending. Many Canadians have a high level of household debt, which makes them more vulnerable to a high interest rate environment. Upon closer inspection, approximately 74% of the $2.9 trillion household debt are in the form of mortgages. With rates increasing, Canadians are projected to allocate a greater share of their income – from 13.6% in 2020 to 15.4% as of Q2 2023 – to paying their debt.

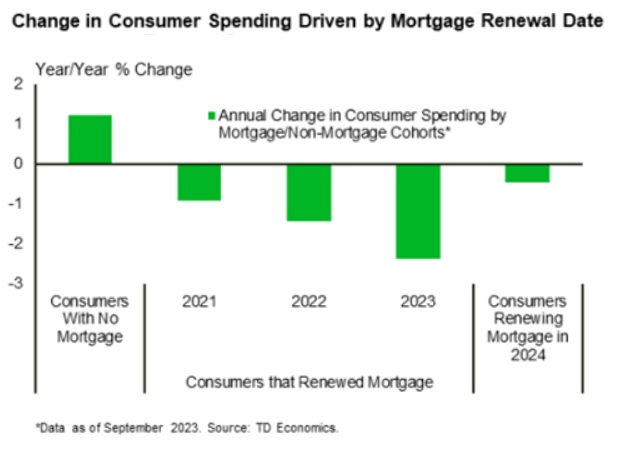

According to TD Economics, ever since rates started increasing in the beginning of 2022, mortgage holders have reigned in their spending by approximately 1%, which equates to approximately $6 billion of reduced spending in the economy. Individuals with mortgages resetting in 2023 saw the biggest pullback in consumption as they were the most recent cohort to be impacted by the high rates. For those individuals with mortgages renewals in 2024, the expectation is for their spending to be reduced at a greater pace unless interest rates decline in a dramatic fashion. For consumption to remain strong, the country will be relying on the 65% of Canadians that do not have mortgages (ie. homeowners or renters) to support the backbone in spending. As depicted in the chart below, over the past year, these consumers have been able to increase their spending.

Time will tell whether consumption will be derailed as mortgages are reset at higher interest rates. While the above findings suggest that Canadian consumers are becoming increasingly strained, it is important to keep in mind that a majority of Canadian households do not have a mortgage and thus their spending will likely stay in growth mode in the quarters ahead, thanks in part to continued job creation and wage gains. With the Canadian economy already in a fragile state, it will be up to these consumers to keep Canada from falling into a recession. As such, the underperformance of the TSX relative to the major US indexes appears justified. That being said, this simultaneously sets up the opportunity for Canada to catch up, as the Bank of Canada may also be closer to cutting interest rates to support and bolster the economy.