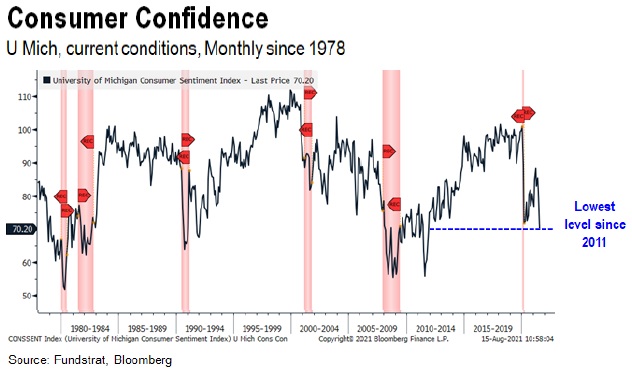

The narrative surrounding COVID is constantly changing as the population moves in and out of different ‘waves’ throughout the past year and a half. After the announcement of effective vaccines, consumers had great expectations of having life back to ‘normal’. Unfortunately, the Delta variant has poured cold water on this notion. The latest University of Michigan Consumer Confidence Index showed that consumer confidence is currently at the lowest level in a decade. The reading is now lower than anytime during the COVID pandemic and even lower than the period between March to May 2020 when the US was in full lockdown. Taking a step back, this is a bit of a head-scratcher as in early 2020 there was no vaccine on the horizon and mortality got as high as 8% (1 in 12 confirmed cases). Currently, there is over 70% of US adults with at least 1 vaccine dose and the mortality for vaccinated Americans is <0.04% (1 in 2,500 confirmed cases).

The feeling of “let down” and surprise for Americans appears to be extreme as this was also the 5th largest 4-month decline in consumer confidence in 45 years. Only the Eve of the Gulf War (Oct 1990), Hurricane Katrina (Oct 2005), the Great Financial Crisis (May 2008) and the start of the Global Covid-19 pandemic (April 2020) showed larger declines. This is may be understandable as the rise in US hospitalizations surpassed both the first and second wave figures leading to a more disheartening outlook. As a result, 2Q21 real GDP only grew at a 6.5% q/q seasonally adjusted annual rate, which falls short of the consensus estimate of 8.5%.

With all this said, the question that we ask ourselves is “how quickly could this confidence level change”? Recent reports are showing that the daily covid cases of 18 states may be starting to peak. This includes states like Florida which had not implemented any new covid restriction protocols and have already experienced its’ back-to-school season that started in mid-August. On a national basis, investors should also welcome the news that the 7-day Delta in Daily Cases (7D Avg) is also on a flattening trend and that the 'positivity rate' is peaking at around 9%, which is well short of the 15% level seen during the 3rd wave. Given that there is little consumer and political appetite for economic lockdowns, it is encouraging to see that daily vaccinations have also jumped higher in response to the Delta variant. Public policy appears to be one of “vaccinating” their way out of this pandemic. A rise in the "unvaxxed" seeking vaccinations has also contributed to the rise in daily vaccinations to 1 million doses per day, which is up more than 70% relative to early July. This number could increase with the full approval of the Pfizer vaccine granted by the FDA, which has given businesses, universities, and government institutions the confidence to require employees to be vaccinated. Fortune.com has compiled a list of notable companies that require proof of vaccinations including Microsoft, Disney, and Chevron. The full list can be viewed here. Finally, to the surprise of many, we even saw former President Trump recommend his supporters to get vaccinated at an Alabama rally last weekend.

Taken all together, the ingredients for a narrative change to a more positive tone are in sight. The timing of a sentiment and consumer confidence shift is difficult to predict, however, as witnessed throughout the covid-era of investing, markets and momentum can change quickly. A narrative of pent up demand, back-to-school-and-work shopping, and holiday spending is hopefully just around the corner.