The pandemic has impacted all sectors around the world. One sector that has been hit particularly hard has been charities. Two-thirds of charities have experienced a 31% decrease in revenues but the demands for their services have not gone down. With lower revenue dollars and increasing costs, many charities are finding it tougher to navigate the “new normal”.

Many businesses have adapted to the pandemic by upgrading technology and changing their ways of doing business by investing into infrastructure. Many not-for-profit organizations do not have this luxury as they operate on razor-thin margins, which can make capital investments in technology more challenging. Instead, charities are forced to go on ‘survival mode’, continuing services that are viable while stopping some that are no longer sustainable. This in turn affects the most vulnerable that are in need.

COVID-19 has impacted many people but the magnitude has not been universal. The majority of Canadians are adjusting to new routines by using technology for work and social events. For those marginalized communities who cannot afford those changes, they are the first to put their health on the line to keep their jobs. Moreover, their struggles with food and shelter insecurities have increasingly led them to turn towards charitable goods and services. The importance of charities cannot be understated during this unique time. The Toronto Daily Bread Food Bank has reported that their demands have increased by 300% since the pandemic began.

This pandemic has also coincided with a 10+ year bull market that has led many investors to accumulate large unrealized capital gains. Right now, investors have a great opportunity to help in a time of need while also generating huge tax savings by donating securities in-kind.

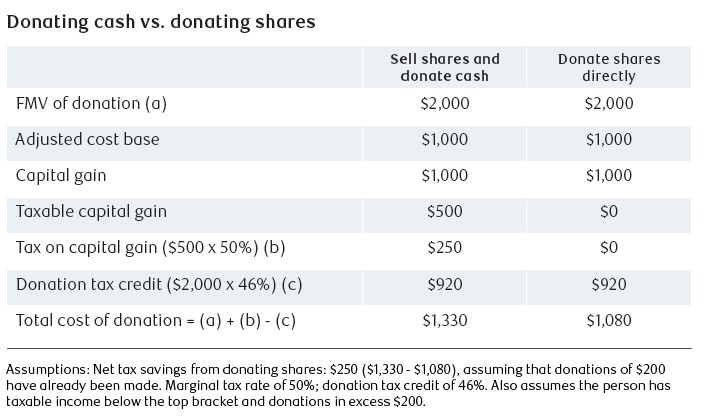

It is always more favourable to donate securities ‘in-kind’ as opposed to selling the securities, generating a taxable capital gain, and donating the after-tax proceeds. If you donate the securities in-kind, no capital gain tax will be triggered which means more of your money goes to the cause you support while saving you more taxes at the same time.

The general rule to remember when making any charitable donation is that a Canadian taxpayer can claim a charitable donation of up to 75% of their income (or 100% in the year of death or earlier). The excess can be carried forward for up to five years. The donation tax credits vary from province to province but any amount over the initial $200 could provide a tax credit upwards of 50% depending on your tax bracket and the federal and provincial credits combined.

It is important to consult with your advisor to determine the most appropriate securities to consider donating in-kind. There are many charitable giving strategies (i.e. starting a charitable foundation) that can amplify the impact of your generosity. Therefore, it is important to speak with your advisor to ensure you embark on a charitable giving strategy that maximizes your impact with the added benefit of saving taxes.