This week’s announcement of Pfizer and BioNTech’s Phase 3 Covid-19 vaccine was great news for a world that has been held hostage to the virus for most of 2020. For the first time, we have been given evidence towards a concrete solution rather than just precautionary protocols that aim to reduce the spread of infection.

This joint vaccine trial consists of a two-dose schedule and indicated an efficacy rate of above 90% at seven days after the second dose. This implies that protection is achieved 28 days after the initial dose. With that said, final efficacy rates may vary as scientists await additional data.

A 90% efficacy rate exceeded the expectations of most. The US FDA required a 50% efficacy rate before any Covid19 vaccine is granted approval. This benchmark is similar to the 40-60% efficacy rates that are achieved by the influenza vaccine (flu). Top U.S. infectious disease expert, Dr. Anthony Fauci, had said an efficacy rate of 50-60% would have been acceptable. Hence, a 90+% rate is surely good news and puts it in the same league as the measles vaccine which the Centre for Disease Control & Protection measures at 93%.

Markets responded with jubilation from this news, with many underperforming sectors like banks, travel and leisure recording significant gains. At this time, we believe that it is important for investors to still keep in mind that there are significant hurdles that the markets need to overcome. For instance, there continues to be significant political uncertainty regarding the extent to which Trump will contest the election results. We also will not know until January 5th, 2021, whether the Senate run-off elections in Georgia will lead to a Democratic or Republican majority. The control of the Senate will determine the extent to which Biden’s campaign policies, including tax increases, will be implemented. Finally, although the vaccine trial news is positive, COVID-19 cases are still rising significantly in the US and the economy will not turn back to normal immediately.

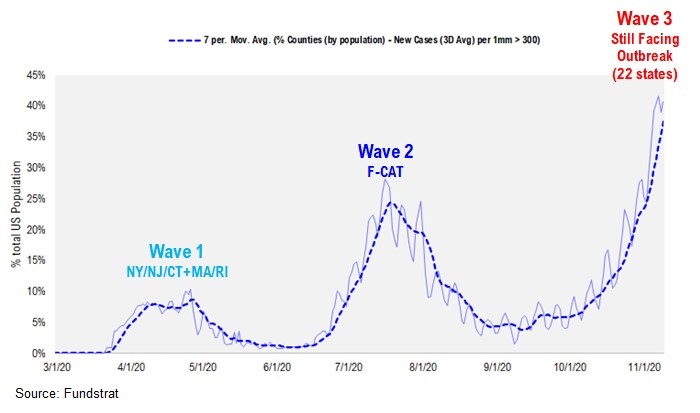

As seen in the chart below, COVID-19 cases are hitting new highs and this has caused increased nervousness and resulted in some statewide soft-shutdowns, limiting gatherings, and requiring closures of indoor dining and gyms.

Despite the rise in cases, the mortality rate has yet to spike to the levels seen in previous waves, and should that trend continue, the likelihood of a national economic shutdown as seen in March should be avoided. Needless to say, this data will be keenly monitored, but at the moment it does provide markets some degree of comfort.

In an interview with ABC’s Good Morning America, Dr. Anthony Fauci urged Americans to "hang in there" and "double down" on COVID-19 preventative measures. He said, “help is really on the way" and that the vaccines being developed "are going to have a major positive impact" as soon as deployment in December and early next year. Fauci hopes by April, May, and June "the ordinary citizen should be able to get" a vaccine.

We agree that the future outlook for the economy, markets, and humanity at large is one that is brighter and full of hope. That said, in the meantime, investors need to get through short-term COVID-19 headlines and continued political uncertainty which will lead to pressure on markets.

Although volatility may remain high, we anticipate that the Pfizer and BioNTech vaccine will not be the only one. Fauci believes that Moderna’s vaccine should also report a high degree of effectiveness as its vaccine is "almost identical" to Pfizer's. Hence, our expectation is that additional positive vaccine announcements can provide the markets with a boost as it reminds investors that we may be nearing the end of this crisis. With ‘normal’ on the horizon, it would be advisable for investors to review their portfolio holdings to rebalance and review their country and sector mix to determine whether their portfolio is positioned to benefit from a global synchronized economic recovery.