Those able to sit through the constant interruptions that riddled the first US Presidential Debate heard differing perspectives from the candidates on the country’s economic recovery. The moderator for the evening, Chris Wallace, mentioned that while Trump insists that the country is seeing a “V-Shaped recovery”, Biden believes that it is instead “K-Shaped.” Since that debate, we have had a number of clients ask us what this ‘alphabet soup’ of recoveries really means.

A “V-shaped recovery” is exactly how it sounds, a sharp economic downturn, followed by a similarly quick recovery resulting in that distinct pointed “V”. On the other hand, a “K-shaped recovery” is not nearly as straightforward. This shape of recovery is often used to describe situations where some areas of the economy have begun their recovery and trended upwards (the upper sloping section of the ‘K’), while other areas have not (the downward sloping section of the ‘K’), resulting in a divergent path.

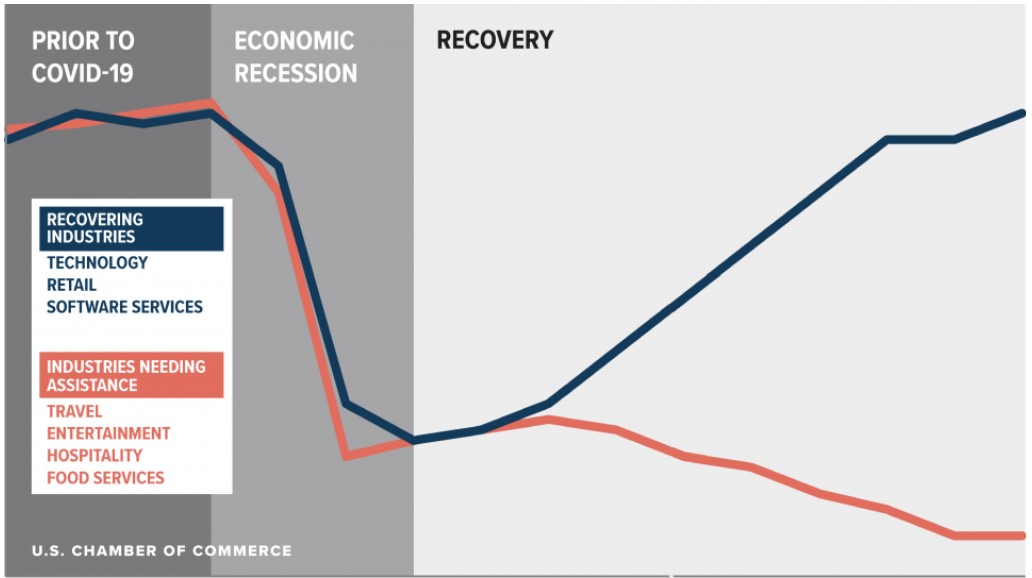

Broadly speaking, performance varies across different sectors of the economy. But throughout economic cycles, it is generally expected to see most sectors somewhat correlated whether that be during a recession or a recovery. A “K-shaped recovery” breaks away from that line of thinking. As seen in the graph above, while some sectors of the economy such as technology and software services may be enjoying a tremendous recovery, others such as travel, entertainment, and food services may be seeing sluggish performance for the foreseeable future.

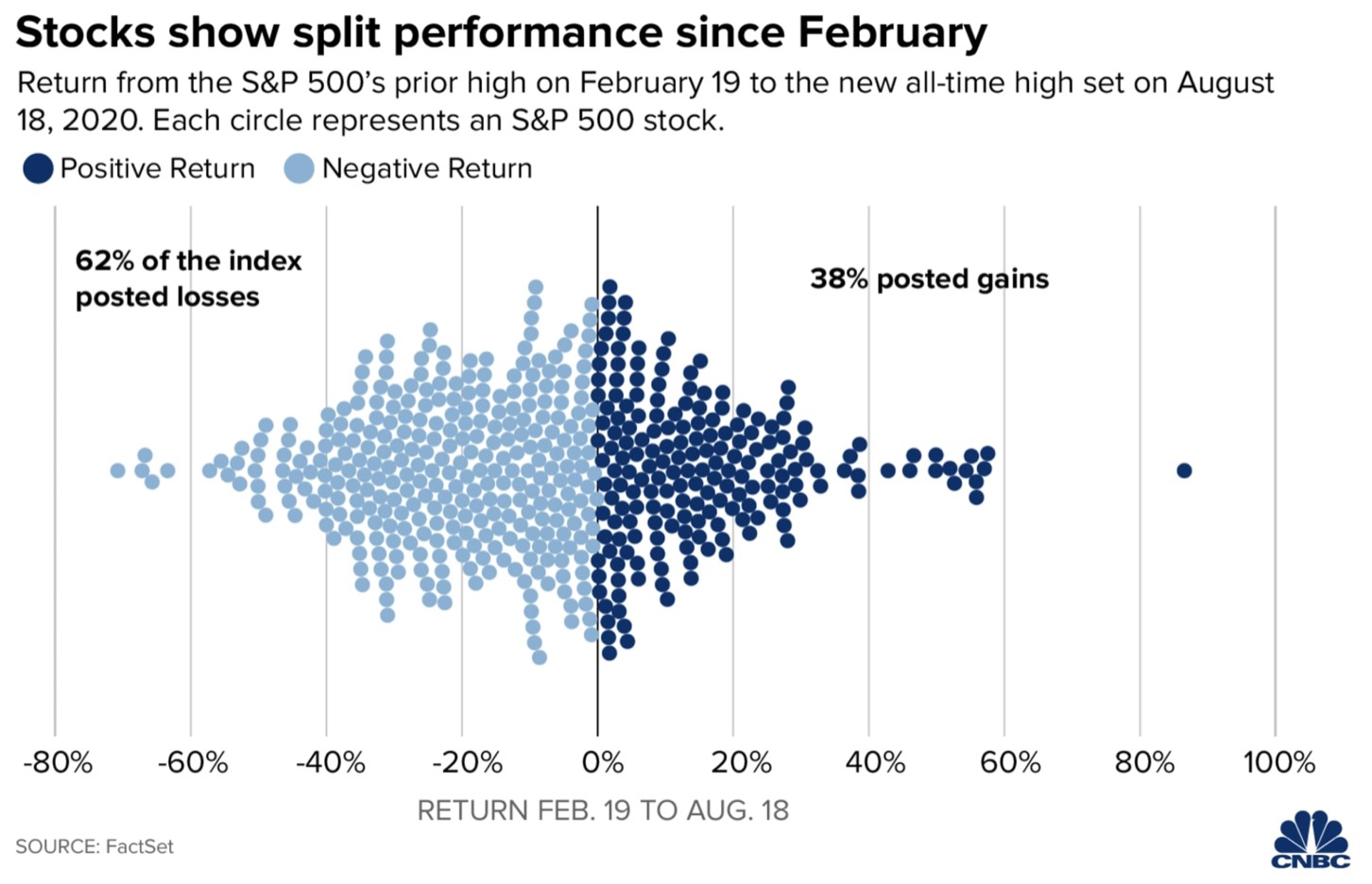

While major indices such as the S&P 500 have had a great performance, not all of their constituents have performed equally well. According to research group Cornerstone Macro, the average stock in the S&P 500 index was still approximately 28 percent below its all-time high in August. To put the situation further into perspective, from the pre-COVID-19 highs of late February to the new high achieved on August 18, only 38% of stocks in the index had positive returns. The remaining 62% posted losses. The disparity of returns between stocks in industries such as technology, ecommerce, and software services that have ridden the wave of the work-from-home trend, and those that have suffered such as hospitality and travel, make it more likely that the recovery fits the bill of being “K-Shaped.”

Now, what does this mean for investors? We expect the names represented by the upper leg of the “K” to see continued growth. Those companies are typically related to technology and some segments of the retail industry. For example, products or services that directly impact how we work, live, and play at home will thrive including cloud, connectivity, social media, and those retailers with a strong omni-channel offering. On the other hand, industries such as travel, hospitality, traditional brick-and-mortar retail, and food services are held hostage to the lower portion of the “K” until the binary event of a successful vaccine is discovered. Should this positive development arise, we believe the markets will award shareowners with a great recovery. However, rather than investing in any lagging performer simply in hopes of a vaccine rally, investors should focus on those companies who have shown an ability to defend their credit rating, reinforce balance sheets with divestments, and deliver operating leverage through cost-cutting. COVID-19 is the ultimate stress test for these lagging sectors and those companies able to survive this downturn have a chance to be the champions of their industry. Speak with your advisor to see how you should position your portfolio to best navigate this K-shaped market.