Everyone can benefit from estate planning, regardless of age or income level. Through estate planning, individuals can potentially reduce the taxes and expenses of an estate, retain their assets, and protect their family members and beneficiaries. Planning can also simplify and speed up the transition of assets to beneficiaries. This blog aims to raise the awareness of having a plan in place.

Planning through COVID

Prior to the COVID-19 pandemic, many Canadians were already aware of our aging population. Currently, there are more Canadians over the age of 65 than under the age of 15. By 2031, it is expected that 25% of Canada's population will be over the age of 65, indicating a greater need for estate planning. In a survey completed as part of the Wealth Planning Report a few years ago, only 54% of those surveyed had a valid will.

However, COVID-19 has brought the issue of wills to the forefront of today’s concerns. Many people are now increasingly concerned about the future of their assets and have taken an increased interest in their Wills. As of late, an unprecedented number of Canadians have been writing, or making changes to their Wills. This has led to the need for new government policies that aim to smooth the process of creating a valid will. For example, early on in the pandemic, people recognized the difficulties of having two witnesses to physically witness signatures under the requirement of social distancing. A recent change was enacted by the government whereby virtual witnessing through video conferences is permitted. In this case, the two witnesses could watch the signature through video connection. Some provinces, including Ontario, have more specific requirements such that one of the two witnesses of the video conferences must be a part of the Law Society of Ontario.

Passing Away without a Will

Passing away without a Will, also known as dying “intestate”, can result in complex situations that may not be aligned with your wishes as most decisions are made through pre-existing legislation. This results in a lack of flexibility. In addition, an individual who wishes to become the administrator of the estate will need to make an application to the court. This may result in an unnecessary burden for surviving loved ones. Another consideration is that if a parent passes away, a child under the age of majority will immediately receive their full inheritance the moment they reach the age of majority. This may not be optimal as their inheritance is not deferred, meaning there is no opportunity to plan for taxes. In addition, the child may not yet be mature enough to handle these assets.

Transferring an Estate

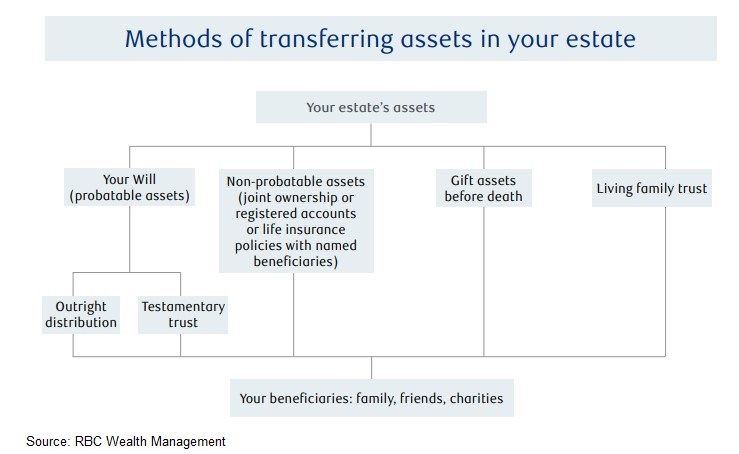

Typical wills should include information on the executor, the instructions for the management and distribution of your assets, the naming of a guardian for your minor children, instructions to minimize income taxes (if possible) and funeral arrangements. You may also want to consider trusts or multiple wills that can provide tax and control benefits. See Chart Below.

Estate Plan Objectives

Spending time on defining both personal and financial objectives can potentially save money and can help ensure these objectives are met. The following are key questions that can help determine your plan’s objectives:

a)Who will be the beneficiaries of the estate?

b)What impact will the estate plan have on your family?

c) For how long do you intend to provide support to your immediate family?

d) Are there significant family assets that will need to be addressed?

e) Is the minimization of income tax and probate taxes important?

f) Do you want your beneficiaries to receive their inheritance immediately or at some future date?

g) Do you wish to leave any portion of your estate to charities?

h) Do any of your beneficiaries have special needs?

In addition to your defined objectives, there will be several other factors that will need to be considered. These factors include inflation, tax liabilities due to the deemed disposition rules and specific provincial family law legislation. It may even be a surprise to many Canadians that although they may have no residency or citizenship in the US, they could still be liable for US estate taxes if they own US stocks and/or real estate. Evaluating your defined objectives can be extremely challenging.

The Next Step

Estate planning can be very overwhelming. Therefore, we recommend clients to break down their estate plan into 6 steps:

1. Prepare an inventory of your assets and liabilities.

2. Define your estate planning objectives.

3. Evaluate your objectives based on your current financial situation.

4. Determine which actions are necessary to achieve your objectives.

5. Consult the appropriate advisors to implement the components of your plan.

6. Periodically review your plan

In all, don’t procrastinate and start planning for tomorrow today. Let’s start the conversation with your loved ones. Your RBC advisor, lawyer and accountant should be able to share their experiences and recommendations with you.