Recently, a client asked if her mother should drastically change her 60% equity and 40% fixed income portfolio to a 35% equity and 65% fixed income portfolio because her mother is over 80 years old. There is no one-size-fits all answer to this question because the asset mix of one’s portfolio should depend on many different variables. The textbook approach has led many investors to automatically believe that age is the most important factor, and the older you are, the fewer stocks you should own. While this might sound reasonable, in reality, this ultimately depends on many factors. For example, how do you want to withdraw your money from your portfolio? How much, how soon and how often? Different needs require different approaches. For example, do you want to take all your money out in one lump sum, within a very short time horizon (within 1-3 years), or do you want to withdraw a percentage from your account for the rest of your life, like in a RIF account? If it’s the former, you may not have enough time to weather market volatility, so perhaps a short term GIC is more appropriate. If it’s the latter, then your RIF payment typically starts at 5.28% of your account size and this percentage gets larger every year, until it reaches 20% at age 95 and above. Therefore, if you invest in only GICs, then your RIF account is likely to be depleted too soon.

Another important variable in determining whether you should have more fixed income is the current level of interest rates. One can see that current interest rates are very unattractive. Currently, 10 year US Treasuries are paying 0.68%, 10 year Government of Canada yields are paying 0.54%, and a 5-year GIC is paying on average 1.27%. Ultimately, the lower the interest rate, the lower the opportunity cost to seek out equities and alternative investments.

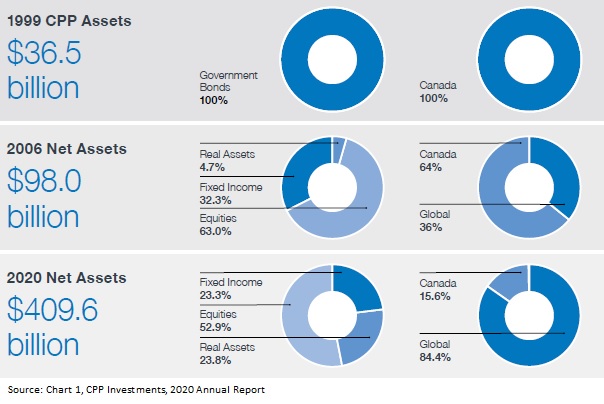

To understand this relationship, we can take a look at the annual report of the federal Canada Pension Plan, CPP.(Chart 1). Pension plans have to meet long term payout obligations and adhere to regulatory requirements. Hence, they are traditionally considered to be conservative. In 1999, CPP invested 100% of its assets in fixed income. That was when long term Canada bonds (over 10 years) were yielding 5.69%. In 2006, long term Canada Bond rates were yielding 4.3% and the CPP invested 32.3% in fixed income and 63% in equities. In 2020, CPP invested only 23.3% in fixed income with long term Canada Bond rates yielding around 0.54%! (Historical interest rates).

Therefore, one can see that the percentage of money invested in fixed income has been shrinking over the years as interest rates decreased. Of course, fixed income still plays a role in our portfolio as a balancing factor and to smooth out the ups and downs of stock prices. However, its’ role as an income-generating investment has drastically diminished. Under this ultra-low rate environment, stocks have become relatively attractive. Many dividend-paying stocks are actually paying higher dividend rates compared to their corresponding fixed income counterparts. The potential for growth that comes from long term equity investing further increases its’ relative attractiveness.

Finally, one must view their asset mix in relation to one’s risk profile. Volatility is experienced as price fluctuations, and it is the inherent nature of stocks. Stock prices fluctuate because stocks are very liquid and marketable. GICs are usually locked-in and are not marketable, therefore, there are no price fluctuations. Real estate is illiquid and therefore, the price fluctuations are usually delayed. Imagine how long it would take to sell your real estate compared to stocks during the coronavirus lockdown. Hence, volatility in the stock market is due to the benefit of its’ liquidity. However, some investors still perceive this as a risk, and volatility can drive investors to buying high and selling low. Therefore, if you are risk-averse and cannot stand any price fluctuations, then a lower equity mix may be most suitable. After all, not everyone is fit to participate in the stock market. That being said, contrary to what one may naturally assume, there exists many scenarios where older investors should still invest in the stock market. With the assistance of your advisor, we recommend reviewing your ability to meet income objectives with bonds, your liquidity needs and your ability and willingness to face volatility.