To the surprise of many, the fixed income and bond universe is three times the size of the equity market. Therefore, this market cannot be ignored in asset allocation discussions. Bonds can be categorized by the entity that issued the bond, including government bonds and corporate bonds. Active management of bonds can include balancing different risks including: credit/default risk, interest rate/inflation risks, and overall market risks. With the ongoing COVID-19 pandemic, this universe is growing rapidly as governments and companies seek to issue bonds during a low-interest rate environment. Corporate bonds make up $8trillion of the $100 trillion bond market and this blog seeks to review the investment opportunities in this space.

Government Bonds: Low Forward-Looking Returns

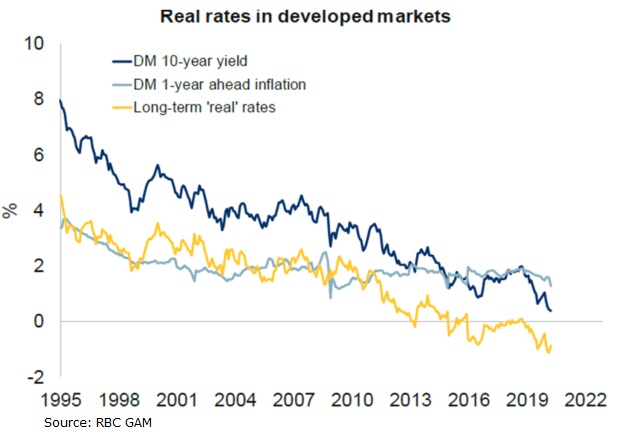

The forward-looking returns from government bonds are low and are not expected to rise soon. “Real rates” represent the actual interest return after subtracting inflation. As the chart below shows, these rates have been declining for around 30 years. With interest rates at rock bottom levels, inflation has resulted in a negative return for developed market government bonds.

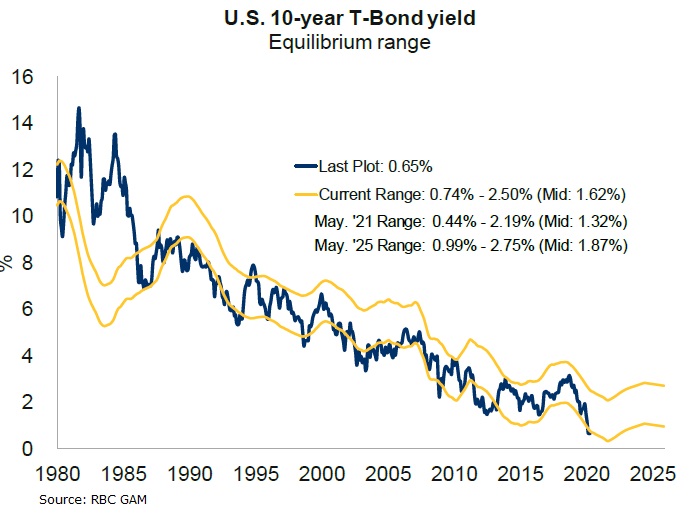

Looking more specifically at US interest rates, the potential returns appear bleak for the US 10 Year Treasury. The chart below shows the long term historical yield range, and the trend points towards a continued low level of income for investors. With the last data plot (May 29) at 0.65%, it does not leave much room to cover any inflation costs. It is important to note, however, that government bonds still have a role to play in the portfolio. They provide liquidity, ballast, and potentially modest gains when equity markets face volatile periods.

Corporate Bonds: Forward returns relative to credit risk

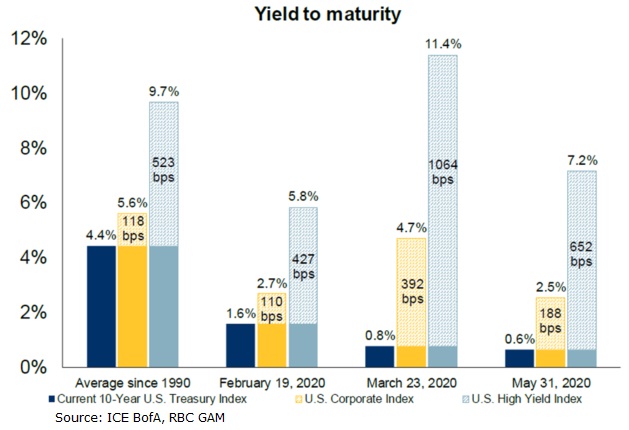

Investing in ‘credit’ refers to investing in fixed income securities such as investment-grade corporate bonds and non-investment grade corporate bonds (aka. High Yield Bonds). Depending on the credit rating of the bonds, investors may be exposed to greater credit risk, which can be defined as the risk of default. Investment grade bonds have a relatively low likelihood of a default. However, because the risk is still greater than buying government treasuries, investors expect these bonds to pay higher rates and yields. Correspondingly, non-investment grade bonds have an even higher risk of default and therefore they must compensate investors with even higher rates and yields. As the chart below indicates, since 1990, the Corporate Bond Index paid 1.18% (118bps) more yield than the 10 Year US Treasury. Likewise, the High Yield Index paid 5.23%(523 bps) more yield. Fixed-income investors refer to these yield differentials as the “spread”. Therefore, during periods where the spread is greater than the average, one could posit that investing in corporate bonds is relatively attractive and that they are getting compensated well for taking some credit risk. On February 19th, at the stock market “peak”, the bond spreads were below the long term average. This did not signal a great buying opportunity. On March 23rd, at the “lows” of the Covid bear market, the bond spreads were 2-3 times higher than the long term average. This happened to be an opportune time to take on credit risk and buy bonds. At the end of the last month, spreads were still above the long term average. Although not as attractive as just a couple months ago, corporate bonds and high yield bonds are paying spreads that are relatively attractive to historical averages and can be tactically added to portfolios.

Active Bond Management

Managing a portfolio of corporate bonds and high yield bonds is not a simple task. The open inventory of individual bonds that retail investors can access is limited. Typically, institutional clients and large mutual funds that can afford to make large purchases are able to obtain better access and prices to bonds. Moreover, tactically taking profits, monitoring the credit risk and managing the interest rate risk requires active management. Incorporating seasoned fixed income managers to a bond portfolio can add a substantial amount of value and potential return during this difficult part of the economic cycle. Speak to your investment advisor to review your fixed income positioning.