When investors talk about ESG (Environmental, Social, Governance), they may conjure up ‘old’ expressions of Socially Responsible Investing (SRI). In SRI, the manager filters out those so-called “sin stocks” related to tobacco, alcohol, casino, etc. This investing approach has been labelled as a niche investment style, where investors focus on moral values and potentially at the expense of investment returns.

ESG has a different approach. It is often referred to as sustainable investing, and is more broad based compared to SRI. ESG includes three specific categories: Environmental, Social, and Governance. This approach would favour companies that proactively reduce gas emissions (i.e. Environmental). It would also favour companies that promote gender equality, protect human rights and give back to communities (i.e. Social). ESG investing also looks favourably at the independence of a company’s board of directors, and how a company handles security, privacy and conflict of interest (i.e. Governance)

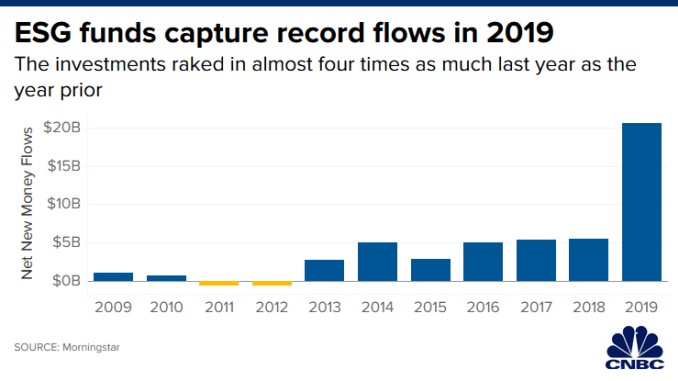

ESG investing is growing exponentially. According to Morningstar, ESG funds attracted four times as much flows of new money in 2019 compared to 2018 (see Table below).

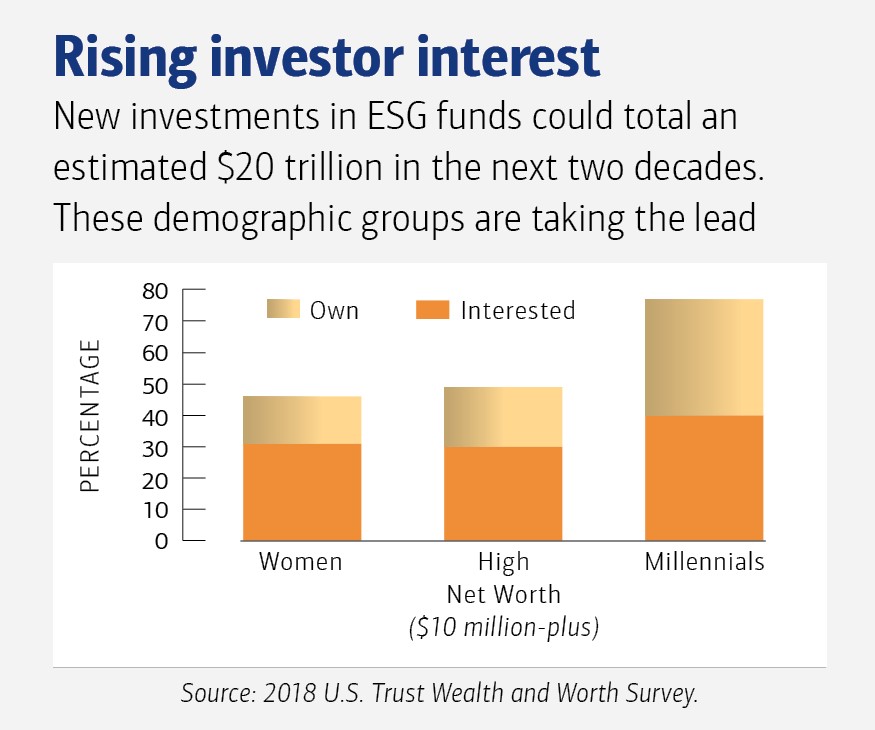

Further, a Bank of America research report estimated that the amount invested in ESG funds could rise by $15-$20 trillion over the next two decades. The question is, why are ESG funds attracting so much money?

Some people think that ESG investing is a fad. They attribute the popularity of ESG investing to millennials (see survey chart below). Millennials are generally perceived to want to make this world a better place and therefore they want their investments to align with their personal values. However, the investment community should not dismiss the investment influence that the millennial cohort could have. According to a report by Wealth-X, more than $15 trillion of wealth will be transferred and inherited by millennials by 2030. Therefore, millennials could easily become the most powerful driving force when it comes to investing trends in the next decade.

However, this is only part of the story. Sustainable Investing seems to be giving not only positive social returns but also good financial returns. According to a Morningstar report, sustainable funds held up well during the deep bear market through the first quarter of 2020. They attributed this to the quality financial health of the stocks selected under the ESG framework. Research done by BlackRock also shows that the high correlation between sustainability and less volatility. Hence, sustainable companies are expected to be more resilient during downturns. In fact, the crisis caused by the Covid19 may force the greater public to create a more sustainable world. This change in attitude towards sustainability may cause a major shift towards ESG investing for many more years to come.

How can investors gain exposure to ESG focused companies? Some companies are now providing voluntary disclosure on their ESG targets through organizations like Global Reporting Initiatives. Some companies also indicate their ESG targets on their annual reports. Needless to say, it can be a lot of work for individual investors to find out which companies are focusing on ESG. Instead of investing in individual stocks or bonds, investors can consider many ESG focused mutual funds that are managed actively. On the A+ platform of RBC DS, one can also find institutional money managers that specifically use an ESG framework in their investment decisions. Alternatively, there are also ETFs that passively filter for ESG characteristics. At the moment, there is no globally recognized standard or scale that a company can be measured by in order to be rated as “high” or “low” for ESG complicity. Hence, some subjectivity is applied and a company that meets the ESG framework for one manager may not meet that of another. Each ESG product may look different and investors should do their best to get as much information on the individual holdings as possible. Please contact our advisors for more information on navigating the many ESG investment options.