When thinking of investing in the health care industry, our minds likely go straight to ‘Big Pharma’, drug distributors, and companies that produce medical and diagnostic equipment. The most commonly known names to invest in offer products and services to humans. In this blog, we review the Animal Health Industry, whose fundamentals may offer investment opportunities.

Like human health care, animals also depend on medicine, vaccines, diagnostics, devices, supplements, and doctors. The animal health industry has been growing organically, benefiting from steady annual growth of 5-7%, as well as volume and price increases of 2%. Altogether, these products and services total $150 billion of global sales.

As Covid-19 has threatened human life, influenza viruses and other epidemics continue to threaten animals. These parallels have motivated us to focus specifically on the $34 billion market for animal medicine and vaccines. This market can be broken down into companion animals (31%) and livestock animals (69%).

Livestock Animals

The livestock market includes the animals necessary for our dietary needs – cattle, swine, poultry, sheep, and fish. The rapid growth in population has resulted in an increasing demand for livestock. Notably, with the increased standard of living in developing markets, their dietary changes have resulted in increased meat and dairy consumption. The World’s population is estimated to reach 9.7 billion by 2050, an increase of 2 billion from today, and therefore the global livestock needs are growing with it.

However, to feed more people, it has become increasingly important for this food source to be safe, and sustainable. Livestock producers face numerous challenges. Infectious and parasitic diseases are not uncommon and heightened antibiotic-resistant diseases have called for new developments in vaccines through biotechnology. Zoonotic diseases - diseases that are transmitted from animals to humans - have resulted in deadly outbreaks throughout history. This includes diseases such as the bubonic plague, salmonella, and in current times, COVID-19. As such, the challenge of food safety is critical and must be addressed to control food-borne diseases, especially within the context of globalization and climate change.

Companion Animals

Companion animals relate to pet ownership and adoptions. According to the American Pet Products Association (APPA), pet adoptions are growing with approximately 68% of U.S. households owning at least one pet in 2018. This is up from 56% in 1988. The upward trend in pet ownership and adoption has contributed to a greater portion of discretionary income being spent on pets. Spending on U.S. veterinary care is growing at a 4.5% CAGR since 2012, as common vaccines for animals including rabies, hepatitis and pink eye all exist to protect animal health. Regular visits to veterinary clinics for check-ups and treatments have become increasingly important for pet owners. This trend is expected to rise as emerging markets are also expected to show significant growth in pet ownership.

Major Players

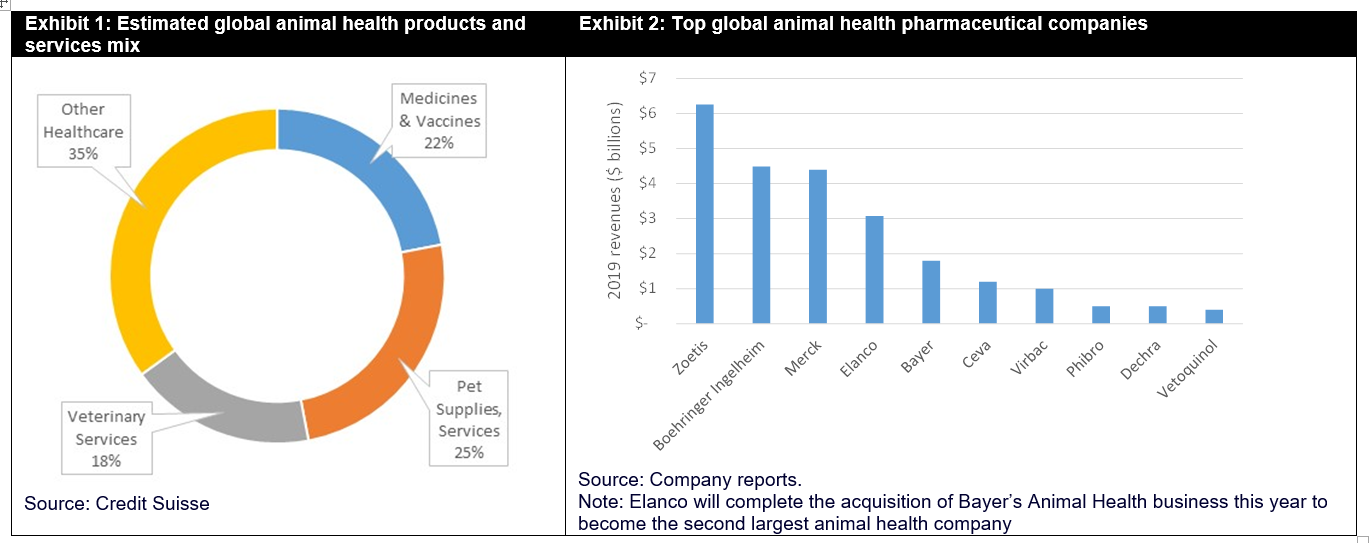

Mergers and acquisitions in this industry continue, with the largest incumbents diversifying and expanding its portfolio of products and service offerings as shown in Exhibit 1.

Within the fragmented animal health industry, there are a handful of large players: Zoetis, Elanco, Boehringer Ingelheim, and Merck (Exhibit 2). Many of the largest animal health businesses were originally divisions of larger pharmaceutical companies. For example, Zoetis was the result of Pfizer’s 2013 spin-off of its animal health division and Elanco, was a spin-off from Eli Lilly in 2018. This continues to be an ever-changing industry. Bayer will complete the sale of its animal health unit to Elanco later this year which will make it the second-largest player in the industry. Merck is also suspected to spin off their animal health unit after they complete their planned 2021 spinoff of women’s healthcare, biosimilar, and other legacy businesses.

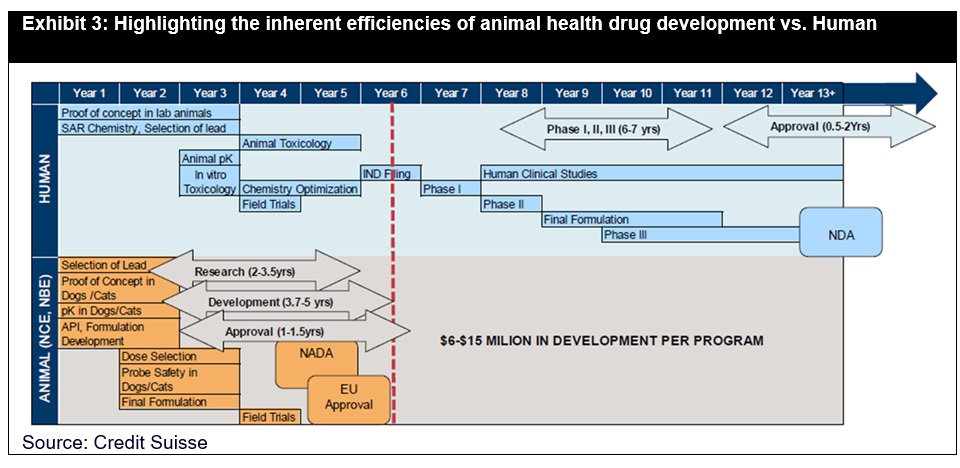

What makes this industry’s fundamentals attractive is that unlike with human pharmaceuticals, drug development costs are lower, drug studies are shorter in duration, and there are no payor-reimbursement concerns. Exhibit 3 visually illustrates the efficiencies of animal health drug development compared to drugs for humans.

The animal health industry also benefits from less generic drug competition. The loss of sales and profits from generic drugs after a branded drug has gone off-patent has always been a financial cliff that most traditional pharmaceutical firms have faced. While generics exist in the animal health industry, there are no large-scale companies that focus exclusively on generics for this segment. This is because each individual product in the industry accounts for a smaller piece of overall market share. Hence, it is not as financially attractive for generics to be created and to compete on pricing. Specifically to the companion animal segment, health products are often prescribed and dispensed by veterinarians. This means pharmacies are not in the position to intervene by offering or suggesting a generic substitution. And specifically to the livestock segment, medicines account for a small portion of the overall production costs, and therefore, farmers and producers are less sensitive to pricing and would rather not risk the use of generic products.

Risks

No industry is without risks. The animal health industry is not immune to the macroeconomic or COVID19 headwinds of slower global growth and disrupted manufacturing. And like any business, they will face new competition and potential weak traction in newly developed products. Further risks specific to this industry include 1) a shift in consumer trends toward vegetarian diets, 2) potential regulatory bans of specific antibacterials in food-producing animals, and 3) severe weather conditions that could lead to a reduction in growing livestock herds. As with any new investment, the suitability of the investment should be considered and reviewed with your advisor and portfolio manager.