Now that we are in a US Presidential election year, the uncertainty leading up to the final results will inevitability be a source of market volatility. It is important for investors to remain steady through all the noise in the political news media, and continue to focus on what the markets care about: the economy and corporate profitability. Therefore, making strategic adjustments to your portfolio, based only on political speculation would likely prove to be short-sighted.

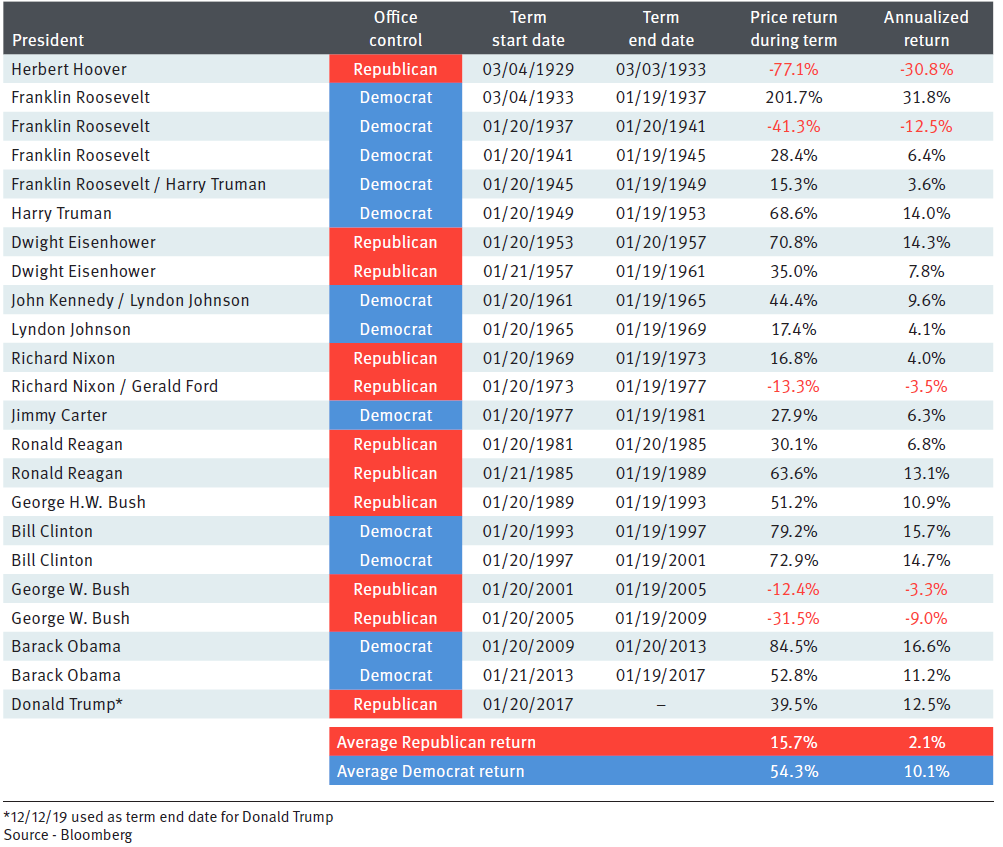

At this point of the juncture, it is too early to determine which party will win the election. The important question for investors is how the markets will react when election results come in. Some are concerned that a Democratic president would not be as favourable to the equity markets, compared to a Republican. However, the returns of the S&P 500 since 1929 show otherwise. The data has shown that Democratic presidents actually witness stronger returns.

It is important to take this data with a grain of salt, as there is no concrete evidence that supports a causal relationship between the elected president and stock market returns. Market returns are influenced by a wide variety of factors, including corporate profits, business cycles, monetary conditions and valuations.

The above chart simply helps to refute the common misconception that the stock market prefers a Republican president. The view that the Republican party is more business-friendly, usually favouring lower taxes and less regulation is ideologically true, but doesn’t guarantee positive market outcomes. With the election coming, investors can brace themselves for headline news that will create short-term market volatility. However, it is important to ignore the political distractions and focus on the fundamentals for your portfolio in the medium and long term.