With taxes being one of the largest expenses for most Canadian households every year, it is important to ensure that you are taking advantage of all the tax benefits available to you. Filing on time is also important, in order to avoid penalties from late or missing returns. As the 2018 personal income tax return deadline looms, the following information outlines some items you should consider when preparing your 2018 personal income tax return.

Filing deadlines – The deadline for filing your 2018 personal income tax return is April 30th, 2019. If you or your spouse are self-employed, you have until June 17th, 2019 to file your tax return. Regardless of the deadline, any tax owing should be paid on or before April 30th, 2019. Late filing or unpaid tax will result in penalty fees of 5% of the balance owing on your return, plus a further penalty of 1% of the unpaid tax, multiplied by the number of full months the return is not filed.

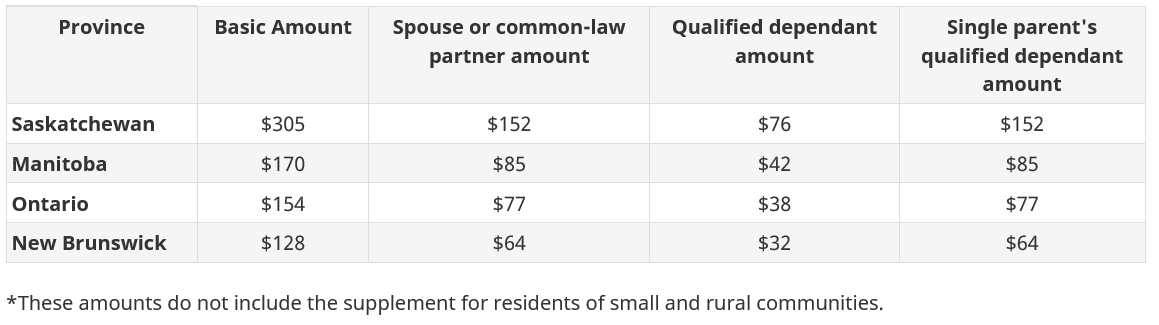

Climate Action Incentive (CAI) – As part of the Government of Canada’s climate change plan, residents of New Brunswick, Manitoba, Ontario and Saskatchewan will be compensated for the effects of the federal climate action plan in the form of a tax credit, called Climate Action Incentive (CAI). The credit is not based on income, which means that most residents of these provinces are eligible to claim it in their tax returns. The maximum you can claim depends on your province of residence, as well as your household structure. You will have to decide which member of the family will apply for the credit, as you are only allowed one credit per household.

Capital Gains/Losses – If you have excess capital losses this year, consider completing the CRA Form T1A, Request for Loss Carryback, to carryback remaining capital losses, to offset any capital gains that you have reported in any of the three previous years. By doing this, you may receive an unexpected refund of some of the taxes you paid in previous years, which could go towards your next summer vacation. On the other hand, if you have any taxable capital gains in the year, determine if you have any unused net capital losses available from previous years to reduce your taxes payable.

Foreign Reporting Requirements – As investment portfolios shifted their focus globally, foreign reporting requirements have become increasingly important. If you own specified foreign property with a total cost of more than $100,000 (Canadian) including shares of foreign corporations, foreign mutual funds and exchange traded funds listed on a foreign exchange, you are required to complete the CRA Form T1135, Foreign Income Verification Statement. The penalty for failing to file this form on time is $25 per day, subject to a minimum of $100 and a maximum of $2,500.

Other Considerations – Income Trusts, mutual funds and limited partnerships tend to issue tax slips later than most other investments. It may be advisable to wait and file your tax return closer to the deadline to ensure you have all the information necessary to file a complete return.

CRA Online – The CRA has a service available called “My Account” for individual taxpayers. This is an online service that provides access to your previous returns, RRSP contribution room and more. This can provide you with timely information to help you complete your tax return.