With summer’s arrival and vacation plans in full force, we offer a quick mid-year outlook that even the last-minute packers should have time for.

While uncertainty lingers around U.S. tariffs, the risk of worst-case scenarios has diminished as trade negotiations make headway. RBC Global Asset Management (GAM)’s base case now projects a slowdown—but not a halt—in economic growth, with any inflation flare-ups likely to be temporary. Equities could deliver solid returns if policy, corporate earnings, and investor sentiment remain supportive, while bonds offer attractive potential with manageable valuation risk.

Economy

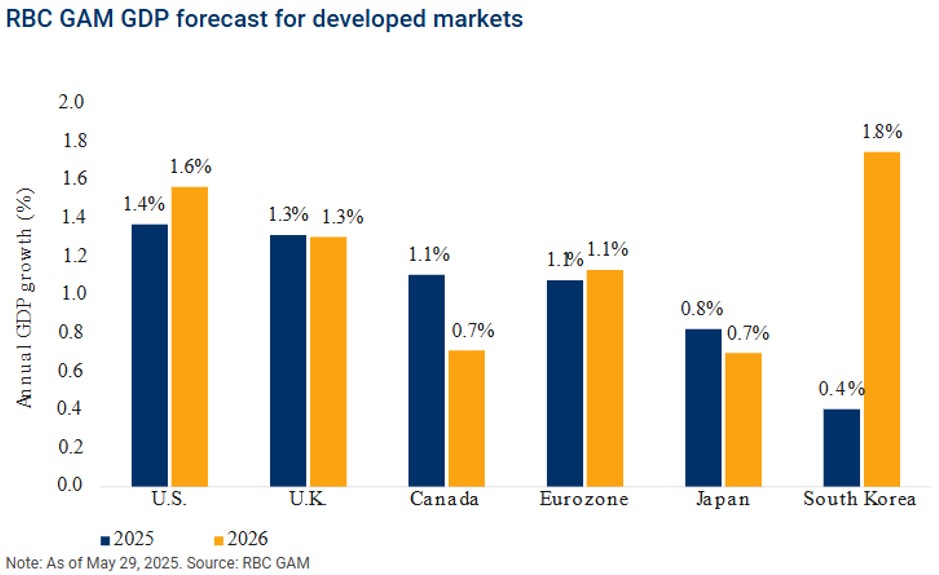

Tariffs set to act as a significant drag on growth: Developed market GDP is forecast to remain under 2% in 2025. Emerging markets also face a mild downturn as tariff effects are expected to cause a modest slump in most emerging economies next year.

Brighter outlook for 2026: As tariff adjustments fade and U.S. tax cuts kick in, conditions should improve.

Inflation to moderate: U.S. inflation is projected to average 3.0% in both 2025 and 2026, peaking at 3.5% in late autumn, mainly due to tariff pressures.

U.S. exceptionalism fading: The diminishing U.S. growth advantage may weaken the dollar and reshape the Global investment landscape.

Equity Markets

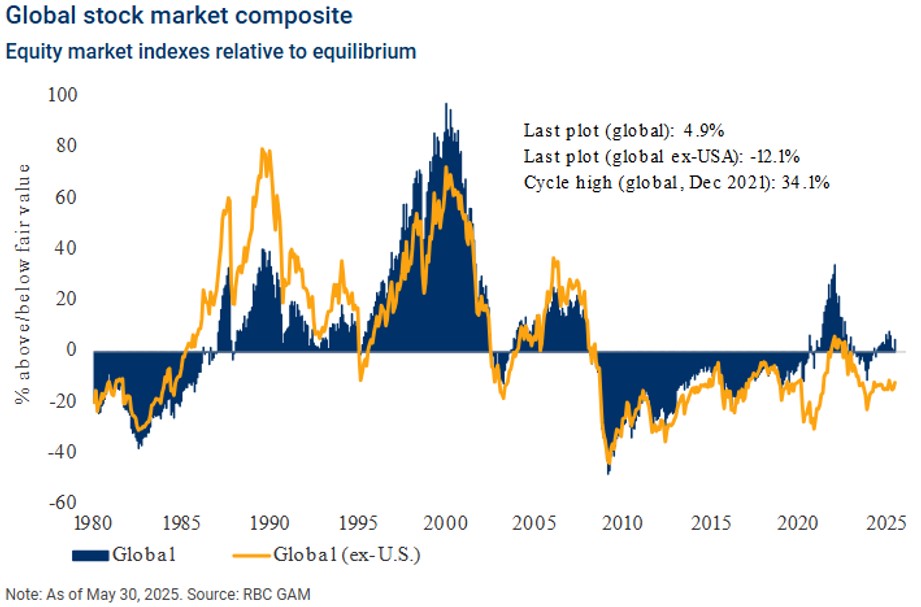

Trade progress lifting markets: The initial tariff shock sent technical and sentiment indicators to extremes, shifting leadership away from U.S. stocks. Subsequent trade negotiations have helped the S&P 500 recover, but future gains depend on strong earnings and sustained investor confidence.

But earnings forecasts revised lower: Ongoing trade uncertainty has led analysts to trim S&P 500 profit growth estimates to 8.5% in 2025 and 13.5% in 2026, down from previous forecasts of 14% and 15%.

Global equities offer value: RBC GAM’s models suggest global equities are fairly valued and offer attractive upside potential, especially outside of the U.S.

Fixed Income

Central banks treading carefully: Policymakers are balancing policy uncertainty against opposing risks of economic weakness and persistent inflation.

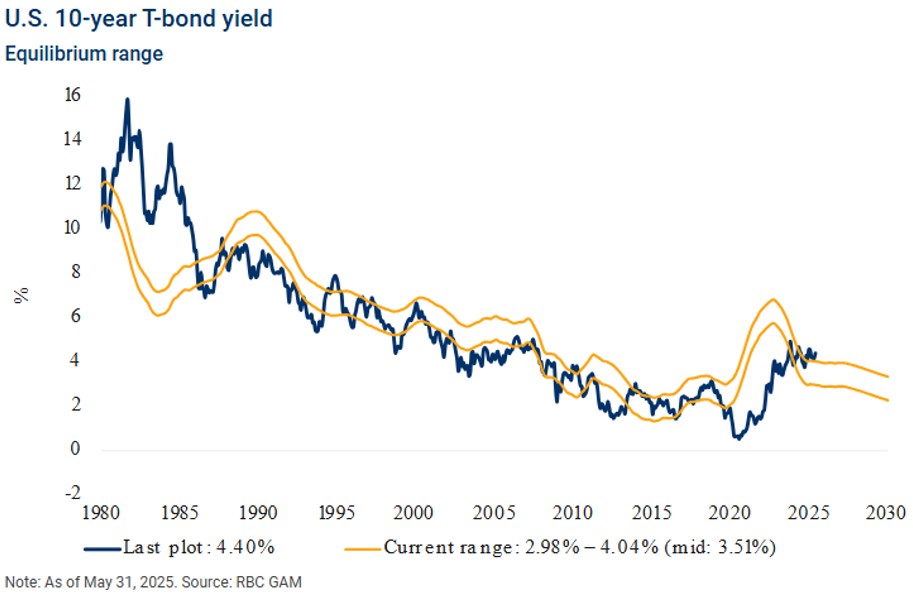

Structural limits on real yields: The U.S. 30-year Treasury yield exceeded 5% in May 2025, its highest since late 2023. However, further long-term increases in real rates appear unlikely due to structure factors. The U.S. 10-year yield, at 4.40%, appears attractive as it sits within the upper boundary of RBC GAM’s equilibrium range.

Modest yield decline ahead: RBC GAM expects the U.S. 10-year yield to dip to 4.25% over the next year, supporting mid-single-digit returns with moderate valuation risk.