Investors often seek to strike a balance between risk and reward when creating an investment portfolio. Traditionally, stocks and bonds have been the two primary asset classes used to create a balanced portfolio. Stocks are considered riskier than bonds, but they also offer the potential for higher returns. Bonds, on the other hand, are less risky but typically offer lower returns. However, one key advantage of bonds is their ability to balance a portfolio during times of market volatility.

Traditionally, bonds and stocks have had a negative correlation. This means that when the stock market declines, bonds can be stable or even go up in price. This may be attributed to an increase in demand for bonds, presumably due to the principal guarantee at maturity and fixed coupon, which becomes attractive during periods of stress. This balancing effect from bonds is why they have been considered a crucial part of a well-diversified investment portfolio.

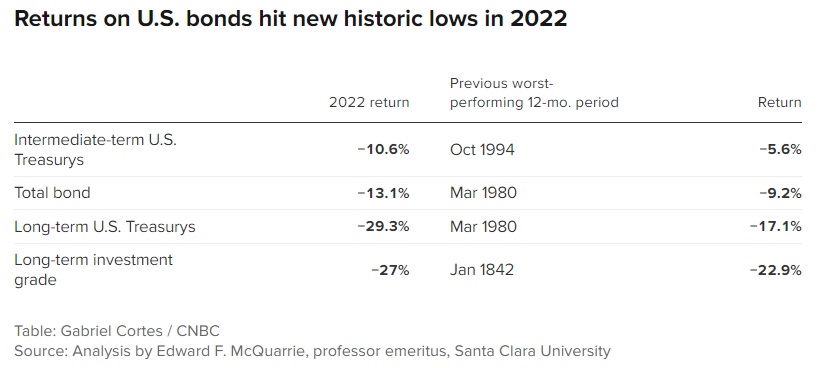

That being said, the aforementioned balancing effect did not happen in 2022. Instead, investment grade bonds declined anywhere between 10-30% due to the unanticipated pace and magnitude of rate increases from the Federal Reserve in their effort to squash inflation. Although the Fed’s initial guidance was for a 0.9% fed fund rate by year-end, they ended up hiking it to 4.25-4.50%. As a result, the bond market was forced to re-price lower as the new higher interest rates left those previously issued and lower coupon bonds to appear relatively unattractive (see Figure 1).

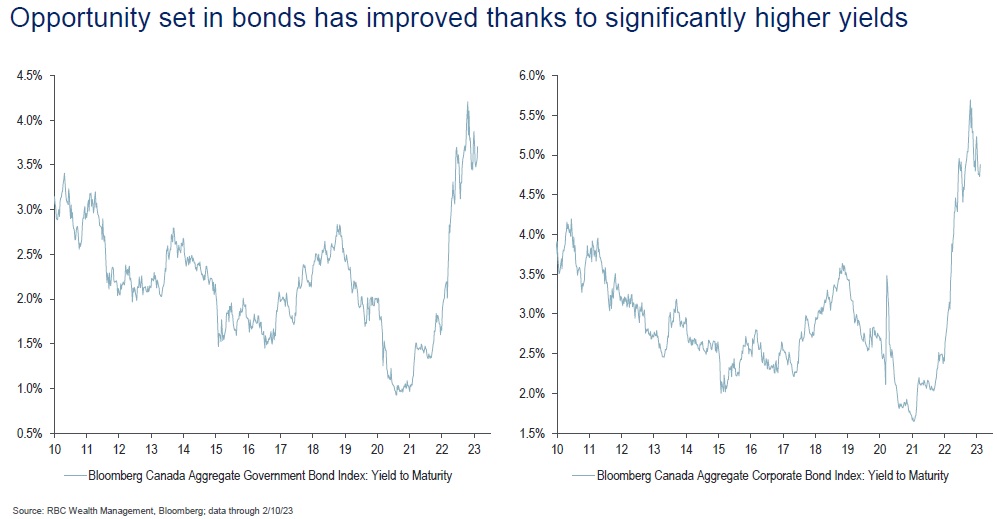

Now that interest rates have come up, the Bloomberg Canada Aggregate Government bond Index is yielding around 3.5%, and the Bloomberg Canada Aggregate Corporate bond index is yielding around 4.5% (see Figure 2). With the government rate hikes seemingly coming to an end before the summer, the currently elevated bond yields are better equipped to provide the historically reliable balancing effect for a portfolio.

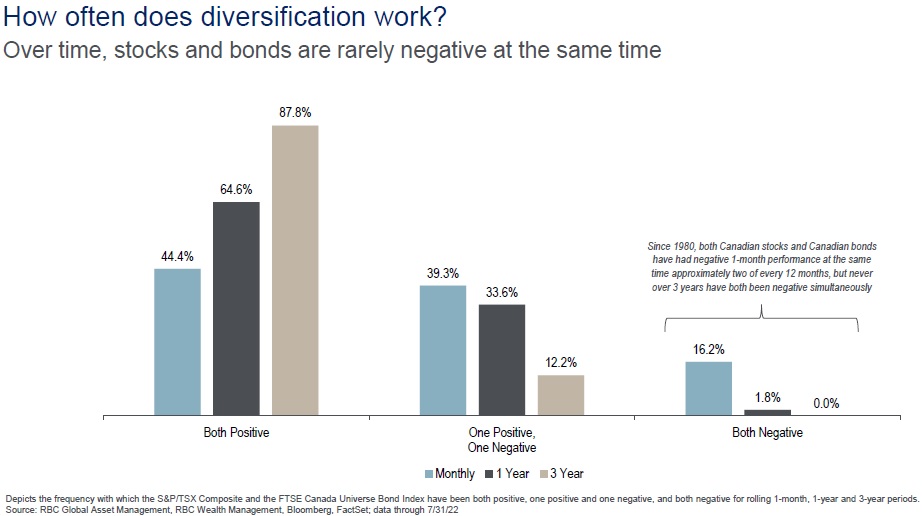

Figure 3 shows that last year’s negative performance of both Canadian stocks and bonds was a rare occurrence. Since 1980, stocks and bonds have had a negative one-month performance at the same time, approximately two out of every 12 months. This translates to a 16.2% chance of occurrence. Over a one-year period, a simultaneous negative return occurred 1.8% of the time. And over a 3 year period, bonds and stocks have never had a simultaneous negative performance. Hence, a diversified portfolio that includes both stocks and bonds has reliably mitigated market volatility risk over the short and long term.

In summary, while bonds did not offer the expected protection in 2022, we submit that this was a rare occurrence. We feel that investors should not give up on the notion of a balanced portfolio and the ability for bonds to provide ballast to a portfolio. While market conditions can change quickly, having a well-diversified portfolio that includes both stocks and bonds can provide investors with a solid foundation for achieving their long-term investment goals.