It has always been considered dangerous to claim that “this time it’s different”. This is something investors may have to contend with as the market is on the brink of the yield curve inverting. At the time of this writing, the 2 Year Treasury Note is yielding 2.3319% and the 10 Year Treasury Note is yielding 2.4568%. By all accounts, a 0.129% differential is considered very narrow. Market participants often follow the 2 & 10 Year Yields, as it has historically proven reliable as a predictor of recession. After all, if the shorter-term yield is greater than the longer-term yield, this suggests that there is more economic concern and risk in the short term and hence investors require a higher return for their short-term deposits.

We take an inverted yield curve very seriously, and it would temper our desire to be fully invested in equities. That being said, all yield curve inversions are not created equal, and not all yield curve inversions lead to a recession. For this reason, it is not uncommon to hear market pundits make a tongue-in-cheek remark along the lines of: “the yield curve has predicted 12 of the last 8 recessions”!

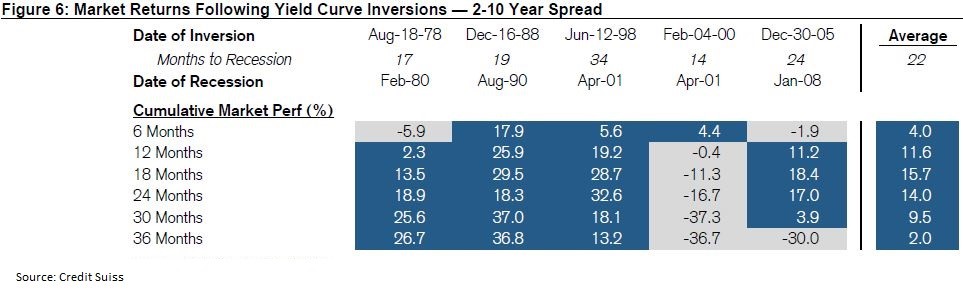

Should the yield curve invert, we suspect the market would become extremely volatile shortly after. However, historically, this is not exactly the right time to start selling or reducing equities. Investors need to remind themselves that a yield curve inversion does not lead to an imminent recession. In fact, looking back at yield curve and recessionary data since 1978, one can see that the time between a yield inversion and a recession has averaged 22months. Moreover, after an initial inversion, markets have historically returned +15.7% in 18months and +14.0% in 24 months. Hence, investors run the risk of exiting too early should they reduce their holdings upon the first sign of a yield curve inversion.

The table above does not include the COVID recession of 2020, which we do feel was truly “different”. The 2 & 10 Yield Curve inverted in August 2019 and a recession occurred 6 months later in February 2020. As unprecedented of an event this proved to be, the economy also exited the recession in record fashion by lasting only 2 months. We do not believe the market had some form of divine knowledge that COVID would take the world hostage. And although we will never know whether a recession would have occurred without COVID, at least we can say that the lead time between an inversion and recession is highly inconsistent and does not warrant immediate panic selling.

The last point I would like to make is that it is important to check whether an inverted yield curve is accompanied by other ominous indicators that suggest a weakening economy. This includes declining retail sales numbers, credit deterioration, and higher layoffs. Currently, this is not the case as pent-up consumer demand, record low delinquencies, and labor shortages suggest that the economy is actually on sound footing. Moreover, the length of time a yield curve stays inverted and the magnitude of the inversion are also important considerations. A yield curve that flips in and out of inversion territory should have far less predictive power than an inversion that is deep and lasts months. Rather, short term inversions may be merely reflecting unique market factors like the historical amount of bond buying from the Federal Reserve, immediate rate hikes, and geopolitical conflicts. Ultimately, an oscillating inverted yield curve should be met with patience.

Every portfolio may be impacted differently by an inverted yield curve. Speak to one of our advisors to discuss the market levels and indicators that would require further rebalancing of your portfolio. Although investors do not want to prematurely exit the market, they also do not want to overstay their welcome.