The COVID-19 pandemic has severely upset the livelihood of millions of Canadians and businesses.

With May rent and other bills now due, anxiety is shooting through the roof—for both renters and landlords. All orders of government have thrown unprecedented lifelines to help those in need get through this crisis. Hundreds of billions of dollars in financial support will keep many renters in good standing and avert major dislocation in rental markets. Still, not everyone or every business will stay afloat. April rent was too much for many retailers, restaurants, bars and other hard-hit businesses to pay in full (or at all). Expect May to be even more challenging.

Rent day is a big deal

Approximately 5 million Canadian households and more than 1 million small businesses pay rent each month. This is one of the biggest expenses for all of them and normally requires careful planning—a task that can be daunting in the best of times for Canadians living paycheck to paycheck and low-margin businesses. In the middle of a pandemic, rent day no doubt is a major source of anguish for many tenants but also their landlords. They too feel enormous pressure to pay their own bills.

Tenants: first-line casualties of COVID-19

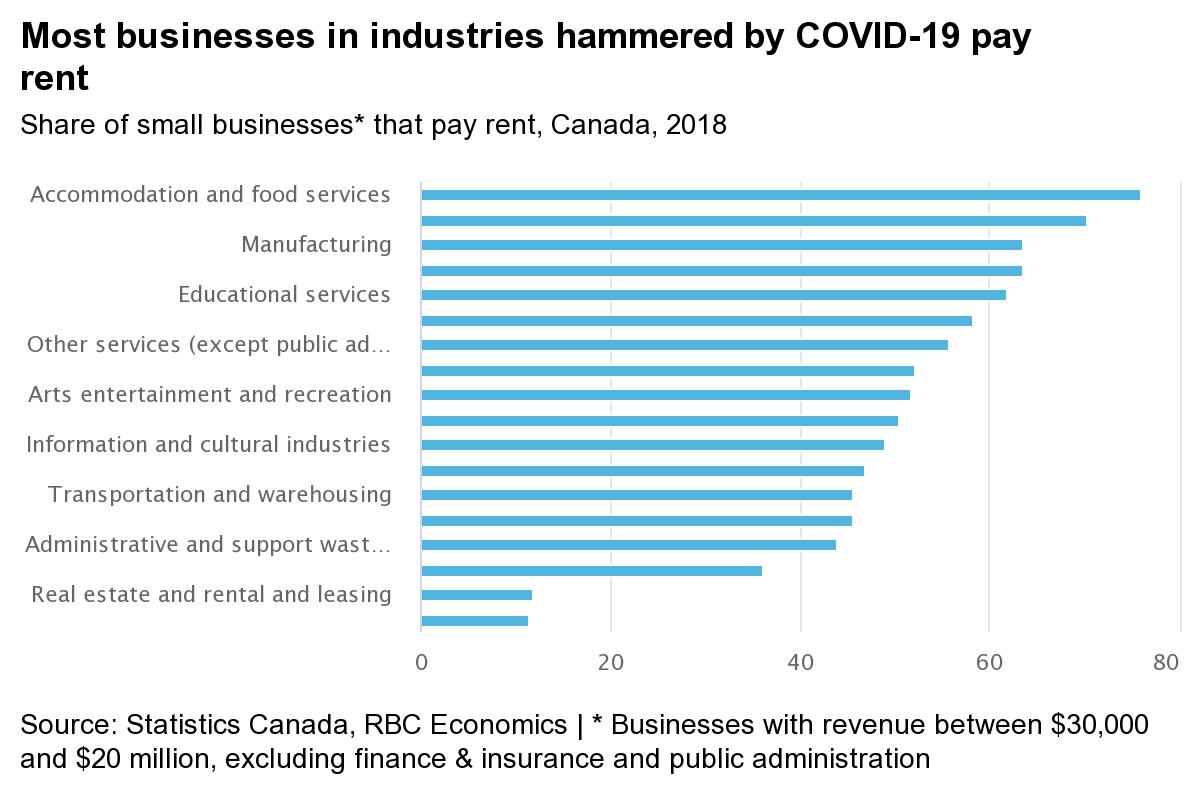

Drastic social distancing measures to contain the spread of the coronavirus hit tenants hard. These measures forced the shutdown of many businesses in industries that tend to employ lower paid workers disproportionately like retail trade, and accommodation and food services. The job layoffs, reductions in work hours and wage cuts that have since ensued predominantly affect a group of workers who most often live in rented accommodations. A large share of strongly impacted businesses are tenants themselves. Accommodation and food services, and retail trade have the highest tenancy rates of all industries in Canada.

Collection of apartment rents varied by size of landlords in April

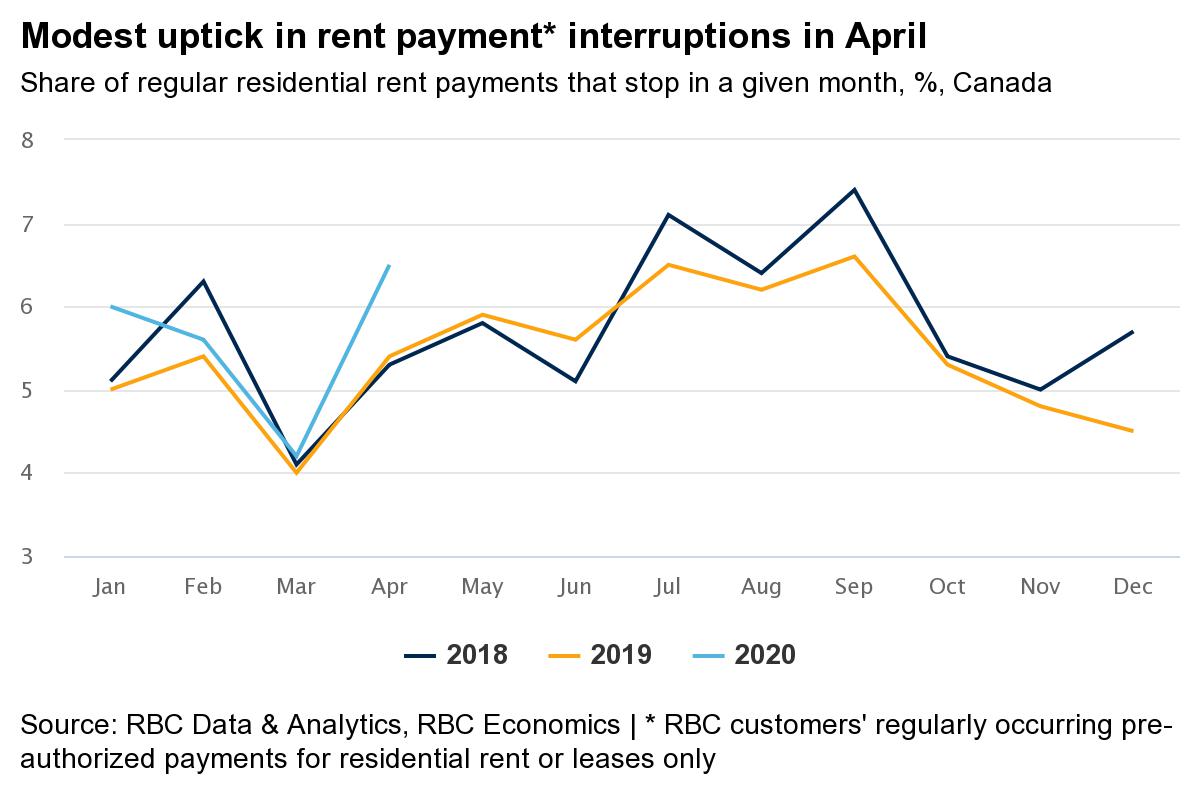

A vast majority of Canadians renting an apartment from larger corporate landlords appear to have paid their rent as usual last month. Early reports from residential REITs—which manage some of Canada’s biggest rental properties—show they’ve been able to collect 95% of gross rent or more. RBC’s own client data suggests interruptions of regular pre-authorized rent payments increased only slightly (relative to what would have normally occurred). The picture is less rosy for smaller landlords. The Canadian Federation of Apartment Associations indicated its members collected just 80% of rents in April. The collection rate was lowest among owners of buildings with one to two units.

Commercial rents were a generalized issue

Early REIT reports indicate substantially lower rent collection rates for commercial units last month of 55% to 70%. Deferral programs are being offered to many tenants. A survey conducted by Statistics Canada found that close to half of tenants in the accommodation and food services industry have deferred part or all their rent. The proportion is nearly a third among tenants in the retail trade industry.

Higher tensions in May

Overall economic stress increased considerably since last time rent was due. Many Canadians and businesses have been deprived of their regular income for more than six weeks now, and we see limited prospects for a quick resumption. Massive government support—including the Canada Emergency Response Benefit ($26 billion disbursed so far), Canada Emergency Wage Subsidy, Canada Emergency Business Account, student benefit, commercial rent assistance and various other measures from the federal and provincial governments—has started to flow but will compensate only partially the income lost in most cases. Financial pressure clearly remains intense as tenants sign their rent payment cheques for May. We expect more of them will seek some form of deferral to gain a bit of breathing room to pay other bills.

Landlords will feel pain

We see further downside to rent collection this month. It’s a very tough environment for landlords to take a hard line. On the residential side, they are up against eviction moratoriums in certain parts of the country that tie their hands. On the commercial side, many of their tenants are in extremely precarious financial positions and may go out of business. The joint federal-provincial Canada Emergency Commercial Rent Assistance program announced a week ago (offering loans to landlords lowering rent by 75% to hard-hit small business tenants for three months) could potentially compensate for a portion of the rent collection losses. The initial details of the program were quite restrictive—raising the risk of a low uptake—though governments have shown willingness to make design adjustments when needed.

Fine policy balance

As governments do their best to support tenants hammered by the COVID-19 pandemic, they must also be mindful of the pain landlords feel, and the risk excessive pain poses to the broader real estate market. It would be the worst the possible time for our economy to contend with a wave of troubled rental properties threatening to destabilize the market.

RBC’s client data statistics use RBC Data & Analytics’ proprietary database of anonymized transactions by Canadian clients. Protecting your privacy and safeguarding your personal information is a cornerstone of our organizational ethics and values and will always be one of our highest priorities. The underlying data for this analysis was aggregated based on transaction date, region and merchant category, and cannot be used to identify any individual client or merchant. For additional information please visit www.rbc.com/privacy.

Robert Hogue is a member of the Macroeconomic and Regional Analysis Group, with RBC Economics. He is responsible for providing analysis and forecasts for the Canadian housing market and for the provincial economies. His publications include Housing Trends and Affordability, Provincial Outlook and provincial budget commentaries.

Disclaimer

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.