Think of any item you buy routinely. It could be something at the grocery store, socks, accessories, etc. We all have them, and we are all acutely aware of the price we pay for them.

For example, I am the one in our household who does the bulk of the grocery shopping. Naturally, my thing is food. I know prices, I know our families needs/wants, and I keep a mental inventory of everything in our fridge and on our shelves. So, when certain items go on sale, to my wife’s shagreen, I’ll load up. In my mind, I always think of Tom and his memorable quote in Guy Rithcie’s ‘Lock, Stock and the Two Smoking Barrels’, “It’s a steal, it’s a deal, it’s the sale of the century.”

Given the current drawdowns in our public markets, I can’t help but think of this same quote. Everything is on sale.

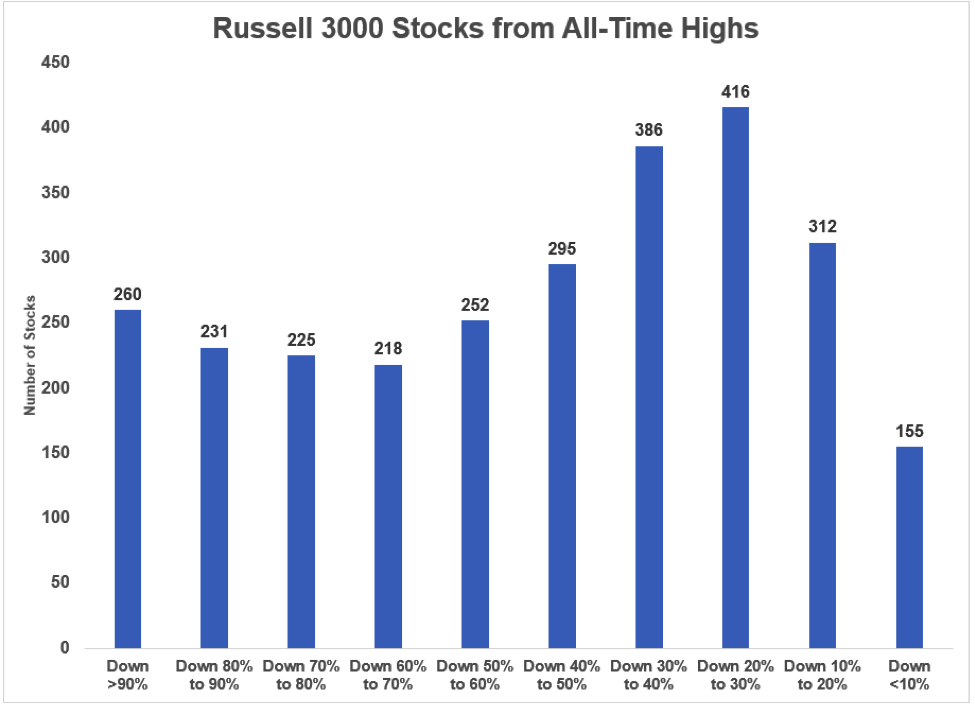

Just have a look at this chart of the Russell 3000, and index that is comprised of the 2700 stocks in the US (check out what’s in it here). The index is down ~17% YTD. Within that index, almost half the stocks are down 50% or more!

There’s a massive sale happening now. And yes, the sale could get even better, but, I’ve always been partial to the 30-50% off rack, and it’s getting pretty full right now. Some of you reading this may like that 70-90% off rack, but I stay clear - something clearly must be wrong with what’s on it.

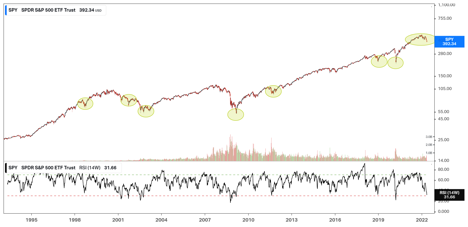

Have a look at this next chart… I’ve highlighted other points in history over the last +20-years when we experienced big drawdowns/sell-offs. My guess is that you are experiencing the same feeling now as you did then (E.g. aware things are on sale, but a little nervous about investing because this is going to be the one time in history when things are different and the market completely crashes to zero). If you’re feeling the same way now, you may be right, but history isn’t on your side.

My guess, a year after these particular drawdowns, you were probably kicking yourself wishing you have invested/invested more; fortunate you didn’t go to cash at the bottom; or, sitting on cash thinking the current run-up was a bubbly that would pop again and you’d have the cash to invest then. How will you feel a year from now?

So assuming you have some spare cash today how should you allocate? If you are nervous about equities, fine, have a look at fixed income as it’s also on sale.

We can now find yields on fixed income ETF/funds or even GICs in the +3% range. Yes, that’s less than inflation at the present moment, but if you are in the camp that inflation will eventually slow, that +3% is right in the sweet spot for long-term investors who prefer/demand fixed income in their portfolio. Yes, interest rates could go even higher (look at the 10-yr) which would cause bond prices to go even lower and bring yields higher, but things look compelling now.

This may just be the sale of the century, maybe not. As I’ve said before, prices are a lot cheaper than they were 5-months ago, so maybe, just maybe it’s time to start picking some items off the sale rack.