Black Friday is the day when everything we want, or think we need, finally goes on sale. If we’re prepared with cash or credit and know where to find the best deals, we can take full advantage.

What makes Black Friday unique is that it’s predictable. It always arrives the Friday after American Thanksgiving. We know exactly when the sales are coming – they are broadcast at us weeks in advance.

Now imagine if investing worked the same way.

What If the Market Had Its Own Black Friday?

Imagine knowing in advance when the companies you most want to own would drop to bargain prices. You’d be ready, cash in hand, to buy more of the businesses you believe in.

But markets don’t announce their sales ahead of time. Their Black Friday moments show up unplanned and uninvited.

This year, we have experienced two such opportunities: first in March/April around the infamous Rose Garden speech, and again in the past week. The market corrected, and several high-quality businesses we’ve long wanted to own, or own more of, finally went on sale.

Long-time clients know we prepare for moments like these. With our “Hail Mary” buy orders already in place, we were able to increase positions in some of the businesses we owned, and add businesses we’ve wanted to own. The deals were so good we purchased more than we had available cash on hand.

Which raises an important question…

What If You Want to Buy During a Market Sale but Have No Cash Available?

One approach is to high-grade the portfolio. If one company has stronger upside potential (risk-reward) than another in the portfolio, you simply rotate money from the weaker company into the stronger one.

But for those of you comfortable with debt, borrowing to invest (also called leveraged investing) can be a strategic tool. It’s not new and when we use it, it’s typically tactical – specifically to take advantage of short-term mispricing with a disciplined/predetermined exit plan (for example, selling and repaying the loan once a holding rises 10%).

The Concept: Borrowing to Invest

Borrowing to invest is simple in concept; you borrow funds and invest them directly in income-producing assets where the goal is to generate a return from the investment exceeds the cost of the borrowed money. It is akin to those of you who are business owners and entrepreneurs and are using “smart debt” to expand your business.

We only suggest borrowing to invest in moments when we want to increase our exposure in a business that have passed our disciplined screening process and is now priced at something we want to pay.

Understanding the Mechanic of Leveraged Investing

1. Magnified Gains, and Losses

When investments rise in value, the returns on a larger pool of capital (your money + borrowed funds) can be significantly higher than investing only your own cash.

Just as gains are amplified, losses are too. If markets decline, the value of the investment may fall while the loan balance stays the same — increasing your downside.

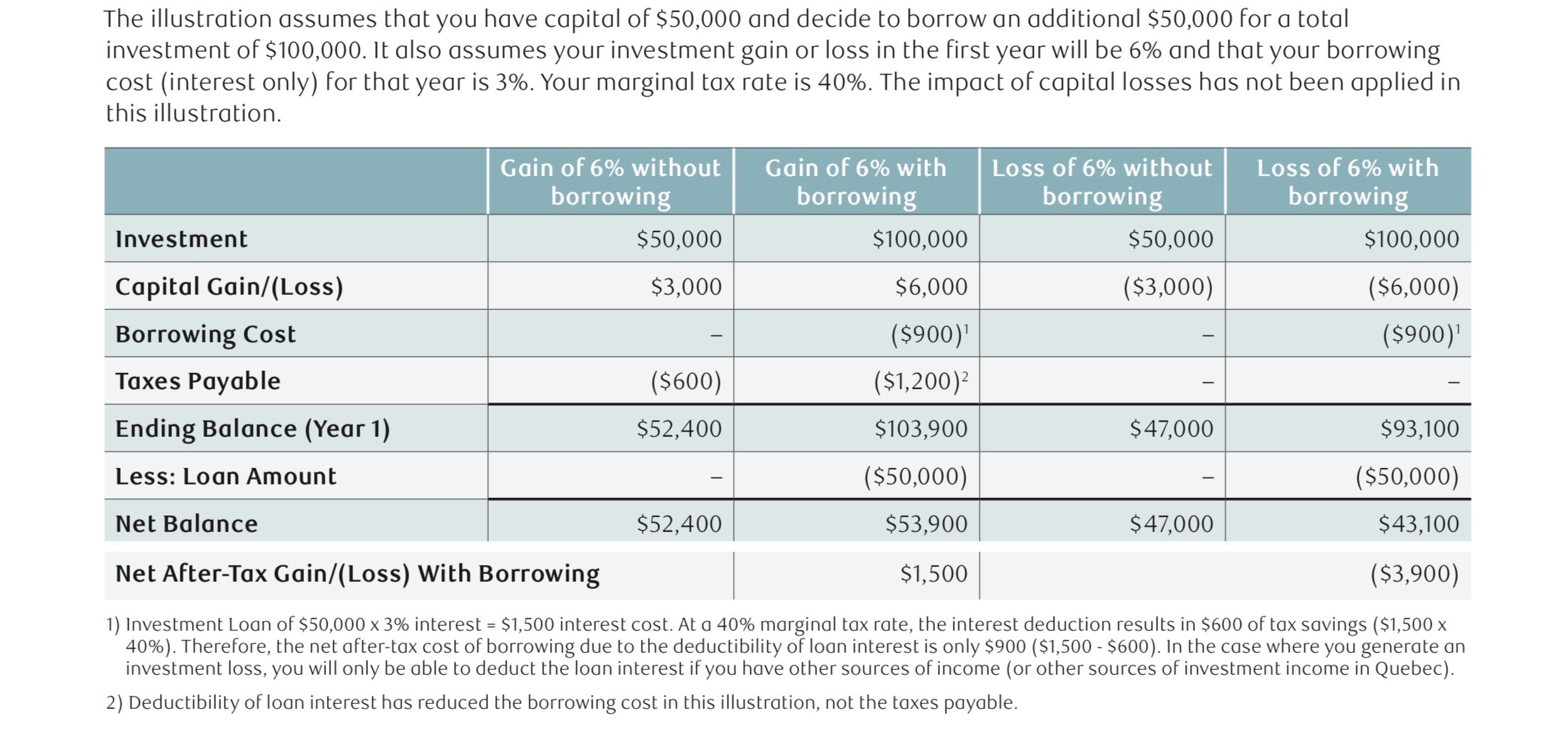

The below table illustrates the impact of a gain and loss when they borrow to invest.

2. Tax-Deductible Interest

Borrowing to purchase income-producing assets often allows the interest to be deducted, lowering your after-tax borrowing cost and improving your net return. However, there are certain conditions that need to be satisfied for this to happen. They are;

- Borrowed funds must be used to buy income-producing investments. As in there a reasonable expectation that what you invest in will generate some form of dividends or interest income. Purchases of common shares of publicly traded securities typically fulfil this requirement.

- Using proceeds for personal purposes (RRSP/TFSA contributions, travel, renovations, etc.) may cause interest to become non-deductible

3. Cash Flow Pressure

Since you are borrowing money, you will be required to service monthly interest payments. As it may take some time for the investment option t begin working, it is important you have the cash flow to service the debt and not be forced to sell (e.g. a margin call).

This may require strong, predictable cash flow outside your investment portfolio. Also, the tax-deductibility of the interest payments comes at tax time. So, you may be forced to service the debt with after-tax income for a period of time.

4. Higher Volatility = Higher Stress

Leveraged portfolios fluctuate more in both directions. This requires the right temperament and comfort with risk. We only recommend this strategy for those of you who comfortable with the ability and willingness to take on such risk/volatility.

5. Long-Term Wealth Creation

With a long enough time horizon, the combination of compounding growth and tax efficiency can meaningfully accelerate wealth creation, especially when buying during market downturns. Being able to buy when things are on sale, especially when you have a long-time horizon, will help be a key element to long-term wealth creation for you and your family.

Bringing It All Together

Borrowing to invest can be an effective way to take advantage of unexpected market opportunities - the market’s own unannounced Black Fridays. But it’s a strategy that requires discipline, cash flow stability, and comfort with volatility.

For those of you who meet those criteria, leverage can be a powerful tool to enhance your long-term wealth, especially when high-quality companies temporarily go on sale.

Want to learn more? Reach out to us at hastingsnoble@rbc.com