Markets

Last week, the TSX Index closed on an all-time high for a 13th consecutive trading session. It represents the longest upward trend in the market since 1985. This impressive performance should reassure some investors about the performance of the Canadian market this fall season.

For its part, the S&P 500 is up 6.2% in October, and reached a new all-time historical high on October 26. As the earnings season is delivering strong numbers, we saw an expansion of the average price/earnings multiple from 20 to 21.1 times, which was the engine driving growth in the market. Investors fear increasing interest rates, inflation and higher energy prices, but these indicators are also a sign of strong economic growth and support expectations of higher stock prices.

As shown in the table below, the S&P 500 shows a return of 15.9% during the first 9 months of the year. Since 1950, there have been 22 other years where the S&P 500’s return in the first nine months has been greater than this year. In all but two of the years, the S&P 500 was positive during the fourth quarter with an average return of 4.5%. The bottom line here is that, in years where market performance starts strong, it historically ends strong. It is therefore not recommended to get out of the market for fear of a correction. History has proven it is not a winning strategy.

Source: Strategas

Nevertheless, the U.S. is struggling with gridlocks on the debt ceiling, the infrastructure bill and the new spending package. It is also experiencing strong resistance from some segments of the public on vaccination mandates.

Supply chain bottlenecks are exacerbating inflationary pressures and pushing interest rates higher. The 10-year Treasuries in the U.S. are now at 1.5%.

The third quarter earnings season, which is now underway, may provide some clues as to how companies are navigating this environment. So far, the results have been more than acceptable.

We still see numerous buying opportunities at this time. U.S. companies have announced record levels of share buybacks, as they believe their shares are trading at a discount to intrinsic value. Goldman Sacks data show businesses have authorized more than $870 billion of share buybacks so far this year, almost three times more than in the same period in 2020.

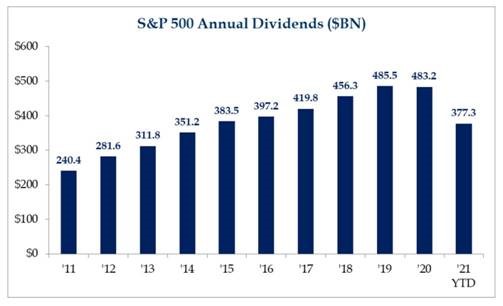

Despite, the dividend yield remaining historically low for the S&P 500, the aggregate amount of dividends paid is on pace for a record year. During the first 3 quarters, companies paid out $377 billion dollars’ worth of dividends, which is $108 billion less than the record set in 2019. Historically speaking, the fourth quarter has proven to be the most robust quarter for dividend payments.

Dividend increases remain robust. With ample cash on the sidelines, S&P 500 companies continue to deploy some of their cash in the form of dividend payments with 72 increases and 5 initiations taking place in the 3rd quarter.

Source: Strategas

In the current environment, we believe a dividend portfolio is well positioned, given owning high-quality, free-cash-flow generating companies that are able to increase dividends over time, and that possess defensive characteristics that tend to perform well during periods of economic uncertainty and market volatility.

Inflation

It is not surprising to see elevated inflation, given the booming economic growth the market is currently experiencing. There have been several pandemic-era developments that have also contributed to higher inflation. A significant rebound in commodity prices, a container shortage that has increased shipping costs, a shortage of computer chips, a continuation of the housing boom(vs. residential real estate bubble). In addition to these, crude oil prices have more than doubled over the past year, rising from $40 per barrel to more than $80 per barrel recently. Natural gas prices are up 130% from a year ago. More recently, some of these distortions have begun to unwind, but it will take some time to get back to normal.

There are always winners and losers when it comes to inflation. The Energy, Materials and Financial sectors are generally positively impacted by a pickup in inflation. This is expected to benefit the Canadian market, as it is has greater exposure to these sectors.

We believe the current environment is temporary, and will gradually revert back to normal, as health restrictions are relaxed. We remain positive about economic growth and improving profitability for corporations.

Changes in the portfolios

Growth portfolios

We believe we are in the early stage of an economic expansion. We have diversified our growth portfolios with exposure to small-cap (minimum $1 billon market capitalization) and mid-cap companies. Our objective is to diversify and acquire some of the future’s great industry leaders. Instead of buying dozens of small positions, we have decided to buy mutual funds with a history of high quality and high returns over a long period. This way, we will own a significant number of quality names, sufficient to significantly reduce risk and offer a potential return similar to private placements.

For mid-cap exposure, we have selected the TD U.S. Mid-Cap Growth Fund. The Fund is designed for investors seeking a diversified portfolio of companies able to increase market share and generate value over time.

For small-cap exposure, we have selected the Pembroke Concentrated Fund (PCF). In its 50th year of operation, the firm launched a North American strategy based on its “Best Ideas”. All securities are selected from Pembroke’s existing U.S. and Canadian portfolios and are generally exciting and disruptive long-term growth businesses. Healthcare, consumer, industrial, technology – and clean technology in particular – are key sectors for the PCF.

« My best advice to individual investors can readily be summed up

in two closely linked precepts. Be patient and don’t be greedy. »

— The late Peter Cundill, Canadian Portfolio Manager and legendary investor

Our Stocks In The News

Teck Resources (TECK-TSX): Teck just reported their most recent results, with an eight-fold jump in third quarter profits, driven by higher prices for steelmaking coal on the back of surging demand from China. Teck said its prices for steelmaking coal more than doubled to US$237 per ton. Revenue for the quarter was C$3.97 billion. Adjusted profits rose to $1.02 billion in the quarter from $130 million in the previous quarter.

Allied Properties (AP.UN-TSX): Allied Properties REIT (Allied) is a leading owner, manager and developer of distinctive urban workspace in Canada’s major cities. The portfolio's largest concentrations are Toronto, Montreal, and Calgary, with clusters of properties also located in Ottawa, Kitchener, Edmonton, and Vancouver. Allied's portfolio consists of 204 properties valued at approximately $10 billion. It has a solid balance sheet with debt of around $3 billion. The most recent quarterly results are encouraging, as free flows from operations were up 10% from last year at $0.62 per unit.

Constellation Brands Inc. (STZ-NYSE): Constellation Brands, Inc. is an international producer and marketer of various alcoholic beverage brands with a portfolio of wine, spirits, and beers including Robert Mondavi and Corona. For the most recent quarter ending August 31st, sales were up 4.9%, amounting to US$ 237 billion. Demand is increasing as more and more bars and restaurants are reopening. Supply chain disruptions and higher production costs had a negative impact on profits, down 13.8%. Constellation is well positioned for the gradual return to pre-pandemic normal performance levels pre-pandemic.

Canadian Pacific Railway (CP-TSX): CP was the weakest Portfolio constituent this quarter, possibly due to supply chain gridlock and grain headwinds impacting volume expectations. The Government of Canada recently updated its forecast for Canadian grain production, expecting a decline of 30% y/y in 2022, reflecting drought conditions in Western Canada. While this could continue to weigh on CP’s shares in the short-term, our long-term view of the company remains the same. CP benefits from high barriers to entry, the critically important nature of rail infrastructure, and a duopoly market in Canada. Furthermore, it is one of the leanest rail operators in North America, and if CP is able to complete the acquisition of Kansas City Southern (KSU), we believe the combination could be a significant driver of long-term shareholder value.

We hope you enjoyed reading our newsletter. Your comments are important, so please share them with us.

We are always happy to answer any questions you may have.

Regards,

Benoit Legros,

Portfolio Manager, The Leclaire-Legros Group