Family business succession planning

Donna and Norm are ready for the next step of their wealth journey. Find out how a custom business succession plan helped this family transition their business into a well-funded retirement.

Consolidating assets for a secure, successful retirement

Jean-Pierre and Sharon are ready for the next step of their wealth journey – retirement. Find out how consolidating their assets and a custom financial plan helped this family feel secure and excited about their new life.

Securing your children's future with an estate plan

A recent diagnosis jolted Denise and Kevin into thinking about the support their daughter, with disabilities, would need once they're gone. Find out how this family got their "house in order," giving them relief and confidence that their daughter will be supported.

A plan for your priorities

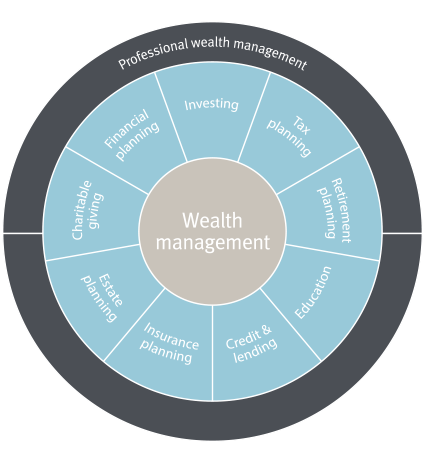

Getting the right investment advice is a key part of managing wealth. But it's just one part of a bigger picture.

That's why you deserve a coordinated wealth management strategy that helps to address the financial concerns at each stage of life, such as:

- Growing assets for future goals like retirement

- Maintaining assets to protect financial well-being

- Creating an income stream for retirement

- Creating a lasting legacy

Contact

We are located in Yarmouth, Nova Scotia. Please complete the following form if you would like us to contact you. Required fields are marked with an "*".

Please be advised that any information sent through this Contact Us page is not considered secure and privacy can not be ensured. Therefore, we ask that you not include any confidential information such as bank account numbers, credit card numbers, or other account details.