The Reset: Committing to the Fall Line

I am writing this with slightly sore legs and a fresh perspective.

Many of you know I spend my winter weekends at Whistler, but you might not know that I have been a snowboarder since I was a teenager. I love the sport—truly. There is a specific, meditative joy in the feeling of "surfing" on fresh powder that remains one of my life’s great highlights.

However, I recently decided to take up skiing as well. I bought a pair of skis and took a lesson because I simply wanted to enjoy the mountain experience in the same way my wife and kids do. My kids are currently 8, 6, and 4, and my wife is still a novice skier, so it’s been about being on the same level and sharing that time together. I’m not giving up the board, but standing at the top of a run as a beginner again was profoundly humbling. I realized that while the mountain hadn’t changed, the tools had. The "equipment" that served me for decades was suddenly the wrong approach. I had to relearn how to move with a different center of gravity.

I share this because the financial markets are currently asking us to do the exact same thing. The "investment equipment" of the last decade—where software and digital processing were reliable staples—is the wrong gear for the terrain ahead. We are witnessing the transition of Artificial Intelligence from a "software trend" into a full-scale Industrial Revolution.

1. The "Zero Cost" Revolution: Why the Models are Changing

To help bring everyone up to speed, I wanted to take a moment to explain why this shift isn't just a "tech upgrade," but a fundamental change in the "physics" of how we invest. For years, we have maintained a diversified approach, but software-driven processing and intelligence services have always been a consistent part of our strategy. Today, AI is changing the rules of that game.

What is Agentic AI? (From "Chat" to "Do")

Most of us have seen AI that can write an email or summarize a meeting. We call that "Generative AI." But we are now entering the era of Agentic AI. Unlike traditional assistants, Agentic AI acts like a specialized worker that can independently plan, make decisions, and execute multi-step tasks to achieve a goal—like resolving a customer dispute or managing a supply chain—with minimal human supervision. To put it in perspective, McKinsey estimates the annual incremental value add of Agentic AI is upwards of $2.6 trillion, roughly equivalent to the GDP of Canada.

The "Zero Cost" Thesis: Intelligence as a Utility

The core idea driving our current strategy is that the marginal cost of intelligence is trending toward zero.

-

The Shift: We are moving from "Software-as-a-Service" (tools humans use) to "Service-as-Software" (where the software is the worker).

-

The Impact: In the past, scaling "intelligence"—whether coding, analysis, or processing—required human-led oversight. With AI agents, the cost to perform the "next" intelligent task drops to nearly the cost of the electricity and chips used to run it.

This creates a risk of counter-positioning and margin compression for legacy software and processing firms. When an AI agent can perform a task that software used to merely "facilitate," the value shifts toward the entity that owns the infrastructure. While many of these companies have been reliable performers for us, the pace of innovation creates a level of uncertainty that is now too high. As such, we have made a number of portfolio adjustments through the start of 2026 to reduce our exposure here to move into areas of greater certainty.

2. Beyond Tech: The Industrial Benefactors

It is a mistake to think this is only a "technology" story. This revolution is quickly moving beyond software, becoming a foundational layer for almost every major sector.

-

Industrial & Manufacturing: We are seeing "Physical AI" transform factories into self-optimizing "Smart Factories". In logistics, autonomous routing is already driving significant cost reductions.

-

Financial Services: Banks are using self-learning agents to cross-validate transactions in real-time, shifting from reactive damage control to proactive risk management.

-

Consumer & Retail: AI agents now influence a growing percentage of purchasing decisions by redefining how consumers discover products and how retailers forecast demand.

The Breakthrough in Medicine

Perhaps the most profound impact is in healthcare. 2026 is the year AI has become essential in drug discovery. Identifying disease targets now relies on computational exploration, shortening feedback cycles from years to months. From precision oncology to genomics, pattern recognition is unlocking treatments that were previously hidden.

3. The Physical Infrastructure: Building the Global Nervous System

To understand the scale, we must look at the "factories" where this intelligence is manufactured: Data Centers.

-

Growth: At the end of 2024, there were approximately 5,200 major data centers worldwide. By the end of 2025, that is expected to reach over 6,100.

-

The 2030 Projection: Analysts anticipate that by 2030, global capacity will essentially double, adding nearly 100 Gigawatts (GW) of new supply—enough to power the entire United Kingdom and Germany combined.

The Copper Reality Check

A single one of these new "Hyperscale" campuses can require between 30,000 to 60,000 tonnes of copper. For context, a typical world-class mine produces roughly 150,000 to 450,000 tonnes per year. This means one large AI campus can consume up to one-third of the annual output of a major world mine. We are building these campuses at a rate that the physical world of mining—which takes 15 years to bring a new project online—will struggle to match.

4. A Moment in History: AI as the New Railroad

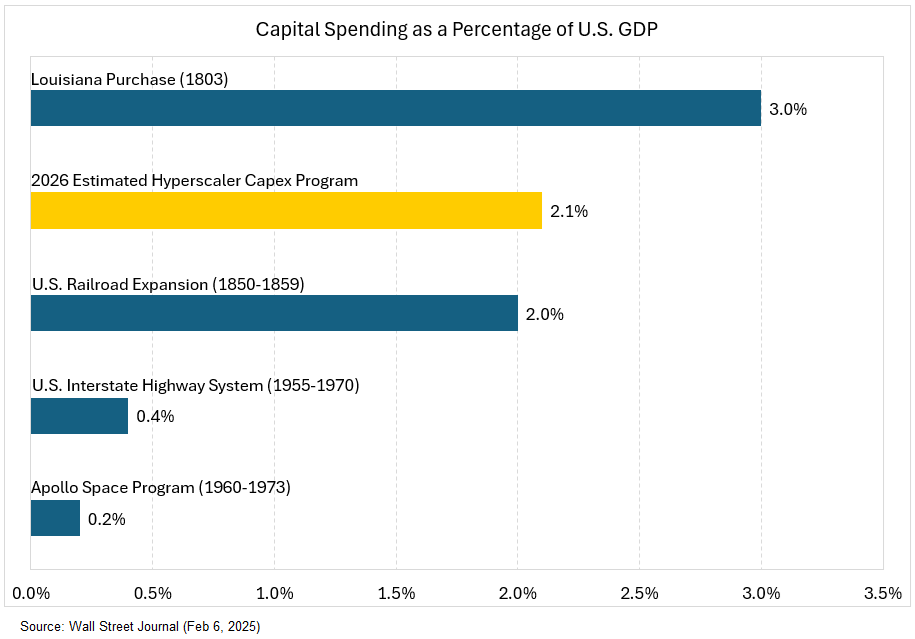

This is one of the greatest industrial shifts in history. When we look at the historical "Great Transitions," the scale of the AI build-out is actually outpacing many of them.

- The Railroads (1850s): Over a decade, investment reached roughly 2.0% of U.S. GDP, this build-out collapsed the cost of distance.

- Electrification (1920s): Peak investment hit roughly 2.0% of GDP. It took 30 years to fully revolutionize manufacturing by collapsing the cost of power.

- Federal Interstate Highways (1950s-70s): This 35-year project approached roughly 0.4% of U.S. GDP.

- The AI Revolution (2025-2026): Infrastructure spending is already exceeding 2% of U.S. GDP.

This revolution is currently being funded by the massive cash flows of the Hyperscalers (Amazon, Microsoft, Google), who are spending nearly $700 billion of their own cash in 2026 alone. However, we are now entering the era of Sovereign AI. Nations are realizing that intelligence is a strategic reserve, much like oil was in the 20th century. Analysts predict that countries seeking "digital sovereignty" will need to allocate at least 1.0% of their total GDP to building domestic AI infrastructure by 2029.

Conclusion: Committing to the Fall Line

In snowboarding—and now, as I'm learning, in skiing—if you lean back out of fear, you lose control. You have to commit to the "fall line" to stay balanced.

While we have adjusted our "equipment" to capture the growth of this historic build-out, it is important to remember that our core philosophy remains unchanged. We are still diversified. We continue to prioritize high-quality dividend payers, robust financials, stable consumer businesses, and energy producers that anchor your wealth. We are owning the Hard Assets and the infrastructure of the next decade, while maintaining the balanced foundation that protects your purchasing power.

We are not positioning for the next quarter's earnings, but for the reality of the next decade. If you would like to discuss the specific names and weightings within your individual portfolio, please reach out. We would be happy to walk you through how these themes are specifically applied to your wealth.

As always, if you have questions—or if you want to see video evidence of my "pizza slice" skiing technique—my door is open.

Marc Correia, CFP CFA Senior Portfolio Manager & Wealth Advisor Correia Private Wealth | RBC Dominion Securities

Sources:

- Agentic AI & Industrial Impact: McKinsey / Deloitte / BCG / SymphonyAI (2025-2026).

- Medical & Genomic Advancement: Sapio Sciences / Mass General Brigham / Pharma Now (2026).

- Infrastructure & Historical GDP: S&P Global / Yale Economic Research / Tomasz Tunguz / Gartner (2025-2026).

- Capex as a percentage of GDP: Wall St. Journal (Feb 6 2026).

- Copper Intensity & Mine Output: USGS Mineral Commodity Summaries 2025 / Natural Resources Canada.

- Data Center Copper Consumption: Schneider Electric

Disclaimer

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. â / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. (insert applicable year). All rights reserved.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that any action is taken based upon the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein.

This commentary is based on information that is believed to be accurate at the time of writing, and is subject to change. All opinions and estimates contained in this report constitute RBC Dominion Securities Inc.'s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Interest rates, market conditions and other investment factors are subject to change. Past performance may not be repeated. The information provided is intended only to illustrate certain historical returns and is not intended to reflect future values or returns.