The Physical Internet:

How Robots, AI, and Policy Are Rewiring the Economy

Every decade or two, a shift reshapes the foundations of the economy. Often, it starts quietly—an undercurrent of experimentation and early deployment—until suddenly, its implications become too significant to ignore. We believe we are in the midst of one of those inflection points today. Not because of one invention, but because of the convergence of several powerful forces: robotics, artificial intelligence, cloud infrastructure, and now, aggressive government policy—all coming together to transform the way the physical world is built, moved, measured, and managed.

We call this emerging system the Physical Internet—an interconnected, decentralized, intelligent network of machines, platforms, and automation systems that interact in real time with the physical world. Much like the digital internet reshaped communication and commerce, the physical internet is set to revolutionize logistics, manufacturing, services, and infrastructure itself.

This isn’t a story about humanoid robots alone. It’s about the platform shift underneath them. Just as early fiber optic cables, data centers, and protocols laid the foundation for Google, Meta, and Amazon, today’s automation layers—robotic operating systems, AI model pipelines, high-precision sensors, and software platforms—are laying the groundwork for a new generation of industrial and economic leaders.

And now, thanks to a new U.S. capital investment stimulus bill and AI Action Plan, this future is no longer theoretical. The incentives are real. The infrastructure cycle has begun.

The $1.5 Trillion Opportunity: UBS and the Rise of Intelligent Machines

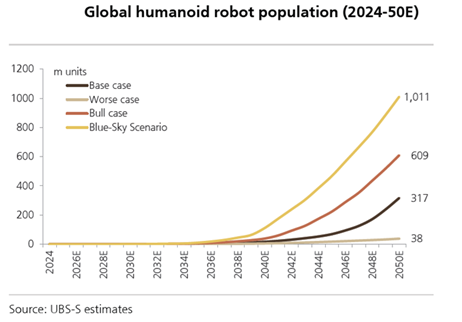

According to UBS’s landmark 2025 Q-Series report, Is the World Ready for 1 Billion Robots? The global population of intelligent robots—particularly humanoid robots—could exceed 300 million by 2050, up from fewer than 20,000 today. That equates to a compound annual growth rate (CAGR) of more than 40%, with a total addressable market (TAM) of $1.4 to $1.7 trillion across hardware, software, services, and support infrastructure.

Why now? Several factors are converging:

-

AI breakthroughs: Foundation models and simulation environments are enabling faster learning for robotic systems, narrowing the gap between fixed-function machines and generalist robots.

-

Hardware cost declines: Actuators, sensors, and motion-control systems are becoming dramatically cheaper and more precise.

-

Demographic pressure: Aging populations and labor shortages—especially in developed markets—make automation not optional but inevitable.

-

Policy tailwinds: Capital investment incentives (discussed below) are supercharging enterprise spending.

UBS draws an important parallel to the early days of electric vehicles (EVs): enormous long-term potential, but short-term bottlenecks. It took EVs more than a decade to move from 1 million to 10 million units annually. Humanoids may follow a similar curve—but as technology and regulation mature, deployment will accelerate.

Not Just Hardware: Systems, Data, and the New Value Chain

Too often, robotics is imagined in terms of metal arms and warehouse bots. But as UBS rightly notes, the real opportunity lies in the platforms and data layers that make these machines intelligent, adaptable, and scalable.

Humanoids are not yet ready to perform general household tasks en masse—UBS expects the “EV moment” for humanoids to begin only after 2030—but the enabling infrastructure is already here. Cloud computing, AI model training, sensor fusion, and robotic simulation are seeing widespread deployment. These are the layers that will ultimately allow robots to “learn together” at scale.

Think of it this way: in the 1990s, most people wouldn’t have thought to invest in the underlying protocols of the internet. But those who bet on infrastructure—Amazon Web Services, Microsoft Azure, Cisco—benefited from decades of compounding platform value. Robotics is now at a similar moment. We’re not chasing the robots themselves. We’re investing in the architecture that will allow millions of them to operate, learn, and evolve in the real world.

The Big Beautiful Bill: Capex Stimulus and the Policy Flywheel

Against this technological backdrop, a powerful macroeconomic tailwind has emerged. In July 2025, the U.S. passed what has been unofficially dubbed the One Big Beautiful Bill (OBBB)—a sweeping capital investment stimulus package that may prove to be one of the most consequential economic catalysts in a generation.

Here’s what the OBBB does:

-

100% immediate expensing for nearly 80% of capital expenditures across manufacturing structures, equipment, software, and R&D.

-

Effective corporate cash tax rate drops to ~10%, down from ~20% in 2024

-

Tax savings of $300 billion in year one alone, representing more than 1% of GDP

-

Capex now has 3x the GDP punch of housing: a 10% capex increase can add over 1.5% to real GDP in two quarters

Piper Sandler calls this the “most underappreciated growth engine” in the U.S. economy—and we agree. The incentives don’t just reward spending; they reward strategic investment in automation, productivity, and resilience. Companies like Verizon, AT&T, and Johnson & Johnson have already flagged significant increases in cash flow and planned investment directly tied to the bill .

From our perspective, this is more than stimulus. It’s policy-driven structural transformation.

The AI Action Plan

The American AI Action Plan unveiled on July 23 by President Trump, lays out a bold 90-point roadmap to secure US dominance in AI. It centers around 3 key pillars: innovation, infrastructure and international leadership.

-

Innovation and Regulation: remove red tape, promote open-source models and accelerate AI adoption across industries and government.

-

Infrastructure: streamline permitting, modernize the electrical grid, expand data centers and restore onshore semiconductor manufacturing

-

Diplomacy: Build a US aligned global AI alliance, enforce export controls, and counter Chinese influence in AI governance.

Wining the global AI race is a national imperative, economically, militarily and culturally. To secure dominance America will need to walk a knife edge that unleashes innovation and dismantles regulatory roadblocks while protecting national values.

Capex Meets Autonomy: A Perfect Storm for Robotics

When you combine a technological inflection point (robotics + AI) with a fiscal catalyst (OBBB) and government backing (AI Action Plan) you create a multiplier effect. Consider the downstream impact:

-

Warehouses and factories will adopt mobile automation faster—especially for “last 10-meter” tasks where humanoids or mobile robots replace low-skill labor.

-

Construction and logistics companies gain an incentive to digitize their workflows, integrating robotics into their physical infrastructure.

-

Cloud and data platforms become critical control layers for coordinating large fleets of devices across facilities and geographies.

This isn’t theoretical. The Empire and Philadelphia Fed Capex Plans Index has already begun to tick higher. So have Fastenal’s industrial sales—an early indicator of manufacturing buildout. UBS estimates that humanoid robot adoption in manufacturing will grow faster than traditional industrial robots ever did, due to lower costs and faster ROI.

The key point: capital is being deployed not just to automate, but to modernize.

The Amazon Use Case

With 750,000 robots in operation, assisting with 75% of customer orders, Amazon is the undisputed leader in robot deployment.

The “Sparrow” uses AI to handle millions of unique items in Amazon’s catalog.

Packaging automation stations in Amazon’s warehouses “box on demand”. These are machines that based on measurements taken by sensors will wrap the order, with each station able to process 700 orders per hour, replacing 24 human workers. A packing robot will cost $1 million plus operating expenses, yet Amazon recoups the capital outlay in just 2 years through saved labor expenses.

Proteus, Amazon’s original autonomous robot picks up pallets, driving them to loading docks and is capable of hauling 880lbs at a go, reducing employee injury risk while improving operating efficiency.

Tying it all together, a fully automated Amazon facility works 20+ hours a day, can achieve 25% cost savings during peak order weeks. The future for Amazon is clear, with over 1 million frontline employees, robots can lower employment churn, reduce injuries and drive warehouse efficiency.

The use cases for robots stem further than simple logistical work in warehouses or food delivery. One should consider the opportunities in health care, especially rapid diagnosis or surgery, along with complex industrial and pharmaceutical manufacturing and defense, as being major beneficiaries of robotics.

Investing in the Physical Internet: Infrastructure Over Headlines

Our investment philosophy is straightforward: we don’t chase robotics headlines—we invest in the infrastructure of autonomy.

That means focusing on companies with:

-

Durable competitive moats

-

Mission-critical platform roles

-

Strong balance sheets

-

Exposure to secular productivity growth

Several of our core holdings already reflect this conviction:

-

Microsoft (MSFT) – A cloud-native powerhouse, Azure integrates robotics simulation, IoT infrastructure, and edge AI, making it foundational to automation ecosystems.

-

Amazon (AMZN) – Already operating the largest robotic workforce globally, Amazon is a logistics and AI platform company with a structural data advantage few can match.

-

Snowflake (SNOW) – A leader in data infrastructure, Snowflake enables real-time analytics and cross-organizational data sharing—critical for robotic learning and automation feedback loops.

-

Cadence Design Systems (CDNS) – At the heart of robotic system design, Cadence’s simulation tools allow complex systems to be built and tested virtually before deployment.

-

Ametek (AME) and Amphenol (APH) – Specialists in sensors and electrical interconnects, these companies are supplying the sensory and connective tissue of the physical internet.

We’re also actively evaluating the entire value chain, several adjacent opportunities that align with this infrastructure thesis include:

-

Teradyne (TER) – A leader in robotic testing and advanced automation for high-reliability manufacturing environments.

-

Rockwell Automation (ROK) and ABB (ABB) – Industrial automation integrators with significant exposure to factory retrofitting and intelligent control systems.

While we don’t currently hold these names, we’re studying them—and others—to assess how best to gain exposure to the next layer of automation and platform integration.

The companies we favor are not building humanoids. They’re building the operating system of the physical world. And that’s where we see the most enduring value.

Humanoids: The Long-Term Horizon

UBS’s analysis projects a global humanoid population of over 2 million by 2035, and more than 300 million by 2050. The total market could reach $50 billion by 2035 and exceed $1.5 trillion by mid-century.

But as UBS wisely cautions, mass-market humanoids will not arrive overnight. We expect the pathway to unfold in three waves:

-

Industrial Applications (2025–2030): Carrying, packaging, and inspection tasks in factories and warehouses.

-

Service Sector Adoption (2030–2035): Hospitality, elder care, security, and maintenance.

-

Household Use (2035–2040+): General-purpose assistants, child care, and mobility support.

Technical bottlenecks—particularly in AI brain functionality, sensor fusion, and regulatory compliance—still exist. But as AI training environments and robotic simulation improve, these constraints will erode over time.

Our strategy does not require direct exposure to humanoid OEMs. Instead, we focus on platform enablers: semiconductor firms, rare earth suppliers, cloud providers, and AI software developers who power the ecosystem.

Why This Matters Now

This is not a hype cycle. This is an infrastructure cycle.

Labor shortages persist. Global supply chains are reconfiguring. Aging demographics are putting pressure on service sectors. And now, policy is aligning capital with transformation.

The automation economy is no longer a speculative future—it is a necessary present. And the long-term implications are profound:

-

Productivity gains that reduce inflationary pressures

-

More resilient supply chains, supported by domestic manufacturing

-

Democratization of physical labor, as machines increasingly handle low-skill, high-risk, or repetitive tasks

We believe the Physical Internet—powered by robotics, AI, and policy—is one of the defining investment frontiers of the next two decades.

Bringing It Back to You

We share this thesis not to chase headlines—but to help you stay ahead of long-term structural shifts that could shape portfolios for decades.

The rise of the Physical Internet is more than a technology story. It’s a productivity story, a policy story, and ultimately, a resilience story. We believe this convergence of robotics, AI, and capital investment will redefine how industries operate and where future value is created.

As always, our role is to interpret these shifts and position your portfolio with care and clarity—identifying real opportunity while avoiding hype. That means owning durable businesses that enable the automation economy, benefit from long-term tailwinds, and deliver resilient performance across cycles.

If you’d like to explore how this theme connects with your current strategy—or how it might evolve over time—we’d be glad to have that conversation.

Our goal is simple: to ensure you stay ahead of the curve, not caught behind it.

Regards,

Marc Correia

References:

UBS - Q-Series: Is the World Ready for 1 Billion Robots

Whitehouse.gov - One Big Beautiful Bill

Whitehouse.gov - AI Action Plan

Disclaimer

This commentary is based on information that is believed to be accurate at the time of writing, and is subject to change. All opinions and estimates contained in this report constitute RBC Dominion Securities Inc.'s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Interest rates, market conditions and other investment factors are subject to change. Past performance may not be repeated. The information provided is intended only to illustrate certain historical returns and is not intended to reflect future values or returns. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2025 RBC Dominion Securities Inc. All rights reserved.