Making sense of the current situation

Let’s start with – the current economic/market situation is weird. The obvious reason for this is – tariff uncertainty and its impact not only on current data, but the direction of future data. That said – we thought it would be worthwhile to take a swing at the current dynamic and do our best to give a sense as to where things are and where they could be headed.

Let’s start with the U.S. economy and then add some thoughts on Canada.

The Headline: Things have slowed down, but this may be the “new normal”

While there are different ways to build a model of a country’s Gross Domestic Product (GDP), a simple formula would be GDP = Size of the workforce (W) x Productivity of the Workforce. The second part – Labor Productivity – is the amount of real GDP (so adjusted for inflation) that is generated per hour of labor. So, if the size of the workforce is growing and labor productivity is growing, then the economy is growing. But, if one or the other is not growing, then then other must grow at a faster rate in order to offset the lack of growth in the other.

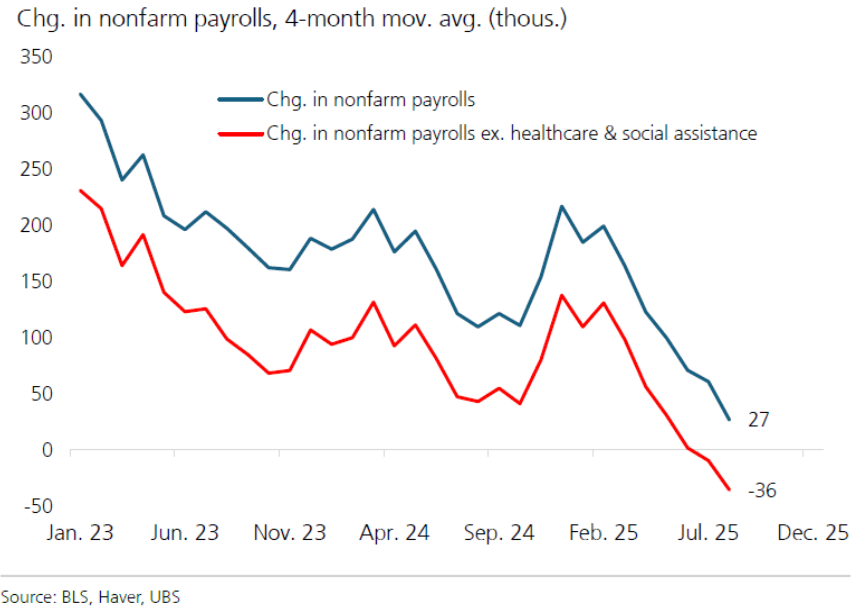

With is in mind, let’s look at a chart and then comment:

The size of the labor force is at best stagnating and is at worst outright declining. If we strip out healthcare and social assistance jobs, the U.S. economy has essentially not created any net jobs in the past five months. There are a lot of things contributing to this, including:

- Tariffs and tariff-driven uncertainty: while we can debate whether tariffs will ultimately lead to a surge of investment in the U.S., this is likely to be years down the road, whereas in the near-term, U.S. based companies seem unwilling to hire.

- Immigration: net immigration to the U.S. is forecasted to be between -200,000 and -500,000 in 2025. Further, anecdotally, there are workers who may or may not be in the U.S. legally, who are unwilling to go to work for fear of arrest. The recent “Korea Incident” at a Hyundai plant in Georgia exacerbates these fears as 475 Korean nationals were arrested and jailed without much apparent thought put to whether or not they were working at the plant legally.

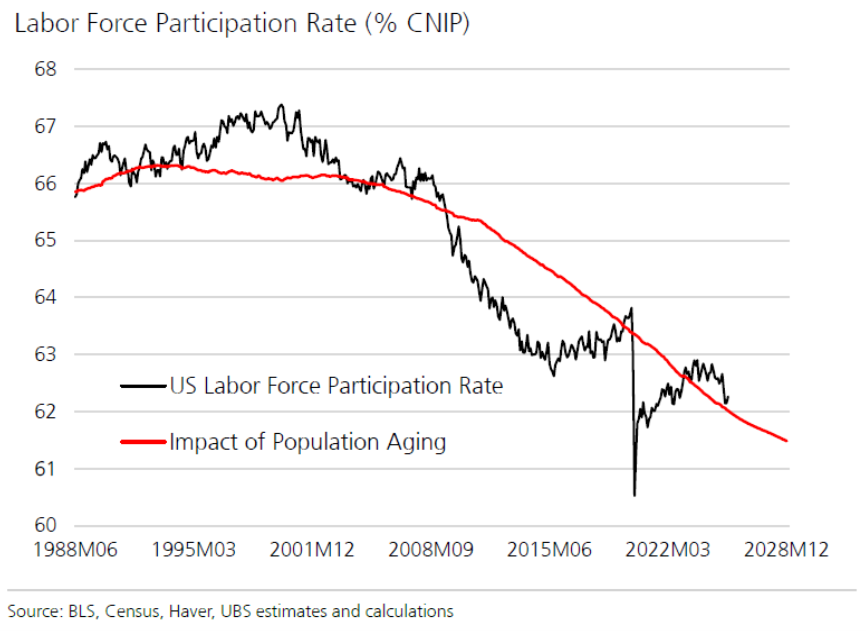

- Aging workforce: again, let’s pivot to a chart for this one:

So, if the labor force is stagnating, productivity needs to pick up the slack in order to drive higher GDP. The good news is – we have seen early signs that Artificial Intelligence (AI) investment is beginning to contribute to a resurgence in productivity growth – the so-so news is – we do not know yet how sustainable this will be.

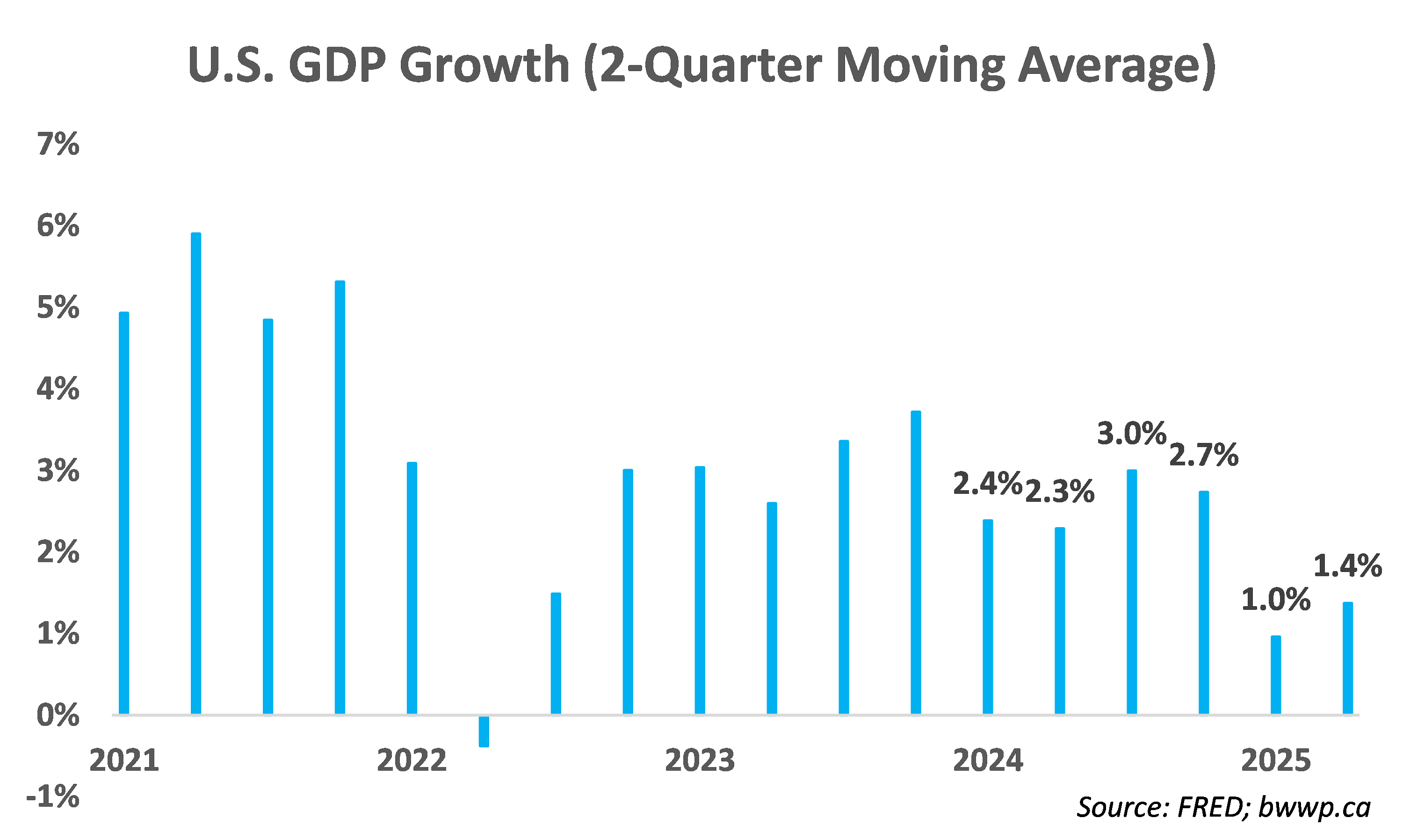

As a result, real GDP growth in 2025 has downshifted from a 2-3% run rate to a 1-2% run rate:

Now, as we wrote over the summer – a combination of fiscal stimulus from the One, Big, Beautiful Bill and falling interest rates are likely to lift this 1-2% run rate for 2-4 quarters, but this will simply mean that the economy is running hot, which may not be a good for inflation, which we will get to in a bit.

What about Canada?

RBC Economics has a fairly positive view of the Canadian economy going forward. While the job market has shed 107,000 jobs the past two months (the equivalent of the U.S. economy losing more than one-million jobs), almost all of these losses were confined to Manufacturing, Transports and Warehousing, which were the most impacted by tariffs. RBC Economics expects trade to stabilize, while a combination of strong consumer spending and fiscal stimulus should provide a lift to the economy as we head into 2026.

The Headline: The Fed may be about to compound the inflation problem

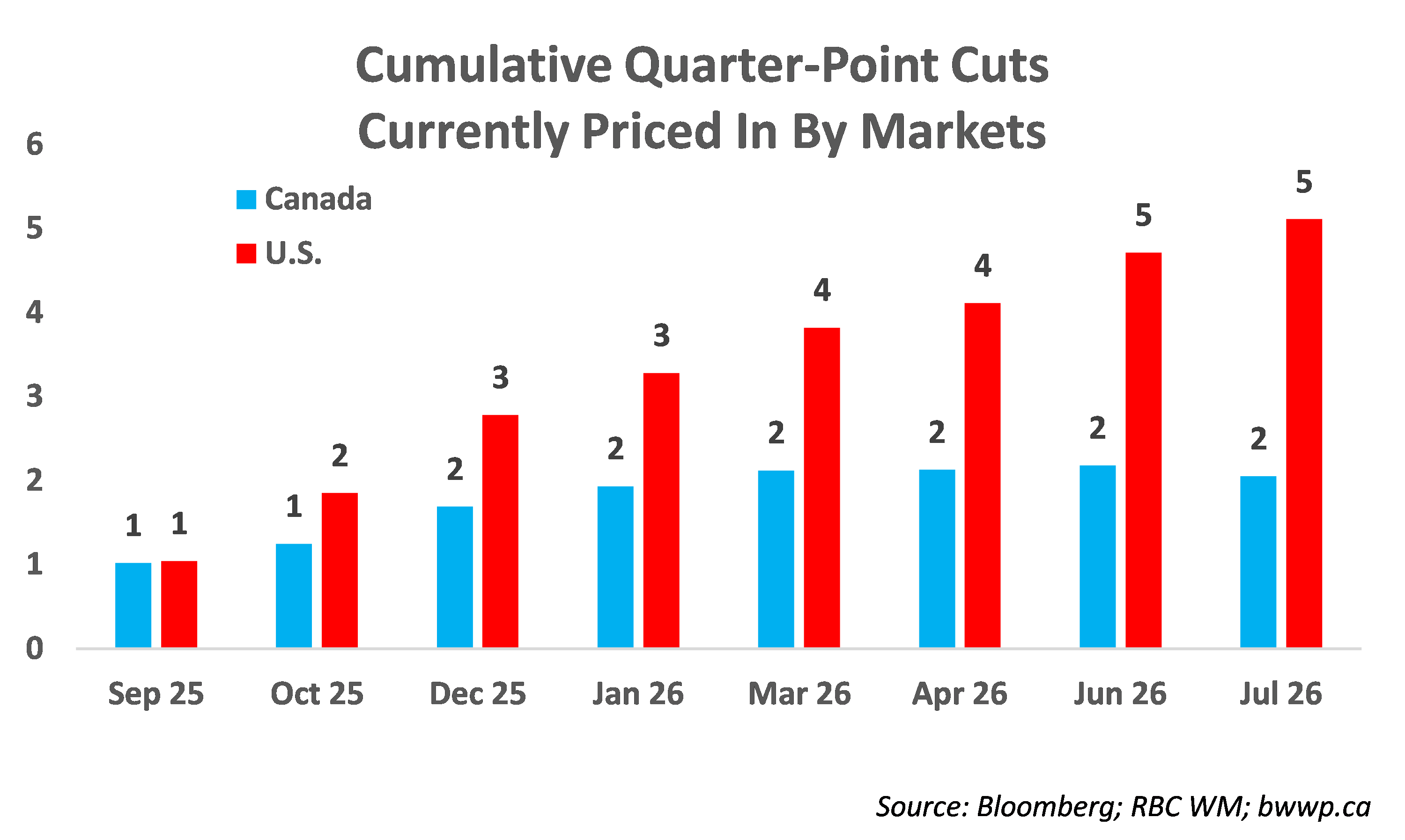

As we wrote over the summer, inflation remains a concern both in the U.S. and Canada. But the new piece of information we now have is – the Fed, which was on hold when we predicted that inflation would become an issue as we headed into 2026, is now almost certain to begin cutting rates over the next several months.

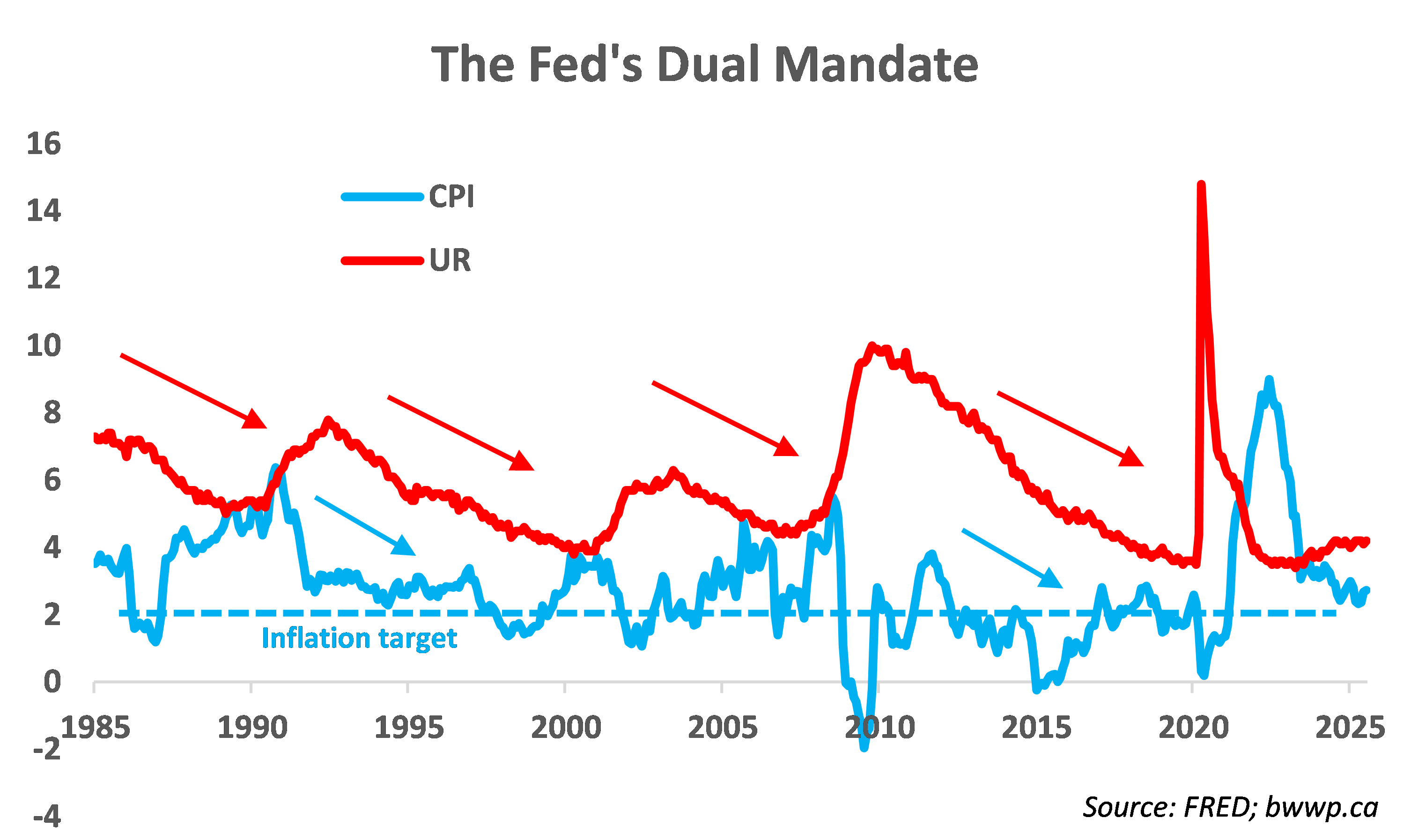

The Fed has a dual mandate – full employment and stable prices. For much of the past 25-years, the focus has been more on full employment, as inflation was either declining or below the Fed’s 2% target, so the Fed could prioritize full employment.

But the past few years have been different, as price stability has proved elusive, while more recently – the unemployment rate has been on the rise.

The problem is – as we described earlier, it’s not entirely clear that the U.S job market is actually bad, but rather that the pool of available labor has stagnated, which has lowered the number of jobs needed to create full employment. In other words – the job market probably does not need the Fed’s help as the lack of available labor should naturally bring unemployment down.

On the flipside, inflation, which is ~0.75% above the Fed’s target, looks to be trending higher with more than 70% of inflation components now rising more than the Fed’s 2% target:

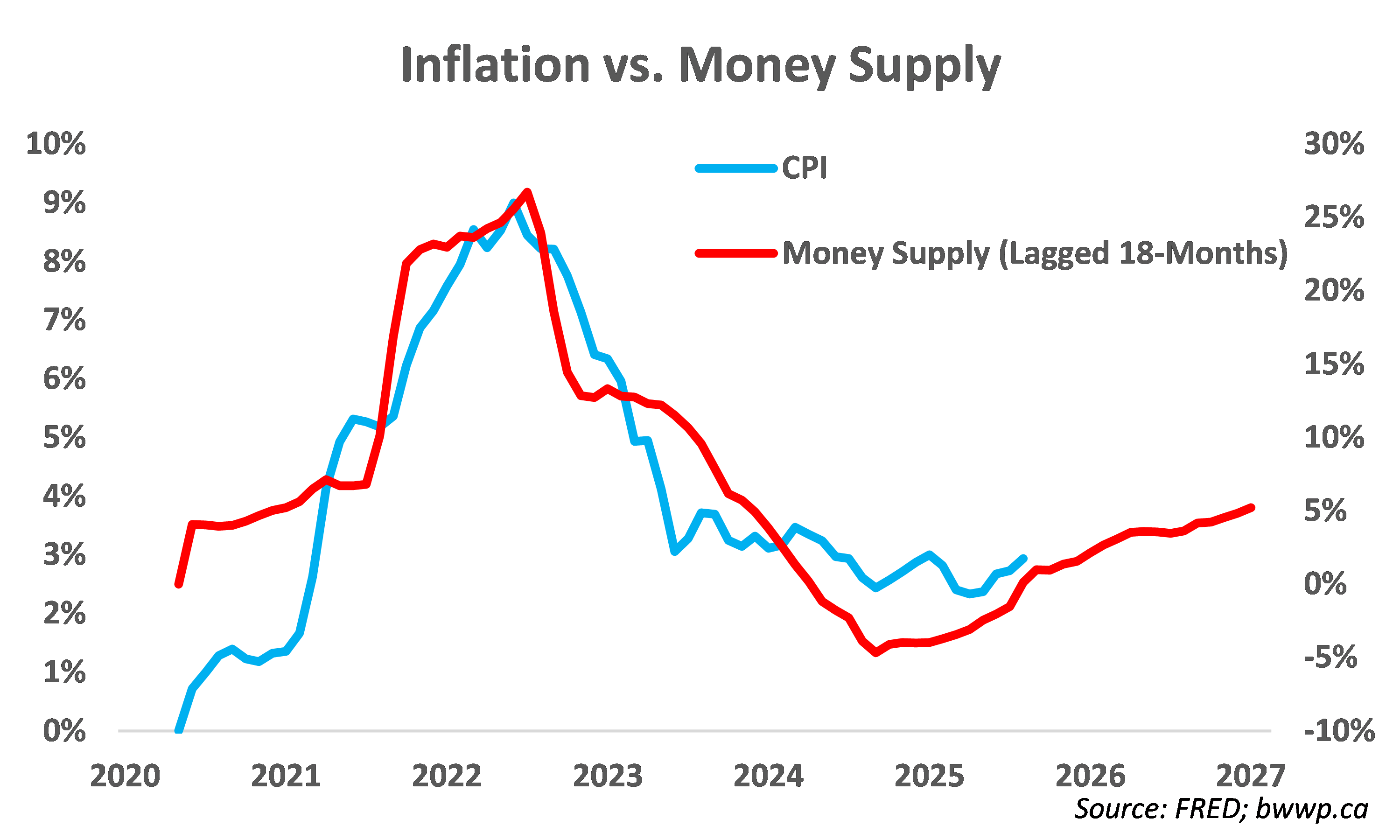

And, as we noted in part two of our 10 Bold-Adjacent Predictions, various indicators that predict the glide path of future inflation, such as the money supply, continue to point to higher, not lower inflation 12-18 months out:

Add to this - Fed rate cuts (which again, were not part of our piece six weeks ago, as at the time, the Fed was on hold and rate cuts were not a near certainty) and we could be dealing with inflation numbers that start with a four or even a five as we look out to the back half of 2026.

What about Canada?

While markets are currently pricing in two more rate cuts over the next 12-months for the Bank of Canada (vs. five for the Fed), including one this week, RBC Economics believes that stickier inflation could keep the BoC on hold for now. RBC Economics points out that while the Canadian economy has been weak, growth has not been far off from the BoC’s forecast. Further, with consumer spending strong and fiscal stimulus coming down the pipe, an interest rate cut risks sparking renewed inflation concerns.

The Headline: The TSX enters the “gilded age”

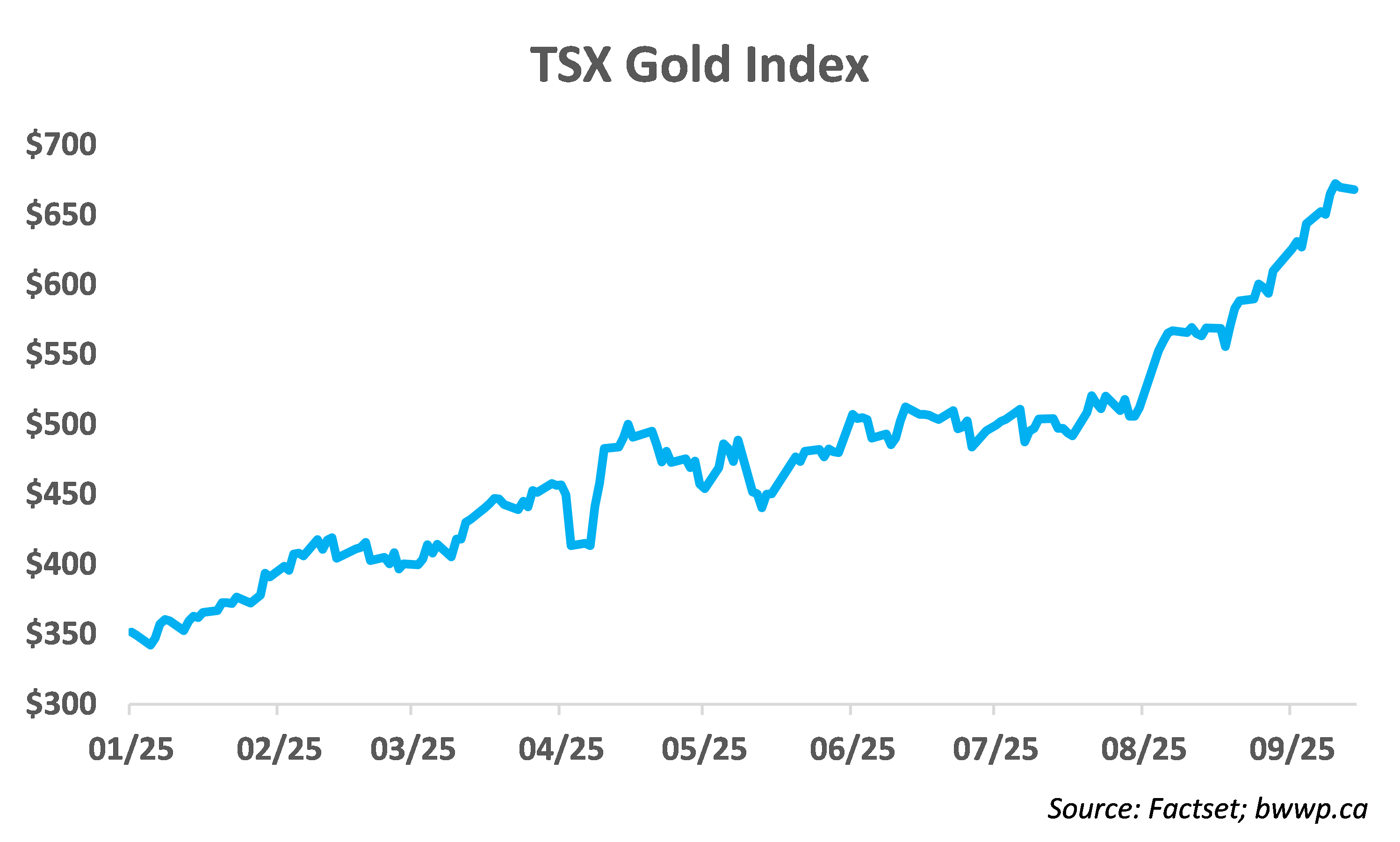

Both stock and bond markets have largely shrugged off the concerns that have arisen over the past 6-9 months. A large part of this has been the continued strength in the Mag-7 stocks with companies more exposed to the lower end of the wage scale generally underperforming. The biggest winner in Canada in 2025 has been gold stocks, which are broadly not great businesses, but occasionally have their collective moment in the sun:

Ex-gold, ~30% of stocks in the TSX are outperforming the index in 2025, which would historically be amongst the lowest levels on record.

Historically, these kinds of rallies in lower quality businesses do not tend to last (gold stocks were essentially flat in the 20-years prior to 2025 with some very big swings along the way) and rather than chase them, we feel the more prudent course of action is to continue to load up on the quality stuff that is lagging, as they will eventually outperform.

Headline: Final Thoughts

Both the U.S. and Canadian economies have had rough patches over the past six-months driven by tariff-uncertainty and a combination of other factors. However, in the case of the U.S. economy, we think things are better than the headlines suggest, while Canada may be moving past the worst part of the cycle. In other words, we think growth on both sides of the border is likely to be better in the next 2-4 quarters.

Over the intermediate-term (12-18 months), we have larger concerns about inflation, especially in the U.S., as the Fed seems poised to treat a wound that does not actually exist.