There’s an old quote credited to Winston Churchill that goes something like: “America will always do the right thing, [pause for dramatic effect] after it has exhausted every other means of solution.” Now, there is no actual evidence that Sir Winston actually said this (the Internet seems to think he did not), but I used to use this line anyway in client events (usually to fits of giggles from the crowd) mainly to show: 1) that I was learned (the two syllable kind) and 2) that there are lots of distortions about the true state of the U.S. and things are generally much better than they appear.

This week, markets were generally roiled by a ratings downgrade of none other than all U.S. government debt by Fitch Ratings Service. No longer worthy of Fitch’s AAA rating, the U.S. will now carry a AA+ rating, marking the second time that U.S. government debt has been downgraded (S&P did so in 2011 following a brief folly with default orchestrated by the ignoramuses in Congress). For its part, Fitch cited “a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters. The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management.”

While we whole-heartedly agree with Fitch’s pithy assessment, we also think the folks at Fitch probably recognized that the best way to sell newspapers is to proclaim, “the sky is falling” as opposed to “the sky will probably not fall but take an umbrella just in case”.

Is the Sky Falling on the U.S.?

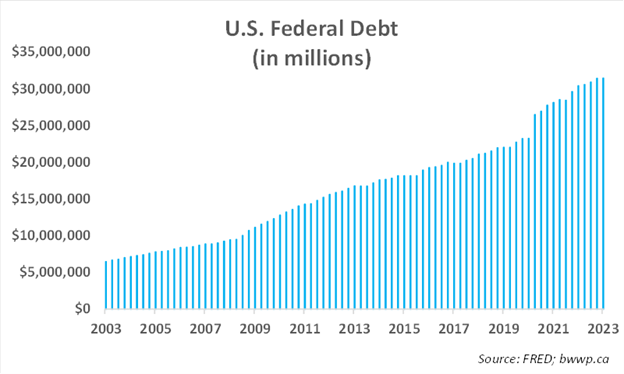

Let’s start with a chart and then comment:

Federal debt in the U.S. now totals more than $31 trillion, which is about 3x the level it was in 2008 and nearly double what it was a decade ago. This, in and of itself, is not necessarily a problem if one could proclaim that there was a cogent plan for at least reducing the growth rate of this debt, but as Fitch points out, there really is not a plan to do so and given the deep divisions in the U.S., there does not appear to be even the makings of a plan:

Federal deficits should be counter-cyclical. That is – when the economy slows, deficits should rise, but when the economy is humming along, deficits should drop so that there is money available for the inevitable rainy day when you are going to need it. As you can see, the Global Financial Crisis (GFC) and the COVID lockdowns led to big spikes in deficits (as they should have), but unlike the post-GFC era when deficits steadily declined (at least until very unnecessary tax cuts in 2018), the post-COVID era has been marked by a steady rise in annual deficits.

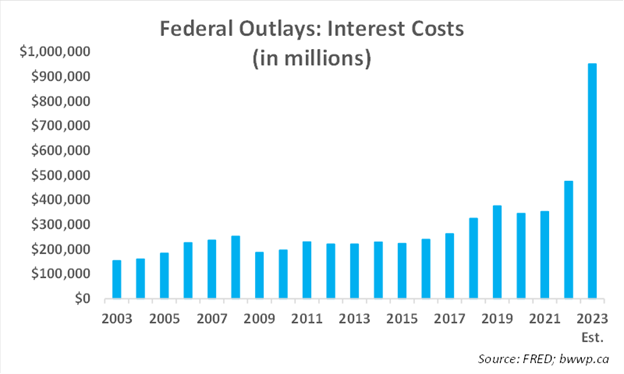

Further, the above does not really take into account the recent spike in interest rates, which is going to make the deficit problem even harder to govern as interest costs rise sharply over the next couple of years:

And this, of course, does not consider the significant rise in entitlement programs – Social Security, Medicare and Medicaid – over the next 10-20 years, which are only going to make the above deficits even worse.

It is all enough to conclude that the U.S. may not be taking our potentially fake Churchillian phrase to heart, as doing the right thing surely is not running large and rising deficits in a “non-crisis” economy, while a looming rise in interest costs and entitlements costs is fast approaching.

In other words – maybe the folks at Fitch were on to something.

Or were they?

The Sky is still very much, err, in the Sky

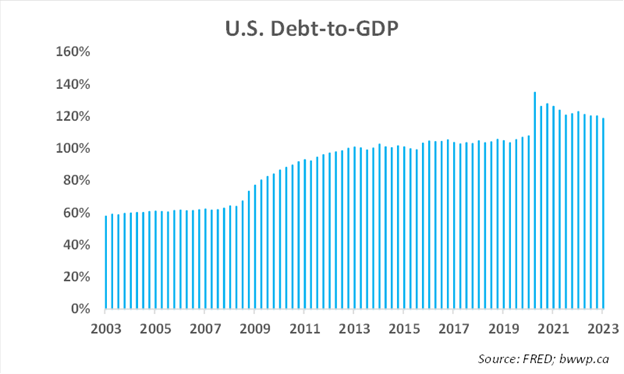

Okay, there is no doubt that there are lots of negative things to harp on, but before we join forces with Chicken Little, let’s try to put the above in some context. Let’s first start with a chart and then comment:

While the absolute level of debt matters, it is more useful to look at it in the context of the size of the economy. And as you can see from the above, the U.S. crossed over 100% debt-to-GDP in 2013 and peaked at ~135% during the early days of the COVID lockdowns. Since, the ratio has been steadily, albeit gradually, coming down and now sits at ~119%. This decline is indicative that while deficits have been quite high, the economy has been growing faster than these deficits, which has helped to lower debt-to-GDP – at least modestly.

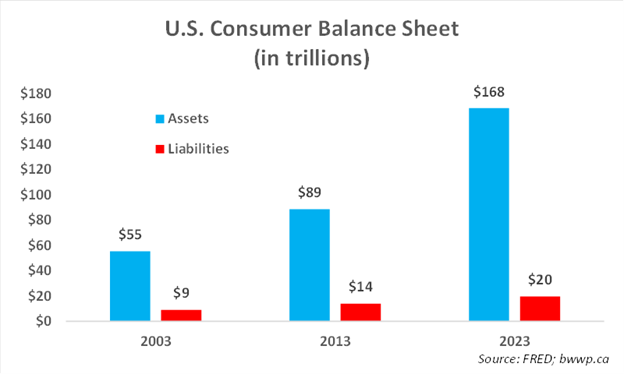

Burying the Lead

Okay, now we are going to pivot slightly and get to something that we think not only makes the above less important, but also calls into question the downgrade that Fitch bestowed upon the U.S. Let’s take a look a chart (actually “the chart” in our view) and then comment:

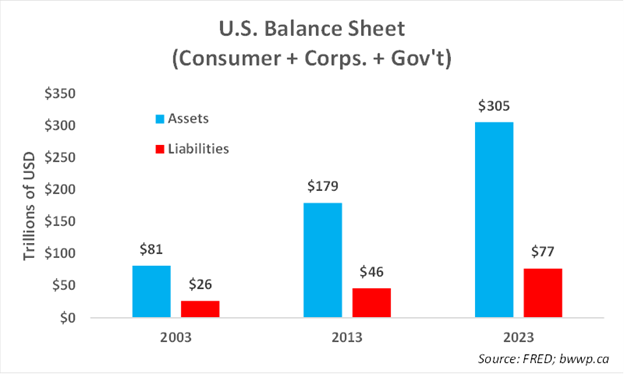

Here, we are looking at the balance sheet of the U.S. consumer. As you can see, the asset side of the balance sheet – which sits at ~$168 trillion – completely dwarfs the liability side, which stands at ~$20 trillion, with the vast majority of this debt (~$12 trillion) in long-term fixed rate mortgages at very low rates. In other words – the U.S. consumer is absolutely flush, which makes any issues that the U.S. might face a bit more manageable. For context, this same calculation for Canada would yield a net figure (assets – liabilities) closer to $10 trillion. Okay, let’s adjust the above chart by adding in corporations and the government:

When we combine the three biggest contributors to the economy, we get a balance sheet with ~$305 trillion of assets and liabilities of ~$77 trillion with close to half of these in Federal debt (the aforementioned $31 trillion). Now, this does not include future entitlement costs, which could amount to another $50 trillion of costs if nothing is done to alter the calculus, but when net wealth totals ~$230 trillion, which is more than 4x what it was two-decades ago, it provides a tremendous buffer to deal with any problems.

When we combine the three biggest contributors to the economy, we get a balance sheet with ~$305 trillion of assets and liabilities of ~$77 trillion with close to half of these in Federal debt (the aforementioned $31 trillion). Now, this does not include future entitlement costs, which could amount to another $50 trillion of costs if nothing is done to alter the calculus, but when net wealth totals ~$230 trillion, which is more than 4x what it was two-decades ago, it provides a tremendous buffer to deal with any problems.

Putting it All Together

The U.S. has seen a sharp rise in government debt and has no clear plan at present for dealing with it. This is somewhat mitigated by the fact that the economy is growing at least in-line with debt growth, so debt-to-GDP has been gradually declining. But the much bigger mitigator to any “crisis” in the U.S. is the staggering amount of net wealth that exists at all three levels (consumer, corporate and government), especially the consumer and corporate levels. This massive amount of net wealth at the very least provides the U.S. with a much longer window of time to deal with its fiscal issues, a luxury that most other countries would not enjoy. Ultimately, some hard choices will need to be made – higher taxes, cuts to entitlements – and while it seems impossible to imagine a willingness to make these changes given the current divisions, Americans have tended to do the right thing after all other means at their disposal have been exhausted, and we will hang our hats on that.