- Market concerns are common, but stocks often do well despite them.

- We recently read two interesting, but contrasting perspectives on today’s markets.

- One argued that despite speculation, earnings growth and corporate resilience support staying the course and not worrying about a “bubble”.

- The other suggested investors have no excuse not to be prepared for a downturn, but also not to abandon long-term strategies.

- The sum of both articles reinforces the value of a well-structured financial plan that helps manage worry and maintain focus during market volatility.

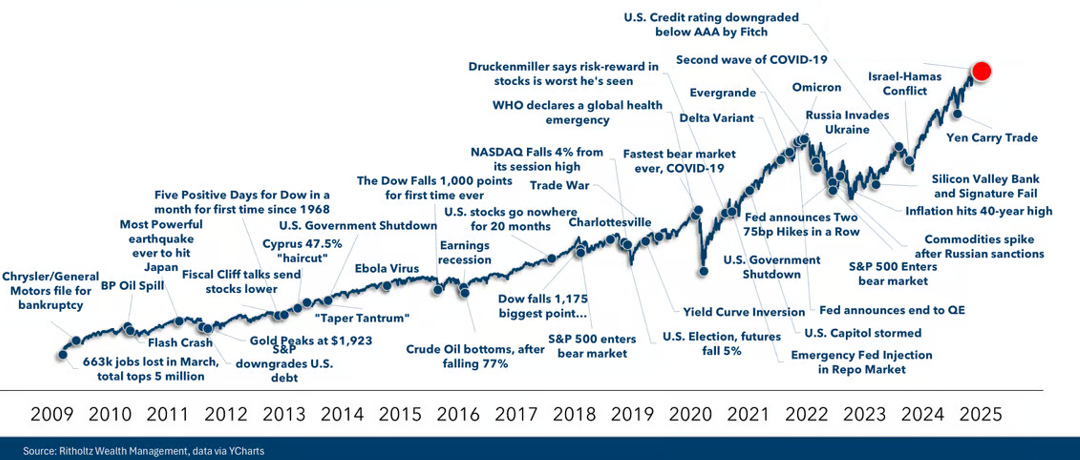

In past commentaries we have delved into the impact of fear and greed on investors, but we have yet to address a more subtle yet ever-present force: worry. In today's fast-paced world, there's always something to fret about, but whether these concerns truly affect financial markets is another matter entirely, as we've seen time and again.

There is always something to worry about… whether it impacts returns is a whole different question!

Two approaches to today’s market

In our weekend reading we came across two intriguing articles in the Globe and Mail (linked below) that offered contrasting perspectives. The first article was titled “Take a breath. The stock market isn’t that scary”, while just below the fold on the same page we found “Investors have no excuse for not preparing for a bear market”. We read both pieces expecting to come away with two wildly different viewpoints. It is at this point we were reminded of the fact that headline writers and the author of the article are not usually the same person!

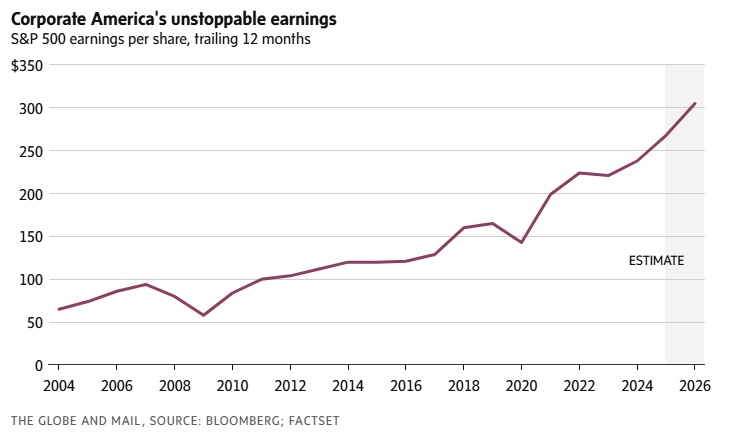

The ”take a breath” author made a lot of the points we discuss with clients as to why markets are still acting rationally, even if there are pockets of speculation. Earnings growth remains robust, profit margins are expanding, and companies have proven adept at managing challenges like tariffs. In the past half-decade they've navigated COVID, inflation, interest rate hikes, and now AI technology with remarkable resilience.

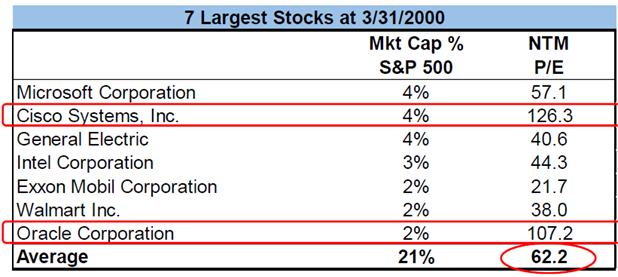

The author did concede that that U.S. stocks are pricing in a lot of good news, but comparisons to the year 2000 seem wide of the mark. 25 year ago there seemed no price too high to pay for a good growth story, as illustrated by the table below comparing the largest seven stocks in 2000 versus today.

Source: RBC Wealth Management; Factset

Their conclusion was that it is impossible to call a bubble in real time (we agree) and that time tends to heal all wounds in the market, while those who need near-term liquidity can dial down their risk. While sensible advice, it is not quite the same as “Investors have no excuse for not preparing for a bear market”!

Interestingly enough, the second article starts off with this: “There is so much talk about bubbles these days that it’s almost certain not to happen. It may be like the imminent recession of 2023, 2024 and 2025.” Huh? Sounds a lot like the first article, but the author quickly goes on to say that the presence of speculation means nobody has an excuse for not being prepared for a downturn.

But what does being prepared mean? Once again, similar to the conversations we have with clients daily, it does not mean going all to cash. Timing the market is impossible and getting back in is often harder than getting out. The author suggests making sure that one’s portfolio aligns with their long-term asset allocation, and if the current level of risk in the portfolio is uncomfortable, reconsider the target mix of stocks, bonds and cash. They also suggest having cash set aside for any near-term spending needs, being mentally prepared for markets to eventually drop, and to take small steps when changing a portfolio as opposed to all-in leaps. Frankly this advice sounds like many of the principles enshrined in a well thought out, personalized financial plan, a core tenet of our client relationships!

Differing opinions can both be true

Upon reflecting on these seemingly contradictory articles, we realized that in fact they can both be true! While it is very difficult to push concerns about the market (news of the day, valuations, politics, conflicts, you name it!) out of our minds, we all know intuitively that markets climb a wall of worry. Such feelings are perfectly normal. While “take a breath” may be good advice, it is easier said than done. One thing that makes relaxing about our portfolios easier is knowing that we have a robust plan in place. That alone won’t shield a portfolio from a challenging market, but it leaves investors prepared to manage through without veering off one’s long-term track.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.