- The Canadian dollar has seen some of its 2025 gains against the U.S. dollar evaporate since the summer.

- At the same time, the broad U.S. dollar has been range-bound against other major trading partners.

- Both the U.S. and Canada have cut interest rates at the same pace in recent months, suggesting other factors are at play.

- It’s true that oil prices are weaker, but gold continues to surge, somewhat negating commodity price swings as a near-term factor.

- With the USMCA renegotiation due next year, we think investors may be discounting the risk that Canada ends up in a worse position after the fact.

- There is also a non-zero chance that the timeline for renegotiation becomes accelerated, risking the protections Canadian exporters have enjoyed since the tariff war got underway.

- In the event that Canada emerges from trade negotiations battered and bruised, we think U.S. dollar exposure is the most effective hedge Canadian investors can hold.

One of the headwinds that Canadian investors have faced in 2025 is staring to fade. No, we are not talking about an imminent end to the tariff war – more on that later. The biggest headwind to performance for Canadians this year has been the strength of the Canadian dollar, which by mid-June was up 6% versus the U.S. dollar. This meant that in order for a U.S. dollar-denominated investment to simply break-even in Canadian dollar terms it had to return 6%. Since then we have seen the loonie give up some of those gains, which now sit at about 2.6% year to date.

U.S. dollar starting to gain ground on CAD but treading water against others

The chart below depicts the trend in the USD-CAD exchange rate and the broad U.S. dollar index, which measures the U.S. dollar against its major trading partners. Both are expressed in U.S. dollar terms, i.e. a rising line represents U.S. dollar strength and vice versa. What we see below is that through the end of 2024 the USD was strong across the board and peaked around the end of the year. For the first six months of the year it then weakened across the board, benefiting the Canadian dollar. Since June a new trend has emerged. The broad U.S. dollar index has been range-bound, but the USD has been gaining ground on the Canadian dollar.

Are markets anticipating more pain on trade?

Given the U.S. Federal Reserve and the Bank of Canada have both only cut short-term interest rates by 0.25% since the summer, it seems unlikely that interest rates are driving the currency pair. Oil prices are down, but gold prices are up substantially, likely offsetting each other from a commodity-price influence perspective. One potential change markets may be starting to anticipate is on Canada/U.S. trade. Canada has been relatively well insulated from the tariff barrage thus far due to the protections granted by the USMCA trade agreement. With renegotiation set for next year, markets are likely starting to think about what this looks like for Canada and most would agree we are likely not going to come out of it in better shape than we are today. Further, few would be surprised to wake up on any given morning to see that the U.S. has withdrawn from the agreement via a social media post. If Canada’s trade position with the U.S. becomes severely diminished, the most logical release valve is Canadian dollar depreciation. It could be that the market is seeing how fragile supposedly completed trade “deals” are, and are starting to price some risk into the Canadian dollar.

RBC forecasting further Canadian dollar strength, but with one big caveat

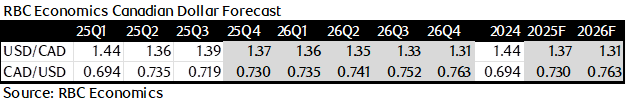

If we look at RBC’s currency forecasts, they suggest little concern over the USMCA and are based largely on expected interest rate movements. In their view, the Federal Reserve is likely to cut interest rates by another 1.25% while they see the Bank of Canada as nearly done. With all else equal, the U.S. cutting rates significantly more than Canada should yield a stronger loonie but they do note that a risk to their forecast is Canada losing USMCA protection and being hit with higher tariffs.

U.S. dollar exposure is the best hedge against USMCA collapse

If the past eight months have taught us anything, it is that tariff negotiations with the U.S. can be fraught and unpredictable. Canada currently enjoys one of the lower effective tariff rates on exports to the U.S. and if we maintain this position than the downside to the Canadian dollar is likely limited barring a rout in commodities. In our view, that is a big “if”. It seems clear to us that the U.S. intends to repatriate as much production as possible, which leaves Canada in a vulnerable position. If we have an unfavorable outcome in the USMCA renegotiations (or the U.S. withdraws before then) we believe that the U.S. dollar will appreciate against the Canadian dollar, potentially meaningfully so. While the U.S. dollar’s position as a hedge against market chaos has gone down a notch, we still see it as the most efficient way to protect portfolios if Canada ends up in the trade crosshairs.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.