- Much noise has been made about the high weight of the “Magnificent 7” technology stocks in the U.S. stock market.

- While today’s concentration in these stocks may be worrying to some, there is some interesting historical context to take note of.

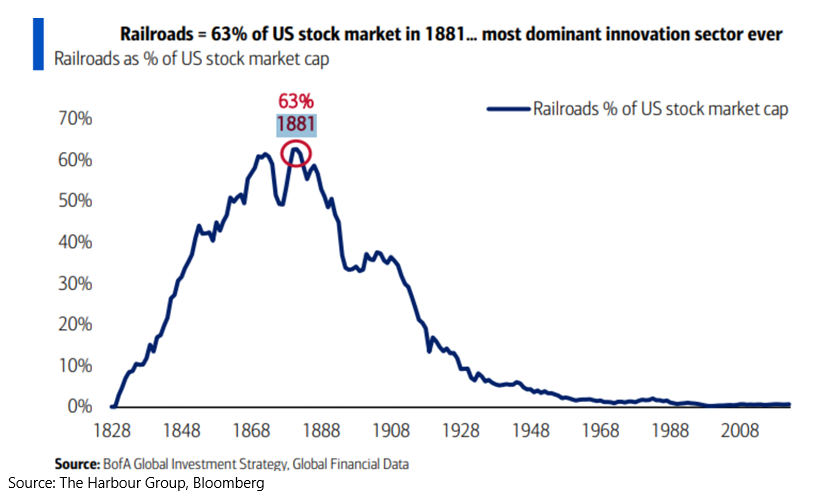

- Way back in the late 1800s, railroads (a novel technology at the time!) made up 63% of the U.S. stock market, a record that still holds today.

- The peak didn’t last long as newer technologies created competition, while the number of railroad companies fell over time.

- Today it is all about the purveyors of artificial intelligence, which is sure to be challenged in the future, even if we don’t know what it will be yet.

- We also don’t know when such disruption will happen, and timing the end of these trends is notoriously difficult, which bodes well for maintaining a diversified portfolio that can smooth out the ups and downs of any specific sector.

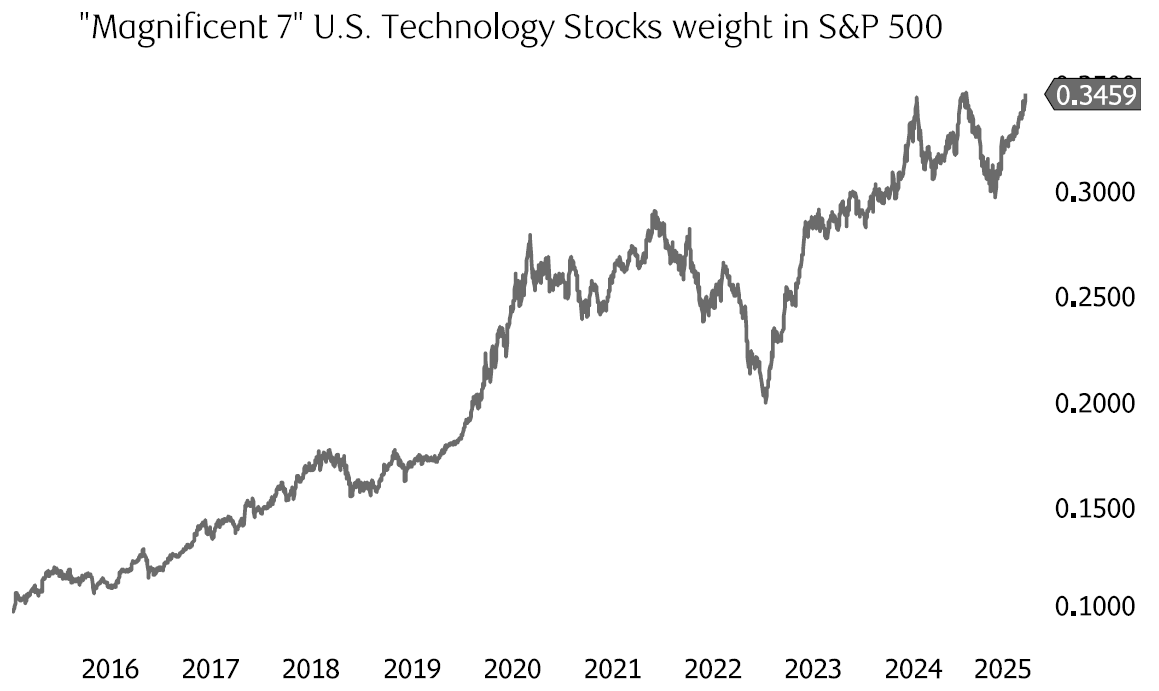

For the better part of a decade, much of the success of the U.S. and global stock markets has rested with the leading companies in the technology sector. As seen below, the weight of the “Magnificent 7” technology stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla) in the S&P 500 has grown from 10% a decade ago to roughly 35% today. The weight of these stocks has more than tripled due to two factors - significant earnings growth which has been further boosted by higher valuations (price/earnings ratios).

Can tech’s dominance run further? History suggests yes…

The overweight the market has awarded to these seven companies is something most of us have not seen in our investing lifetimes, but it does not mean it is fully unprecedented. To find the most extreme example we have to look back, way back to the 1800s. 1881 to be precise! At this time the railroad was a novel and disruptive technology that captured the imagination of investors, pushing shares in these companies to dizzying heights, becoming 63% of the U.S. stock market, nearly double the share that the Magnificent 7 hold today. So can the weight of the big tech stocks go further from here? The answer is clearly yes.

… but beware of change

Yes, the weight of technology companies can go higher, the key word being “can”, not “will”. We also need to beware of shifts in technology and changing investor tastes! After hitting their peak, railroads began a long decline in market influence and now sit at about a 0.5% weight in the S&P 500, despite still being an integral part of the logistics economy. Over time, the hype toward the sector faded, while competition from trucks and cars removed their monopoly on long-distance land travel. Today the market is very clearly all about artificial intelligence. If history rhymes, it will one day be knocked off its perch either by the next shiny object coveted by investors or by expectations getting too far ahead of reality – maybe both. While one can never have enough of a winning trade, the inverse also holds true when markets shift. Timing trend changes is notoriously difficult, and for the vast majority of investors the proper course of action is to remain diversified. While this keeps us out of the highest highs, more importantly it protects us when a previously dominant sector goes out of favour.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.