- In case investors didn’t have enough on their plates, a recent escalation of Middle East hostilities has added another dimension to markets.

- As we have seen many times in the past the impact on markets has been short lived, and in this case, nearly imperceptible when it comes to stocks.

- Oil prices reacted much more acutely, but have quickly reverted to levels seen before.

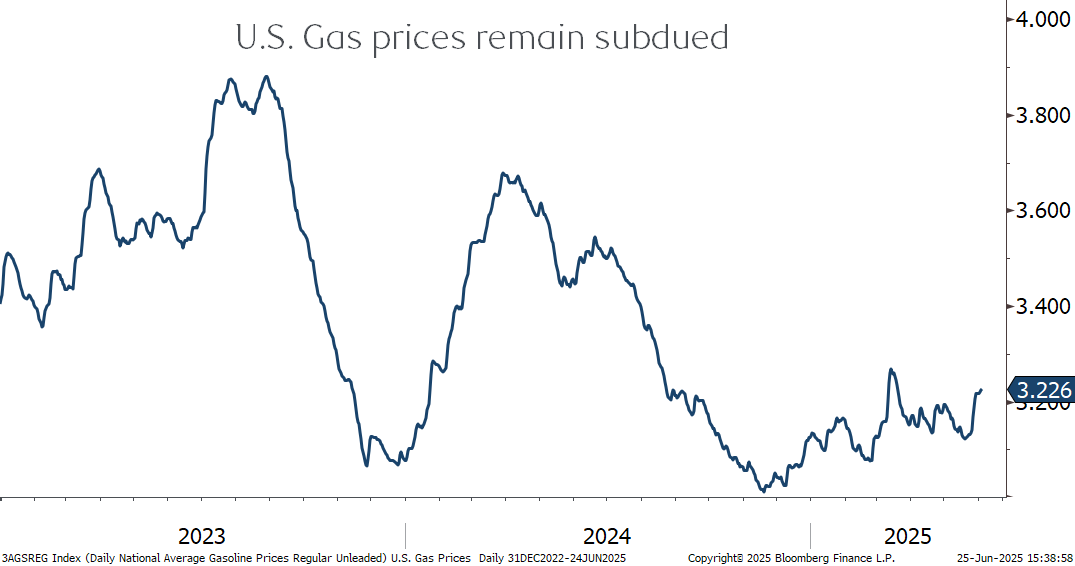

- Low gas prices have provided a boost to consumers, and conversely, high gas prices often lead to recession.

- Unless energy prices rise materially, returns associated geopolitical hostilities typically revert to the trend that was in place beforehand and are driven by the economy and earnings.

2025 has brought investors fresh sources of stress in the form of on again/off again tariff threats. Lately, we have seen a resurgence in a classic recurring issue – the geopolitical conflict. For decades, investors have watched clashes and wars erupt all over the world, only to watch the stock market shrug. Sometimes these events have had an impact on equities, but as seen below it is typically fleeting.

Selected Geopolitical Hostilities that Preceded Market Corrections Since 1950

Scary headlines rarely provide a lasting jolt to the market…

Many see all of the troubling headlines and wonder why markets aren’t reacting more. Simply stated, the market is cold blooded in its analysis. When it looks at an event it will ask the basic question of “will this impact earnings, the economy, or interest rates in a materially detrimental fashion?” and if the answer is “no” it tends to carry on after the initial shock wears off. As seen above, the average time for the market to bottom is two weeks and the average drop is 6.3%, both in “typical correction” range. If anything this table overstates the impact as it does not show the many eye-opening events that resulted in no market impact or even saw stocks rise.

…unless energy prices soar

There is one big exception to the market often sluffing off acts of war – oil prices. In the table above, it is not a coincidence that the two largest losses along with the two longest timelines to get back to even are events that caused oil prices to rise sharply. High oil prices are a direct hit to consumers’ pocket books and are often a precursor to recession. So far, oil prices have remained well contained, leading to benign gasoline prices.

It's all about earnings

While jarring geopolitical headlines can reliably cause a short-term gut check for markets, the impact over the longer term as demonstrated above is often transitory. This is usually a surprise to investors and is in direct opposition to the visceral emotions these events can produce. As always, longer-term returns are dominated by the trajectory of earnings and the most important thing is to populate a portfolio with a collection of businesses that are resilient in a wide range of economic outcomes.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.