- Against the odds (and the media’s advice) the Canadian dollar has rallied in 2025.

- This move higher has made us all wealthier on the global stage as our currency appreciates versus the U.S. dollar.

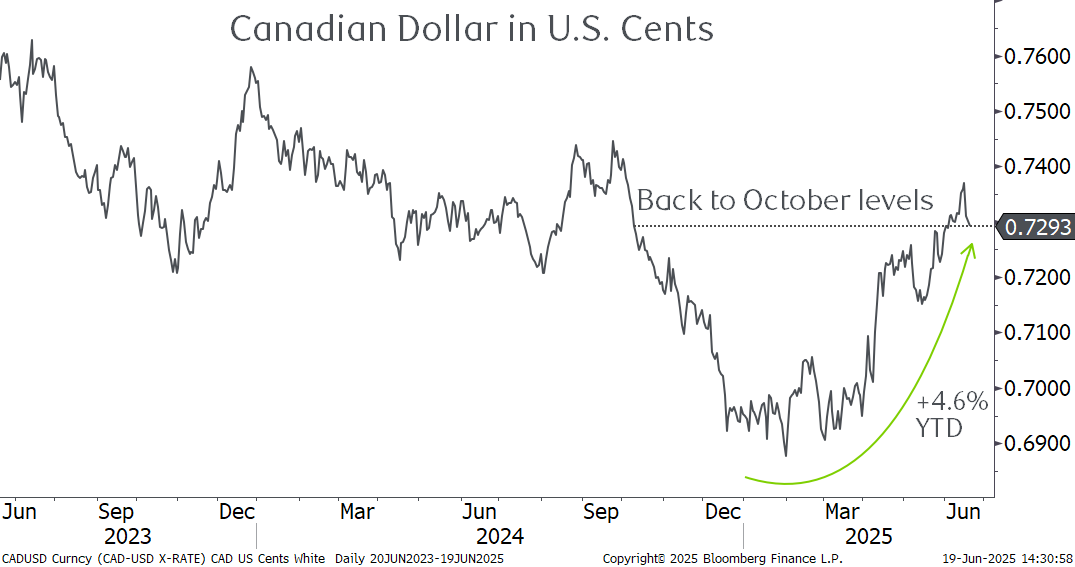

- While the 4.5% gains seen thus far is a dramatic year to date move, this is largely a function of the calendar.

- The loonie’s lows closely coincided with the end of December, exaggerating the magnitude of the year to date gain.

- When we roll the calendar back a bit, the Canadian dollar is trading at levels last seen in October.

- A stronger loonie has weighed on the returns of U.S. dollar securities this year after providing a significant tailwind since 2021.

- Time and again we have seen the value of holding U.S. dollars as a hedge in times of crisis, and we don’t think that has changed.

Buy the rumour, sell the news remains in full force

There have been no shortage of big stories in financial markets this year and for Canadians, the strength of the Canadian dollar is definitely right up there. In further proof that markets are forward pricing mechanisms and that “buy the rumour, sell the news” remains a powerful force, the Canadian dollar weakened sharply after the election, but has done nothing but strengthen as the long-threatened trade war has gotten going full swing. This is in direct contrast to the advice of the media, who as always were fanning the flames of fear.

The calendar has exaggerated the loonie’s rise

For portfolios, we have seen an unfortunate coincidence in timing whereby the Canadian dollar was near its low point as the calendar turned. It is now up 4.6% year to date, offsetting the return of USD-denominated securities and suppressing overall portfolio return reported in Canadian dollars. If we look through a slightly wider lens, we can see above that while the year to date gains have been healthy, the reality is we have simply retraced the losses seen in the final quarter of 2024 and put us back to levels that prevailed for the 18 months prior. We mentioned in April that this is more a story of U.S. dollar weakness than Canadian dollar strength and that remains the case. As seen below, the broad U.S. dollar index is down 7.8% so far this year, indicating that the loonie continues to underperform other major currencies.

RBC Economic thinks we have seen the majority of the move

RBC’s foreign exchange team forecasts that there is perhaps another penny of strength left in the loonie, suggesting that we have seen the majority of the rally already. We note that currency forecasts are always subject to change with market events, but given the outlook for interest rates in Canada and the United States we think this is a reasonable assumption, particularly paired with data we have seen that shows U.S. dollar sentiment is among the most negative in two decades.

Let’s not forget the benefits

A weakening Canadian dollar does a great job of boosting the returns of portfolios with a heavy U.S. dollar weighting, but that is where the fun ends. A softer currency results in higher import prices (inflationary) and makes travel more expensive among other drawbacks. With the Canadian dollar seeing a reprieve, there is an opportunity for those who want or need higher exposure to U.S. dollars. This allows us to buy U.S. stocks at more attractive prices and offsets some of the post-Liberation Day rally we have seen. We also continue to see much more attractive yields in U.S. fixed income markets, with U.S. Treasuries often times outyielding Canadian dollar bonds of lower quality. While there is much talk of the U.S. dollar losing its reserve currency status we think this is premature. For Canadian investors, holding U.S. dollars during times of economic stress has been the hedge with the best batting average, and we are not prepared to abandon it just yet.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.