- With progress on tariffs continuing, the Trump administration’s promised pivot to tax cuts has begun.

- This brings us to what they are calling the “One Big Beautiful Bill Act” which combines tax cuts with all sorts of unrelated legislation.

- Markets typically like tax cuts, but associated higher deficits have given bond investors pause.

- As part of the U.S. legislation process, the bill is now in the senate, with passage most likely by the end of summer when the debt ceiling becomes critical.

- Section 899 is giving investors heartburn, and it entails risks for both foreigners and the U.S. itself.

- Nobody likes watching the sausage get made, but we need to get used to it for the next 3.5 years at a minimum.

- In the near term we expect lots of headlines but not a lot of action, and if we have learned anything so far this year it is that it does not pay to over-react to announced (but far from implemented!) U.S. policy changes.

Beauty, as always, is in the eye of the beholder…

In the aftermath of the U.S. election, stocks surged as investors bet on lower taxes and lax regulations, both sure-fire ways to boost corporate profits for S&P 500 companies. We all know what came next – a deep and disruptive focus on tariffs in the early days of the administration that caused a deep correction in stocks, followed by a stunning recovery as these punitive levies were pushed out for 90 days. The past month has seen the long-promised pivot toward market friendly policies such as tax cuts in the form of the “One Big Beautiful Bill Act” (“OBBBA”). The name is a direct tribute to the President’s insistence that congress create “one big, beautiful bill” that encompasses not only tax cuts but Medicaid and food assistance reform, defence and border security among many more, with some culture war issues thrown in on top.

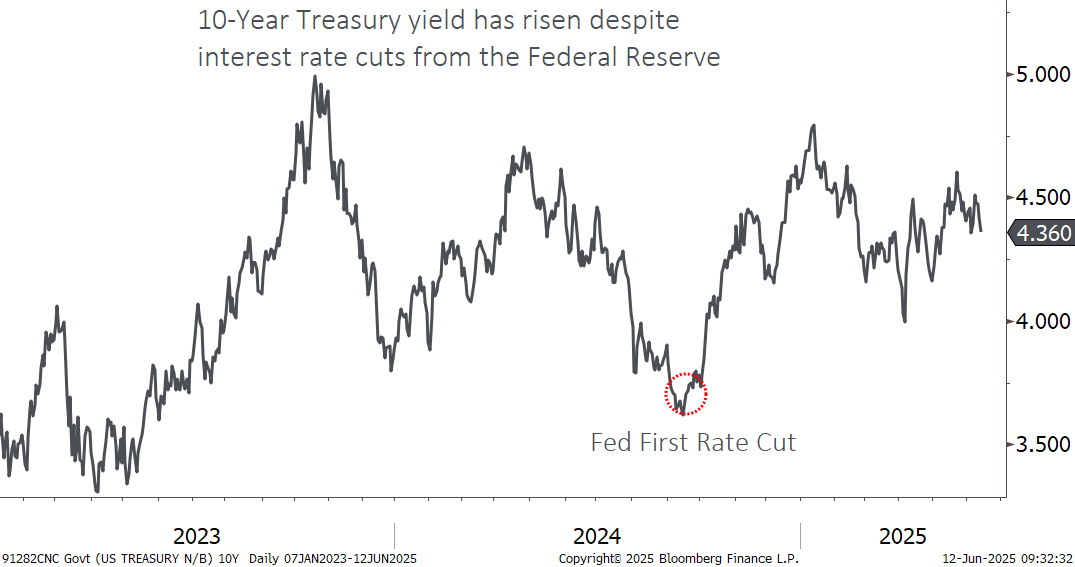

… and markets have become less enamoured with large budget deficits

The bill has passed the House of Representatives by the slimmest of margins, and now makes its way to the Senate, where we could see changes enacted that would have to be agreed by the House in order to pass. This wrangling may go on for months until it reaches “must pass” territory as the debt ceiling risks being breached late in the summer. While there are a lot of things in this bill (tipping the scales at 1,116 pages), the main issue markets are focusing on are tax cuts and the impact on the deficit. To put it simply, equity markets see tax cuts as good, and higher deficits as bad. This is a relatively recent phenomenon! For most of the past 25 years, deficits didn’t really bother markets all that much. Higher government spending added to economic growth, and bond investors didn’t revolt and push interest rates higher. That has changed post-COVID, and the fact that this bill would add over $2.5 Trillion to the U.S. deficit over the next decade has caused some alarm.

Bond markets are the arbiter of budget sustainability

As seen above, the amount of U.S. federal revenue going toward interest payments is approaching 20% and is back at levels seen in the 1980s and 1990s when bond yields were double what they are today. Further, twenty eight cents out of every federal dollar spent is borrowed. To put a finer point on it, the U.S. government now spends more on interest than it does on national defence, a development that may be unpopular with some factions in Washington, DC. This has led to bond yields rising at a time when the Federal Reserve has been cutting interest rates, which is not typical but reflects investors pricing a higher risk of inflation and a larger supply of U.S. Treasury bonds into the market.

Stock markets have carried on as the economy and earnings have been firm

Once the shock and awe from the “Liberation Day” tariff announcement and subsequent deferrals wore off, stocks have been in an optimistic mood, hitting new all-time highs in Canada and nearly there in the U.S. as the U.S. economy and earnings have remained firm despite the turmoil. This likely reflects some optimism that any tariffs applied will be manageable and optimism toward sustained earnings growth as enthusiasm toward artificial intelligence switches back into high gear. With valuations now sitting where they were at the beginning of the year equities are more susceptible to any shocks that may arrive, but they have proven surprisingly resilient even as trade rhetoric has started to heat up again.

Section 899 causing heartburn for investors, but too early to say if it is justified

Perhaps the most newsworthy piece of the OBBBA on our side of the border is something called Section 899. While we won’t get into great detail here (we can provide more fulsome information if requested – reach out to your Harbour Group representative), this section of the bill would increase withholding tax rates for non-U.S. investors to (up to 50% phased in over years) from countries that apply what the U.S. deems a “unfair foreign tax”. In Canada’s case they are referring to our 2024 Digital Services Tax, which imposes a 3% tax on revenue from certain digital services.

In our view, this is likely a negotiating tool (like so many other things!) to get rid of these taxes the Americans deem unfair. While this higher withholding tax would be challenging for Canadians investing in U.S. securities, it would also have the impact of limiting foreign investment into the U.S. and potentially lead to higher borrowing costs for the U.S. Treasury if it is applied to interest payments. As this clause seems to be in no one’s interest, we wouldn’t be surprised to see a negotiated solution of some sort, and as such recommend taking no action until the outcome is clearer.

The 2025 mantra of ignore the noise and react to the facts remains unchanged

There is an old saying that laws are like sausages – it is better not to see them being made. We would argue that this adage is doubly true for the Trump administration as nearly every aspect of governing is playing out live in front of the cameras, and we can expect more of the same for the next three and a half years. We have also learned that many pronouncements get made, but a much smaller number end up being realized. While all investors aim to look one step ahead in order to be positioned optimally for what is coming next, the calculus changes a bit when we have the world’s most powerful economy in the business of being unpredictable. Reacting to shocking pronouncements that are reversed shortly thereafter has been a losing strategy in 2025, and we don’t expect that to change. In today’s market we think it is prudent to ignore the noise to the extent that we can, and react to the facts once they are known. In our experience betting on what politicians are going to do has been a difficult way to make money, and that has never been more true than it is today.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.