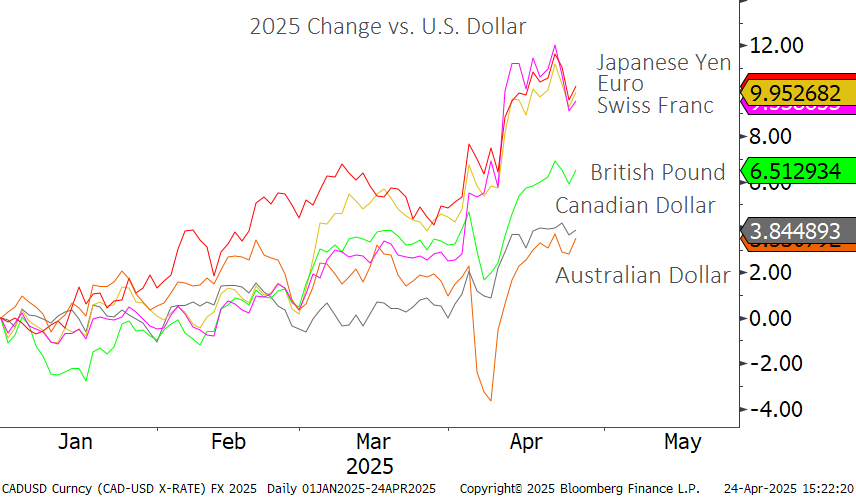

- The Canadian dollar has rallied nicely against the U.S. dollar so far to start the year, increasing purchasing power for investors.

- This is more a story of U.S. dollar weakness than Canadian dollar strength, with the loonie ahead of only its commodity-currency cousin the Australian dollar year to date.

- More strength has been seen in traditional safe-haven currencies such as the Japanese Yen and Swiss franc, and the Euro is right up there as well.

- The massive bet against the Canadian dollar by currency speculators has been halved in size, suggesting further upside may be more difficult to come by.

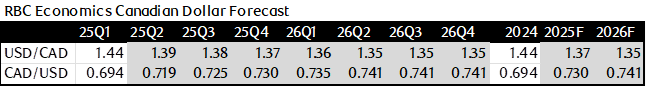

- RBC’s currency forecasts see the current strength continuing but at a more moderate pace for the rest of 2025.

If we would have polled investors at the end of 2024 and said that the U.S. was going to impose significant tariffs on essentially all of its trading partners, few would have guessed that the outcome would be a broadly weaker U.S. dollar. Economic orthodoxy would suggest just the opposite – most if not all economists would have expected that countries that export to the U.S. would see their currency weaken due to slower growth prospects, with the weaker currency also acting as a partial tariff offset. Nearly four months into 2025 and three into the tariff-first Trump 2.0 presidency and the most consistent trend in what has been a volatile year has been the strengthening of major currencies against the U.S. dollar.

Canadian dollar higher, but not on its own merits

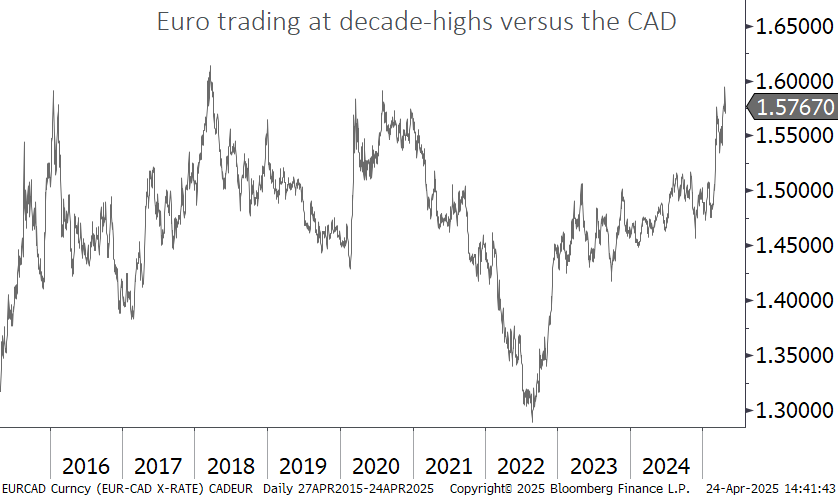

As seen above, the Canadian dollar is among the weakest gainers versus the USD in 2025, with only its commodity-linked Australian cousin behind. This means that the gains we have seen for the Canadian dollar are not really on its own merits – rather it is being dragged up by a broadly weaker U.S. dollar. The fact is our economy remains weaker and our interest rates lower than the U.S., something that is unlikely to change in the near term. To put a finer point on this, take a look at the Canadian dollar compared to the Euro below. The Euro is essentially trading at decade-high levels compared to the Canadian dollar offering little reprieve for vacationers forgoing the U.S. and heading across the pond this summer!

Bets against loonie easing, but haven’t disappeared

One of the metrics we track when looking at the short-term outlook for the Canadian dollar is whether speculators are betting on or against the currency. By the end of 2024 bets against the loonie were at near-record levels, meaning any change in sentiment could send the Canadian dollar sharply higher. Sure enough, as the trend against the USD changed, those betting against our dollar were forced to unwind those positions which has more than likely boosted the loonie’s fortunes this year.

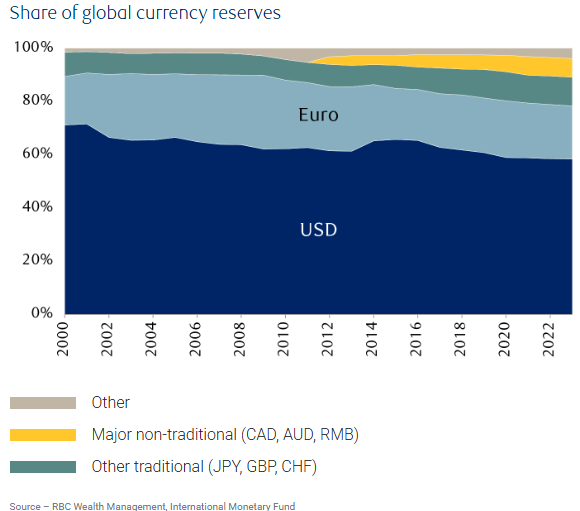

Are we facing a new world order? Not yet

With the sharp decline in the U.S. dollar this year many are asking if this is the end of the U.S. dollar’s reserve currency status. While it is difficult to call a change in a multi-decade trend in real time, we don’t think there is clear evidence that this is happening. As seen below, the U.S. dollar’s share of currency reserves has been coming down slowly but it is still dominant. What is more likely is that global investors are trimming back some of their overweight U.S. exposure, as the U.S.’s share in global stock markets has surged to a record 74%, up from 55% a decade ago.

What does the future hold for the Canadian dollar?

Currencies are notoriously hard to predict (see the opening comments of this piece!) as they are driven by a combination of interest rates, politics and general risk sentiment. Nonetheless, we try our best to synthesize all of these factors to predict where the Canadian dollar is headed. With the Canadian dollar trading at 1.3864 (US$0.7213) as we write this, we are very close to RBC’s forecast for the end of the second quarter of this year. They see steady further strength into 2026 as they think Canada’s economic growth rate will improve relative to the U.S. later this year and early next. We would note that their year-end 2025 target takes us back to where in September of last year, essentially calling for an unwind of the post-election Canadian dollar weakness. Where we actually end up remains to be seen. So long as the U.S. dollar remains the world’s reserve currency we still see value in holding U.S. dollars for multiple reasons. As it stands today, we can earn much higher interest rates on U.S. bonds, while the evergreen benefits of accessing the world’s most innovative companies and an asset that tends to go up when everything else is going down remain incredibly valuable.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.