- Less than a week after “Liberation Day”, the U.S. administration has put a 90-day pause on many of its most damaging tariffs, ex-China.

- Equity markets reacted enthusiastically, with the S&P 500 putting up its third largest single-day rally since WW2.

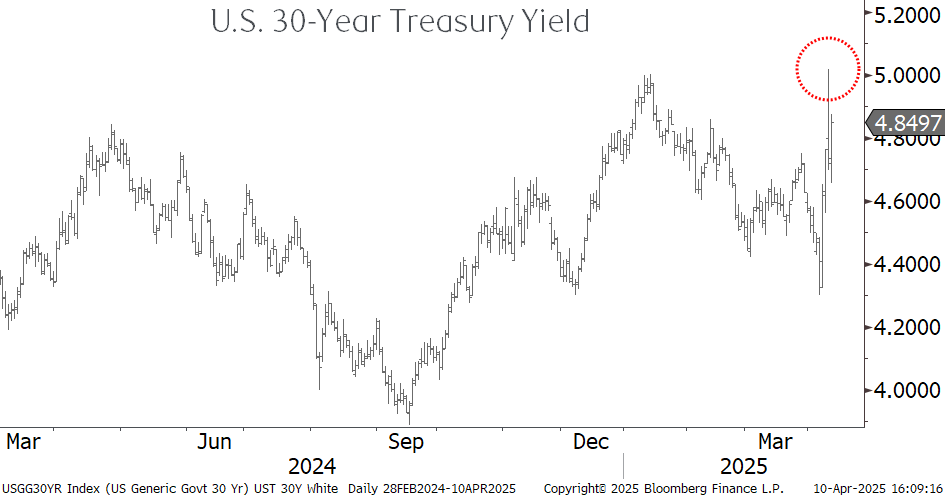

- While plunging stocks likely played a role, it was the bond market which jolted the White House into action.

- Manufactured crises have the potential for sharp reversals, and this time appears to be no different.

- With the worst of the trade war (probably) off the table until summer, markets will now have to determine what is next for the economy.

- Investor sentiment remains deeply negative, and this sort of volatility will take some time to fade from memory.

- Looking forward, we don’t know what the next weeks or months will bring, but historically extremely sharp declines like we just witnessed lead to better days ahead.

While we have some qualms with some commentators suggesting this past week was classic “Art of the Deal”, we would agree that the quick reprieve on “reciprocal” tariffs certainly fits the pattern market participants became used to from 2016-2020. After repeated declarations from White House trade hawks that this was not a negotiation, it turns out that negotiations on tariffs are indeed on the table. Colour us unsurprised. The day the reversal was announced markets did the logical thing and quickly priced out most of the losses since “Liberation Day”, which just happened to trigger be the third largest daily gain since the second world war.

The Bond Vigilantes still have it

Many investors embraced a return of Donald Trump to the White House because under Trump 1.0 he seemed to use the stock market as a real-time report card on his job performance. Add to the fact that his new administration and high profile supporters drew heavily from the billionaire set, and many thought it would be even more the case this time around. Those views were quickly shattered last week when there was little reaction from the White House to the carnage in stocks. The bond market still has the power to get a President to sit up and take notice, however. In the early hours of April 9, the 30-year Treasury yield briefly hit 5%, up half a percent in a matter of days as the “bond vigilantes” who rail against damaging fiscal policies made their presence felt. For an administration who was looking for lower bond yields to reduce interest costs in the budget, this was not part of the plan. Comments from President Trump suggested the move in bond yields had at least some influence in the decision to hold off on the most aggressive “reciprocal” tariffs ex-China.

Animal spirits will take some time to return

As we mentioned last week, bottoms tend to form quickly, particularly when they are from a manufactured crisis. While we have likely passed the most acute phase of this market event, we are still staring at a tariff regime that is more challenging than any we have seen in nearly a century. Barring any new developments from the White House or Beijing, investors will spend the next days and weeks trying to figure out what this new regime means for the economy. Thankfully the U.S. economy was in good shape heading into this, but even the currently in place 10% baseline tariff combined with auto and metals tariffs will result in a hit to growth and will likely boost inflation. Suffice it to say that depressed investor sentiment may take some time to heal and we can expect volatility to remain elevated as the economy adjusts.

Large declines have been followed by healthy (and often great) returns

We find the chart above to be rather fascinating. If you could go back in time and survey investors on any one of the dates listed we can almost guarantee there would have been a chorus of “this time is different”, “we won’t get a V-shaped recovery”, and fears of prolonged economic stagnation or worse. The end of a sharp two-day drop doesn’t guarantee a bottom has been put in. As seen above many of these dates were in the throes of the Great Financial Crisis which saw markets go lower still. The thing these dates all have in common is that the S&P 500 delivered healthy (and often spectacular) returns one year later, and these gains were built on over the second year. It is certainly possible that this time may be different, but our inclination is for long-term investors to give history the benefit of the doubt as we navigate these challenging times.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.