- The tariff levels announced on April 2 are worse than most feared and if they are sustained at these levels for a long period of time, the U.S. economy is at risk.

- The U.S. Treasury Secretary has suggested this is the ceiling so long as there is no retaliation.

- While it doesn’t feel like it now, we may have just passed the peak of uncertainty.

- Markets think six months ahead – today’s reaction is pricing in the impact of tariffs, but by the summer the market will be looking ahead to 2026 and the mid-term elections which are likely to see more pro-growth policies.

- Between now and then we expect heightened volatility to persist, and opportunities are sure to arise for the prepared investor.

- For the first time in a while the TSX is outperforming despite Canada being among the most targeted in the early days of the Trump administration.

- Investors with balanced portfolios have fared much better than what we see in the headlines, and those investors have the flexibility to take advantage of the bargains that typically arise during episodes of volatility.

We would like to say that this was an April Fool's joke but it came a day late. The Trump administration's "reciprocal" tariff announcement came as expected on April 2, and for many countries the result was worse than they could have imagined, with some major exporters to the U.S. now subject to 20%+ tariffs. On the one hand, sustained tariffs of these levels would throw a wrench into the global economy and significantly raise the cost of living for U.S. consumers. On the other, some of these tariff levels are so high that they seem unlikely to remain there for long unless the goal is to push the U.S. economy into a consumer-led recession and boost inflation to COVID-like levels at the same time, also known as stagflation. We would note that true to form, there is a gap of a few days before these new tariffs take hold, presumably leaving a window of negotiation open. Treasury Secretary Scott Bessent said in a television interview yesterday that these new reciprocal tariffs can be viewed as a potential ceiling so long as countries don’t retaliate. So far we have not seen major retaliation announced.

While we won't pretend that we can get into the mind of the U.S. president, we have yet to see a politician willingly implement policies that are deeply unpopular and threaten their political position in the never-ending U.S. election cycle. We will go out on a limb here and suggest that this is the end of the beginning of the trade war. After two months of assorted bluster, threats and last minute reversals, we finally have a starting point from which negotiations can presumably begin. It may not feel like it now, but we may have just passed the peak level of uncertainty. For many emerging market nations and some large developed markets tariffs at these levels are existential to their export capacity. We expect many of these administrations will rush to the negotiating table, where the real work will begin.

Markets already looking at what comes next…

We need to remind ourselves that markets are relentlessly forward looking. Today's weakness reflects a higher probability of a weak economy if tariffs do indeed stick. If these tariff levels are indeed a “ceiling”, it may be that we are seeing the peak in negative news right now, with improvements dribbling out as countries negotiate lower levels. Interestingly Canada and Mexico have come off relatively unscathed despite some of the most aggressive rhetoric coming our way. Come summertime, we expect markets to start looking ahead to 2026 and there is a real possibility of a policy shift going into the mid-term elections with a focus on economy-boosting policies such as tax cuts and deregulation.

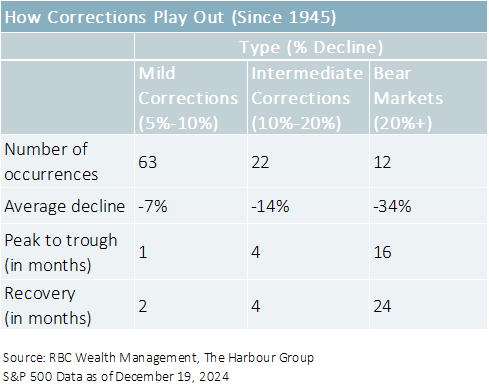

While we are not political experts, we think that if the Democrats retake control of congress it will be very difficult if not impossible for Trump to pass any controversial legislation and he will likely be investigated relentlessly. Therefore 2026 will likely see a full court press to get the economy and markets going in order to improve Republicans' chances. Markets may start to sniff this out in the summer, which would coincide with typical pattern of four months down and another four months to recover seen in medium-sized corrections. Between now and then we expect volatility to persist and if history is any guide we are likely to see attractive opportunities arise for long term investors holding balanced portfolios.

… and they often bottom when we least expect them to

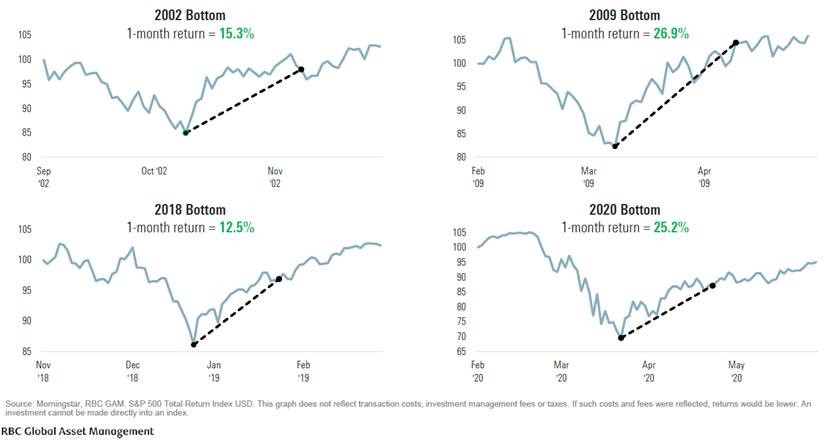

While it can be difficult to think clearly when we are in the middle of a storm, markets often bottom well before good news is obvious. The most stunning example of this was during the Cuban Missile crisis in 1962. During this 12-day ordeal, stocks bottomed on day 7 despite considerable uncertainty afterward. This was during a period where there was a realistic chance of a nuclear war. COVID 19 saw a similar pattern. Markets bottomed on March 23, one day after New York City went into lockdown and vaccines were still a distant dream.

Markets often bottom when it seems least likely, as equities have a habit of sniffing out the slightest improvement to the outlook and act accordingly… often violently!

A great time to be diversified

2025 is shaping up to be another year where diversification pays off, as bonds resume their historical role of portfolio protector and previous laggards such as the TSX have outperformed. This is despite being one of the most targeted countries early on. While it is too early to suggest a longer-term change in trend is upon us, this bears watching after a decade of U.S. outperformance.

Manufactured crises are the easiest to resolve

It is clear that there are no easy answers for investors when it comes to the pending trade war. Logic would suggest that cooler heads will prevail at some point but there is no guarantee. In a promising sign, we have seen U.S. senators on both sides of the aisle start to push back on unilateral tariffs. This is the first sign of life we have seen out of congress since the inauguration. During times like this there are two sayings that come to mind. First, “the U.S. will do the right thing after trying all other options.” Right now we are clearly in the “trying other options” phase. Second, and perhaps more important right now, “politicians panic after markets panic.” While not a fun process to go through, significant market sell offs typically mark the end point of the manufactured crises that have unfortunately become a larger part of the market landscape in the past decade or so. This crisis is 100% self-inflicted and can be solved with the stroke of a pen. Past behaviour would suggest the deal maker in chief would like nothing more than to parade a procession of freshly minted trade deals in front of the TV cameras, and by the time those deals are signed markets will likely already be on the road to recovery.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.