- One consistent source of investor concern in 2025 has been valuations, particularly for U.S. stocks.

- Price/earnings ratios south of the border are indeed above long-term averages, reflecting healthy earnings growth.

- We are often asked what will happen if investor enthusiasm for U.S. stocks wanes and P/E ratios come down.

- The answer may surprise you – markets have historically done fine after P/E ratios peak, but there is an important caveat.

- The bulk of the positive performance has come in instances where P/Es peaked but earnings growth continued.

- If earnings fail to grow and P/E ratios come down , the math is pretty simple and it is difficult to generate strong performance!

- As it stands today, U.S. economic growth estimates are rising and expected earnings continue to hit new highs.

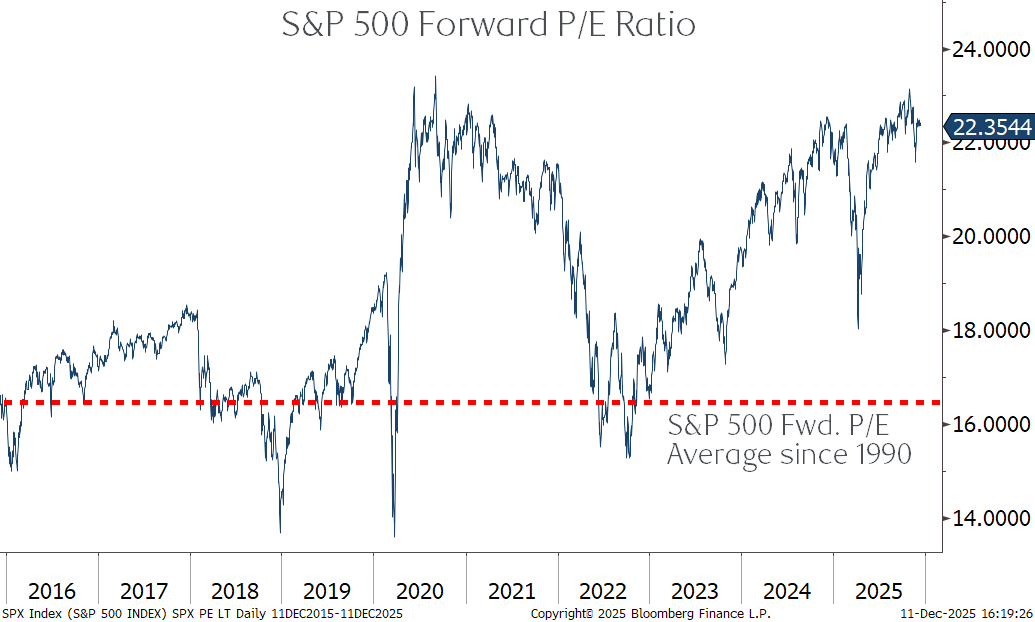

For the better part of a decade, there has been consistent concern about stock market valuations, particularly in the United States. While our investment process is valuation-aware, we have learned a long time ago that valuations are not a catalyst for change – expensive markets can get more expensive, and cheap markets can get cheaper. As seen below, the U.S. market’s forward P/E ratio (price divided by expected earnings per share) has in late 2024 and 2025 been back near the highs seen in 2020.

Forward Price/Earnings Ratio for U.S. stocks

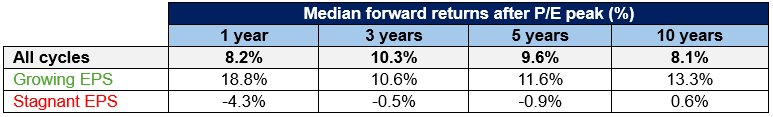

Falling P/Es not always bad news for returns

We recently came across an interesting study from our colleagues at RBC Global Asset Management whereby they analyzed the forward returns after price/earnings ratios have peaked for the S&P 500 and the results were somewhat surprising. They took an interesting approach to the analysis, and instead of simply looking at what returns look like after P/E ratios peak, they also broke the results down based on whether earnings were growing are not. Interestingly, on average returns were nicely positive for the entire data set, augmented by the periods when earnings continued to grow, and the average was brought down by the periods where earnings were stagnant.

Source: RBC GAM. Returns are for the S&P 500 Total Return Index. Periods greater than 12 months are annualized. Peak period starting dates include April 1961, April 1969, August 1986, July 1989, April 1999 and August 2020.

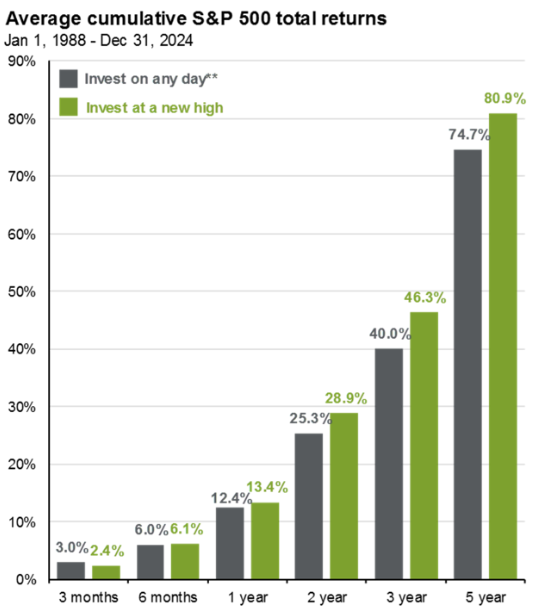

For a generation of investors, investing at all-time highs has been a winning strategy

This data rhymes with another interesting market phenomenon detailed below – since the late 1980s, anyone investing for a period of six months or longer has on average been better off investing on a day the market hits an all-time high compared to any other day! While this data will surprise many, it is a testament to how big of a factor momentum has been in the U.S. stock market, particularly in the period following the Great Financial Crisis.

Source: J.P. Morgan

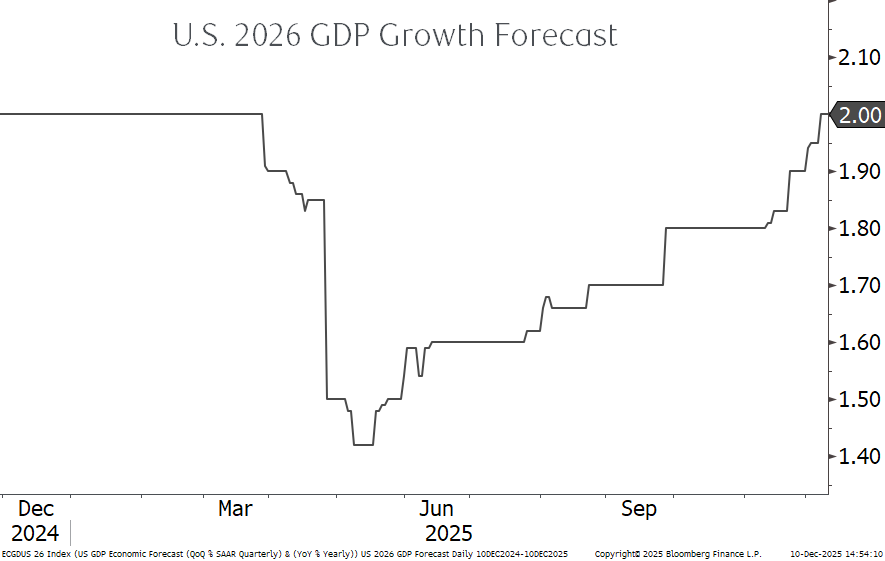

Economic growth forecasts are recovering…

The main ingredients for stock market earnings growth are economic growth – corporate profit growth tends to be highly correlated with growth in the overall economy, and on that score the outlook remains positive. Economists expect the U.S. economy to grow by 2.0% next year, roughly in line with recent averages. This is a big improvement from the spring, when tariff announcements caused economists to slash their forecasts. Since then, a combination of lower realized tariffs, trade “deals” with a number of countries and economic resilience has led to the 2026 forecast fully recovering.

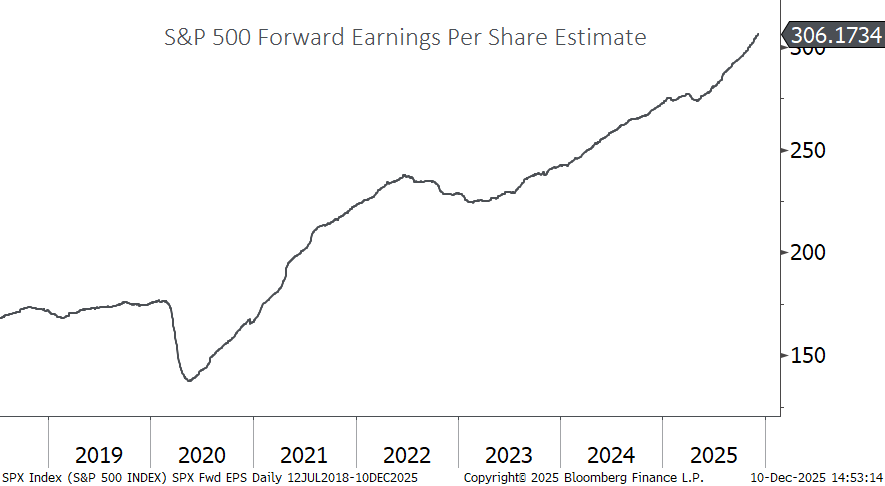

… and expected earnings continue to move higher

We can also track the consensus estimate for S&P 500 earnings growth, and as seen below this number continues to hit new highs. This is the key to maintaining positive returns should P/E ratios falter. Ignoring dividends for a moment, there are two ways for the stock market to rise – all else equal, we need either earnings or valuations to go up. Usually it is some combination of the two, with the most powerful being a rise in earnings and valuations at the same time, which has the potential to lead to high returns. The premise behind the market doing well even as P/Es fall means that earnings growth takes over the baton to drive growth, more than offsetting any decline in the P/E ratio.

2026 is sure to be full of surprises

As we conclude what has been an eventful (and fruitful!) 2025, the outlook for U.S. economic growth and earnings, as detailed above, look favourable. This doesn’t mean that we won’t get thrown our share of curveballs - there is no shortage of event risks as another round of U.S. elections approach and a new Federal Reserve chair ascends next year. As we have seen time and again, corrections can hit for any time and seemingly for any reason, and our actions during these periods of volatility is much more important as to whether they happen or not.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.