- The prospect of significant tariffs on Canada represents a grave risk to the Canadian economy, but the Canadian stock market may be another matter.

- There is little doubt if 25% tariffs are implemented (perhaps by the time you read this), the impact on the Canadian economy would be stark.

- The Canadian dollar would likely act as a shock absorber, and it has been widely reported that Ottawa is planning COVID-style relief packages for those impacted, which would soften the blow to the economy.

- If global stocks decline as tariffs bite, Canada is unlikely to be spared, but pressure from markets may be the one thing that leads to a reversal of an extreme tariff policy.

- Most Canadian stocks we hold are global businesses headquartered in Canada – those foreign cashflows will be worth more in Canadian dollar terms should the loonie take a substantial hit.

- In a worst-case tariff scenario, market dislocations are likely, and we would expect to see interesting opportunities arise for investors with a long-term time horizon.

We have all known since shortly after the U.S. election that tariffs would be a risk to the Canadian economy under the new administration. Last week, we provided a framework for thinking about tariffs’ impact on the Canadian economy from RBC’s Chief Economist. Of equal importance to investors is what the implications will be for the stock market and currency. Economists estimate a hit to as much of 4.5% to the Canadian economy should we see 25% tariffs, but importantly the hit is much smaller if we assume a partial tariff scenario, which is what our economists deem most likely. We would also note that our government is widely reported to be drawing up COVID-style relief plans for those impacted, which would soften the blow to economic growth.

Canadian dollar a likely shock absorber…

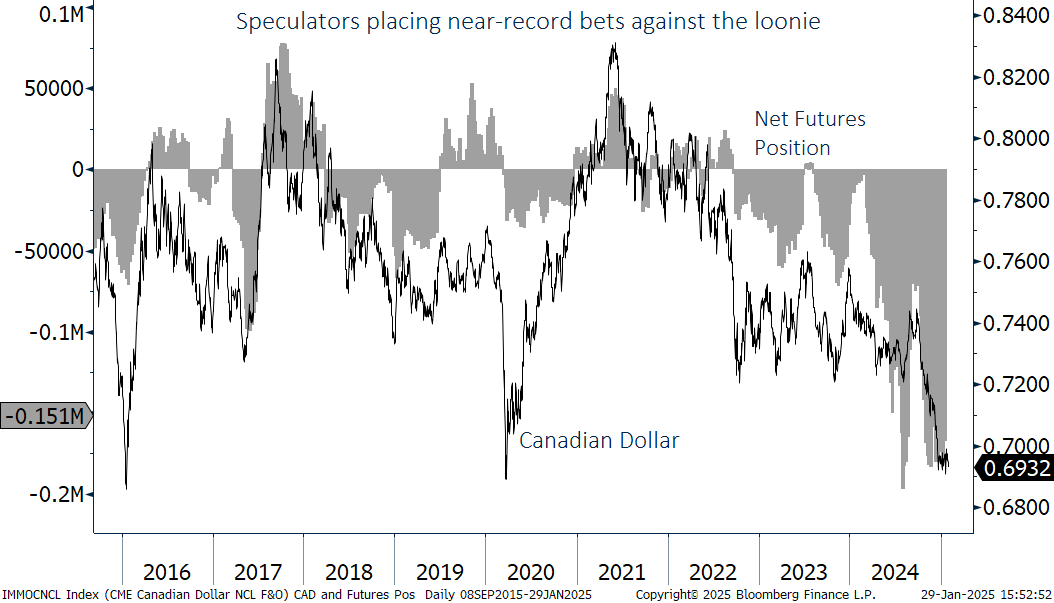

Since the day before the election until this writing (29 January, 2025), the loonie has fallen about 4% as markets, rightly in our view, price in tariff risk. As seen below, we are approaching levels seen in 2016 and 2020, and speculators are betting against our currency in near-record numbers. In our view, the foreign exchange market is priced for roughly 50% odds that significant tariffs hit. In other words, if we do indeed get 25% tariffs, we wouldn’t be surprised to see the Canadian dollar to fall below US$ 0.65. By the same token, if tariffs were suddenly off the table (which seems highly unlikely), we think we could see US$ 0.75 in a hurry. A weaker currency makes exports more competitive, but it is unlikely that the loonie falls enough to offset a full 25% hit. Either way, we see holding U.S. dollars as one of the only reliable hedges available to protect portfolios in the event of a tariff war with the U.S.

… a positive for multinationals

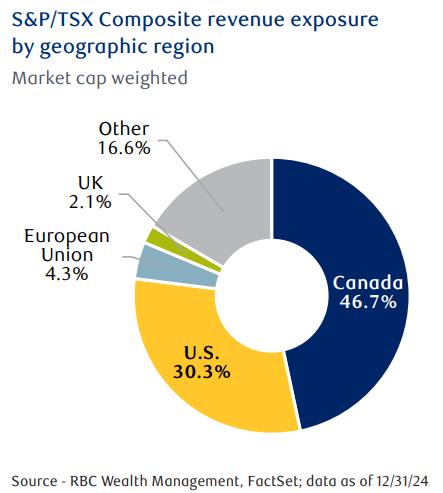

When we think about the largest exporters to the U.S. from Canada, many of them are small and medium-sized businesses or the Canadian subsidiaries of global companies. Automobiles are a clear example, along with industrial products, pharmaceuticals and food. Within the TSX, and specifically in portfolios, significant portions of U.S. and global revenues are via foreign business units that repatriate cash flows to Canada as opposed to direct merchandise exports to the U.S. Many of the Canadian stocks we hold in portfolios are effectively global businesses headquartered in Canada. If the Canadian dollar were to weaken materially due to tariffs, we may see a bit of an offset as the value of the significant U.S./foreign operations will be higher when converted back to Canadian dollars. Does this mean these stocks outright go higher in the midst of a tariff war? It depends – much of that will depend on what happens to global equity markets, but we do think they are less likely to be punished strictly for being Canadian. As seen below, approximately 30 percent of the S&P/TSX Composite Index’s revenue is sourced from the U.S. Of that, only about a quarter is tied to firms in goods-producing industries, suggesting the vast majority of TSX revenues should be shielded from tariff risk, and we can (and do!) dial this risk down further via security selection.

Markets act as a governor on economy-threatening political decisions, creating opportunities for long-term investors

It is widely accepted in the economics community that a significant increase in tariffs will increase U.S. inflation, which naturally will hit the economy’s most vulnerable – those who do not benefit from income tax cuts, for example. We have seen time and again that markets will punish politicians who enact policies that threaten economic growth by correcting sharply in response. While the new administration has proven to be extremely unpredictable thus far, there is one thing we are fairly certain about – they view the direction of the stock market as a real-time report card on their success. Some presidents of the past would have no problem holding firm to a stock-market unfriendly policy if they deemed it to be the right thing for the country, but we think the current administration will be much more receptive to the message of the market. When the market sends a message to politicians it is often messy, but it is often these situations that create opportunities for long-term investors who make decisions based on company fundamentals as opposed to the headlines of the day.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.