- The upcoming U.S. election has many investors on edge as the race remains too close to call.

- Typically markets have a smoother ride in years where the incumbent party wins.

- At the same time, current dynamics suggest markets prefer a Trump victory.

- While both sides of the political debate contain strong opinions, markets have historically done well under both parties.

- They key has been to stay invested, as limiting our time in markets to when only one party or the other is in power has led to disastrous long-term results.

Stocks have historically done best in election years when the incumbent wins…

For the past few months, the upcoming U.S. election has taken up more and more of the oxygen in the media landscape. We have good news and bad news. The bad news is, it is likely to become even more intense in the days to come. The good news is it will all be over on November 5. Well, maybe not exactly on November 5, but probably a few days after in what is expected to be a closely contested election. This focus on the election has made its way into markets, with the number one question we get from investors being about it. As seen below, the stock market has had different historical patterns depending if the incumbent party or opposing party wins. With the strong gains seen so far this year it would appear on the surface based on history that a Democratic victory is widely expected.

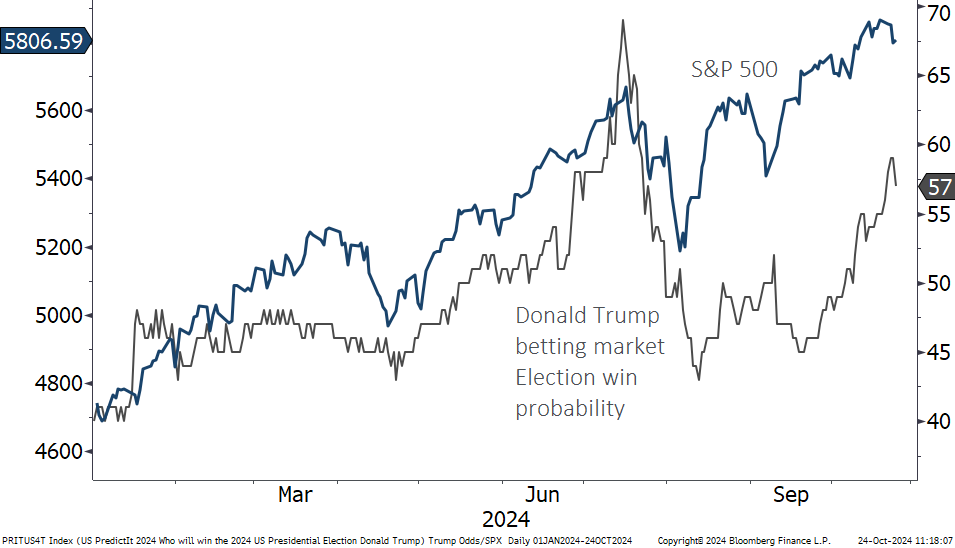

…but patterns seen this year suggest 2024’s gains are the product of something else

However, we have seen another interesting phenomenon take place this year in regards to potential election outcomes. As seen below, the ebbs and flows of the S&P 500 has shown a reasonably strong correlation with Donald Trump’s probability of winning the election, as measured by betting markets. Many find this relationship puzzling, but we think there is a simple explanation. The stock market cares most about earnings. The tax cuts and deregulation at the heart of Trump’s policy mix suggests higher earnings, and that is what markets seem to be focused on. Interestingly at the same time the bond market seems to be focusing on the inflationary implications of tariffs and higher deficits, but those concerns have yet to find their way to the stock market!

Regardless of who is in power, it really is about time IN the market

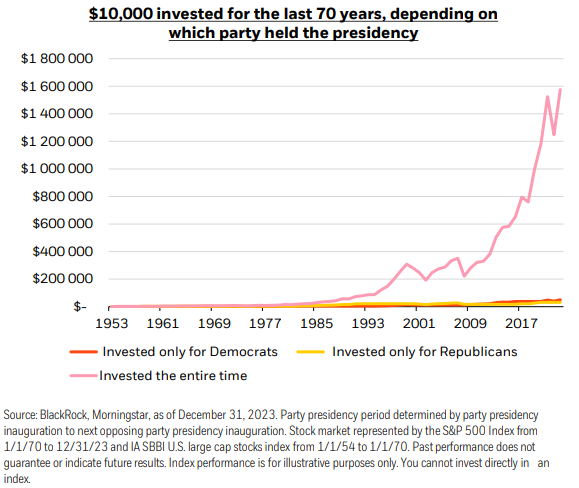

It is one of the oldest cliches in our business – “time in the market is more important that timing the market”. The reason this line has been around for so long is because for the vast majority of investors, it is true! When it comes to investing according to one’s political leanings, the impact is even more meaningful.

As seen above, any investor who only invested when one party or the other was in power over the last 70 years infinitely underperformed someone who stayed invested the whole time. The numbers may be shocking, but they are simply the result of compounding returns over a long period of time. Since 1954, Republicans have held the presidency 57% of the time, and the Democrats for the rest. Said another way, only investing when one party is in power means being uninvested for 43% or more of the time, and that has a massive impact over 70 years. The next few weeks are sure to be full of heated rhetoric from both sides, and uncertainty will likely reign in the days following the election. This may bring on a bout of volatility for markets, but we take comfort knowing that over the long term markets have done well regardless who is in power, and we don’t see that changing over the next 70 years.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.