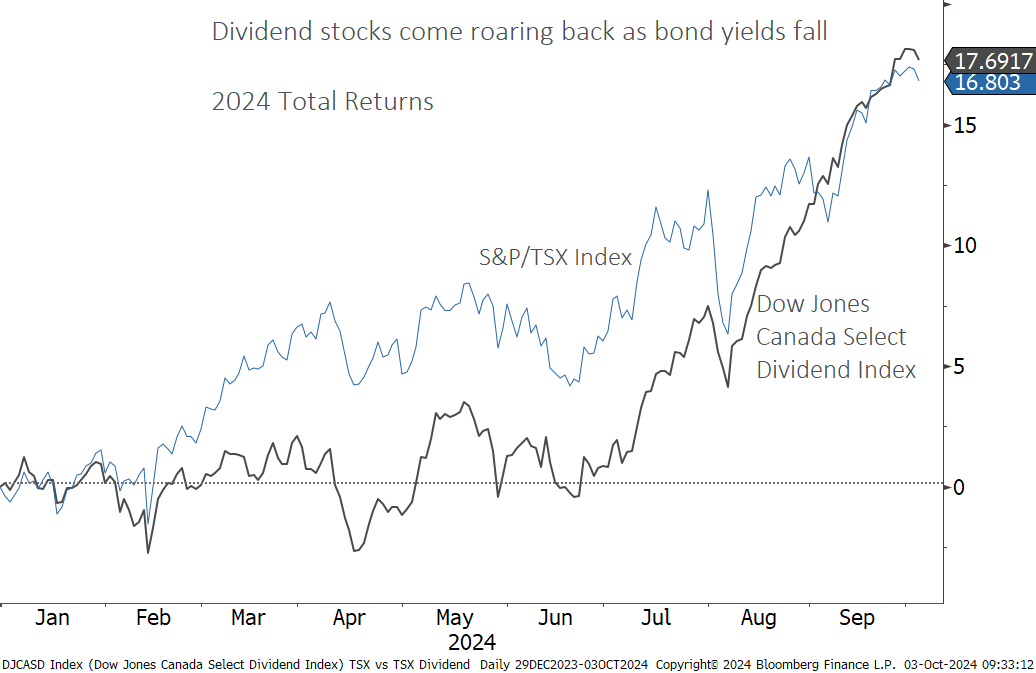

- Dividend paying stocks started 2024 on the back foot as high bond yields posed serious competition for income investor dollars.

- This softness was compounded by the strength in growth stocks, leading to rising levels of investor frustration.

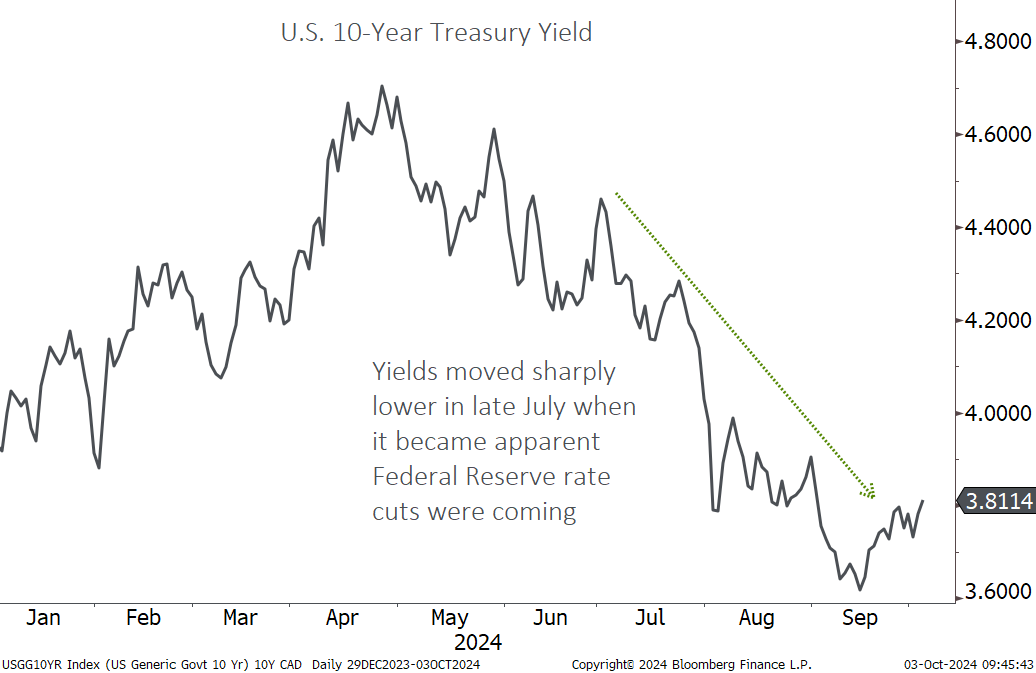

- The arrival of interest rate cuts from the Bank of Canada and the Federal Reserve have seen bond yields drop sharply.

- Lower bond yields have led to a rally in bonds to be sure, but an even larger one in dividend paying stocks as diversification pays off.

- Low valuations and high dividend yields have attracted investors back to the sector, with dividend stocks outperforming the TSX year to date.

- Time will tell if this trend will continue, but we expect another leg lower in bond yields would provide additional support.

Dividend-paying stocks have been the bedrock of portfolios going back decades, but it sure didn’t feel that way through the first half of 2024, particularly as growth stocks rallied relentlessly. Stubbornly high bond yields were creating stiff competition for dividends, which served as the primary source of income in balanced portfolios for most of the past decade prior to the pandemic. The sentiment surrounding dividend investing had reached such a low ebb we felt compelled to provide a bit of a pep talk. Back in May we published a blog post entitled: Revisiting an Old Friend – A Dividend Investing Refresher. We concluded with the following thought: In our view, many of these cash-flow focused investors will come back to dividends when bond yields start to fall below their targeted yield, making the yields on dividend stocks more attractive. We may find that some of these dividend stocks even outperform bonds as yields fall and in the meantime we are being paid handsomely to wait.

It is always darkest before dawn

We published that note on May 3, 2024, about one week after the 10-year U.S. Treasury marked its high yield for the year. We say this not to pat ourselves on the back – we made no explicit call – but it does show how much sentiment drives markets given the dreadful outlook for dividend stocks at the time. In fact, even though yields started to fall throughout the summer, the dividend stock index we track didn’t break free from the zero year-to-date return mark until late June. This is when it came apparent that the U.S. central bank following the Bank of Canada into rate-cutting territory seemed likely. Since then it has been nearly a one way street higher, with dividend stocks delivering all of their return for the year in a little over three months, overtaking the main TSX index in the process and handily outperforming bonds.

Score one for diversification

The other thing dividend stocks have outperformed since mid-year? The technology-heavy NASDAQ and the S&P 500. As of this writing, the NASDAQ is up marginally since June 30 and the S&P is faring a bit better, but both are lagging the TSX and the dividend index. While the U.S. indices are still leading year to date, the gap has been shrinking. We don’t know where it will go from here, and in order to sustain recent momentum we think dividend stocks would need to see a new leg lower in bond yields. What this recent episode does tell us is you never know what will happen next when sentiment has swung too far. A diversified portfolio by definition won’t be stacked with the winners of the day 100% of the time. Constructed properly, however, it should be one of the best tools available for investors to have success in meeting the goals set out in their financial plans in a wide range of market environments.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.