- This week’s kickoff to the Federal Reserve rate cutting cycle officially marks the end of an era.

- While the Bank of Canada has been cutting rates for months, U.S. investors have been able to hide out in short-term Treasury bills and earn 5% returns until very recently.

- This normalized interest rate era has been a boon for savers who spent most of the last 15 years taking more risk than they were comfortable doing, just to outearn inflation.

- Portfolio stalwarts such as bonds and dividend paying stocks have historically done well once rate-cutting cycles commence, while stocks in general have also performed.

- While we do not think we will revisit zero interest rates anytime soon, new tactics will be required as we go back into a rate-cutting cycle.

2022 saw the beginning of a long-awaited normalization of interest rates. After spending most of the prior 14 years with interest rates closer to zero than 5 percent, long suffering savers greeted this news with glee. The transition wasn’t so easy on nearly every other type of investor, however. While we don’t want to reopen old wounds, recall that 2022 was one of the most challenging years for investors in some time as both bonds and stocks delivered negative returns, with “nowhere to hide” except cash and cash equivalents such as Treasury bills. This transition to higher yields gave investors the option to “T-Bill and chill”. In other words, take minimal risk in portfolios and earn a reasonable rate of return on short-term government guaranteed treasury bills, kick your feet up and relax.

Cash becomes less attractive as rates fall…

As the Bank of Canada and now the Federal Reserve engage in interest rate cuts, this strategy is on borrowed time. Indeed, T-bills represent the very definition of reinvestment risk. Every few months these instruments mature, and investors will be exposed to changes in short term interest rates, the trend of which for the foreseeable futures seems to be down. This is one of the reasons the yield curve has been “inverted”, with longer maturities yielding less than shorter ones. Investors were willing to take a lower rate of return in order to lock that return in for a longer period of time, taking a short term hit to returns in exchange for longer-run certainty.

… so what should we do?

The next logical question is what should we do when interest rates start to fall. The simple answer is to just get invested, be it in bonds or stocks. As seen below, both stocks and bonds have historically fared well in the 12 months following the first Federal Reserve interest rate cut. Bonds have seen a higher batting average as lower rates directly translate into higher bond prices while the return on stocks has been more dependent on what happens to the economy but in general the trajectory has been up.

Bonds are a good place to start…

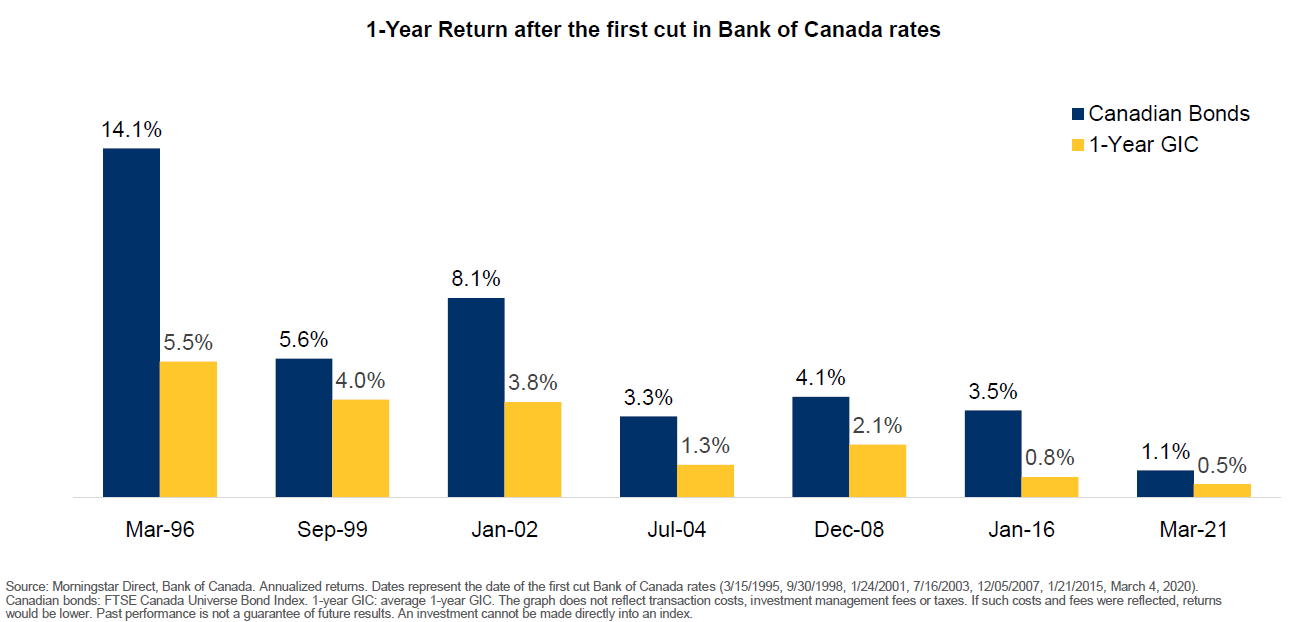

Shifting gears to Canada, we can see below that the Canadian bond market has handily outperformed a 1-year GIC in the first year after the Bank of Canada starts to cut interest rates. We would note that the hurdle rate will be a bit higher this time around as 1-year GICs were in the 5% range when the Bank first started to cut interest rates, but of course bond yields were also higher than they have been during the commencement of the past few rate cutting cycles.

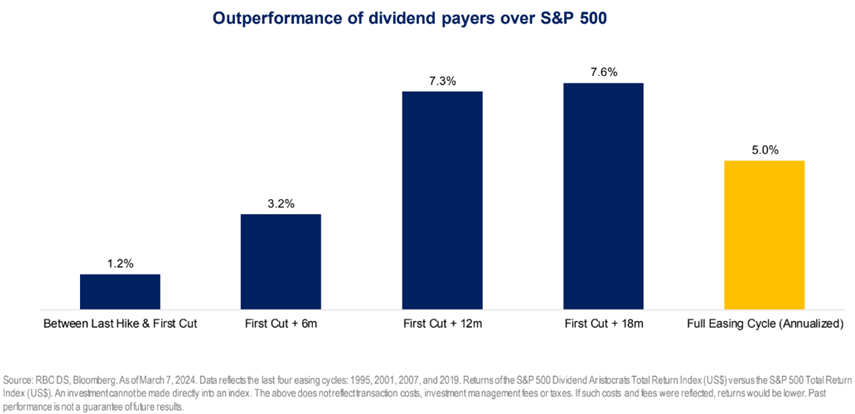

… as are dividend paying stocks

We shared a chart in our August 6 note that showed the rebound in dividend paying stocks as bond yields started to fall in advance of interest rate cuts. This was after a period of meaningful underperformance for these sectors, and sentiment hitting a deep low point. If we look at rate cutting cycles as a whole, this trend seems to continue. As seen below, U.S. dividend payers have tended to outperform the S&P 500 right through the rate cutting cycle. While high dividend yields don’t tend to attract investors when safer bonds offer similar cashflow, they do recognize the opportunity pretty quickly once bond yields start to fall.

Action trumps inaction when rates are falling

Warren Buffet has famously described one key facet to his process as follows: "Lethargy bordering on sloth remains the cornerstone of our investment style”. This was from Berkshire Hathaway’s 1990 shareholder letter following a year in which the company neither bought or sold a share in five of its six major holdings. An ultra-low turnover strategy can provide superior returns when one is invested in a collection of strong businesses that compound cashflows over time. The same, however, cannot be said for maximizing returns on cash when interest rates are falling. The era of “T-Bill and chill” is over, and in order to preserve today’s high yields, investors need to take action by terming out their maturities or alternatively, consider an asset allocation shift into dividend paying stocks in search of better total returns.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.