- Despite the onset of Bank of Canada interest rate cuts, the Canadian dollar has strengthened sharply versus the U.S. dollar in recent weeks.

- Typically the country cutting interest rates (in this case Canada) sees a weaker currency.

- Financial markets move based on expectations – and in the past few weeks it has become clear that the Federal Reserve is about to join the rate cutting parade, jolting the U.S. dollar lower against major currencies.

- In the fullness of time we think the Bank of Canada will cut rates further than the Federal Reserve, which may put the Canadian dollar on the back foot.

- With the global economy in flux, we believe the U.S. economy will prove more resilient than the Canadian one in the next downturn, and such a scenario tends to favour the U.S. dollar.

One of the enduring themes in portfolios for the past decade has been significant U.S. dollar exposure, which has provided diversification and added to returns in two ways. First, we need to hold U.S. dollars to invest in the best and brightest companies from that market, which has outperformed the TSX handily over the medium term. Second, the U.S. dollar itself has been an attractive asset gaining 24% against the Canadian dollar over the past decade. The first seven months of 2024 were also good for the U.S. dollar as it gained over 4% alongside rising equity markets. In the past few weeks some of those gains have eroded as the U.S. dollar has weakened against many of its major trading partners as Federal Reserve interest rate cuts are no longer a question of if but when.

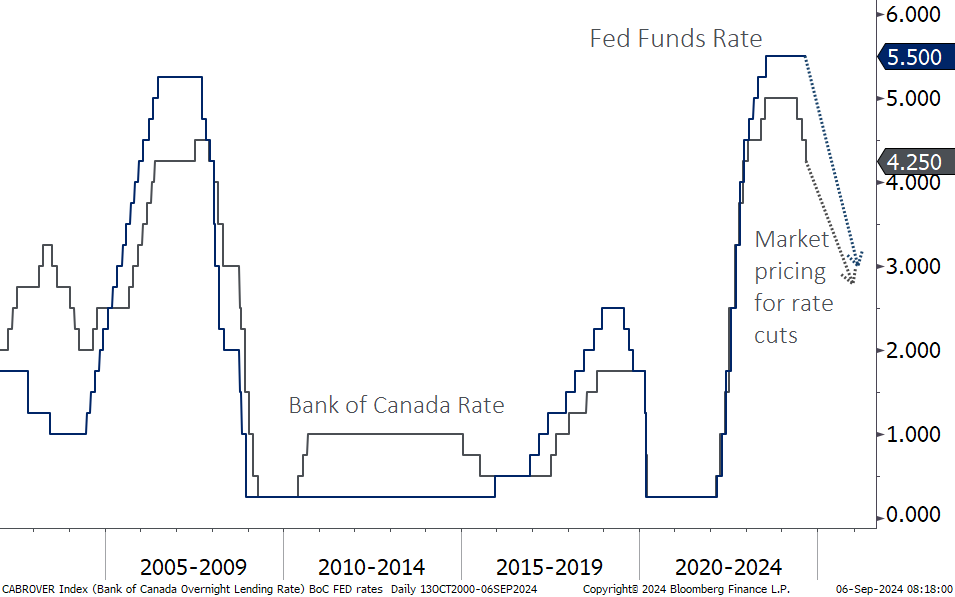

Bank of Canada already cutting, but it is forward expectations that move prices

With the Bank of Canada interest rate already below that of the U.S., some may be wondering why the Canadian dollar has strengthened, even as the Bank of Canada cut rates again this week. Financial markets move on expectations, and that is where the biggest change has taken place. It was clear for most of 2024 that the Bank of Canada would be first out of the gate to cut, and as such we saw the Canadian dollar start to weaken well ahead of the first rate reduction in June. On the U.S. side, it had been more of a “will they/won’t they” cut rates until more recently. As soon as it became clear that U.S. rate cuts were coming, we saw the U.S. dollar start to weaken, and this has fed through to the Canadian dollar as well.

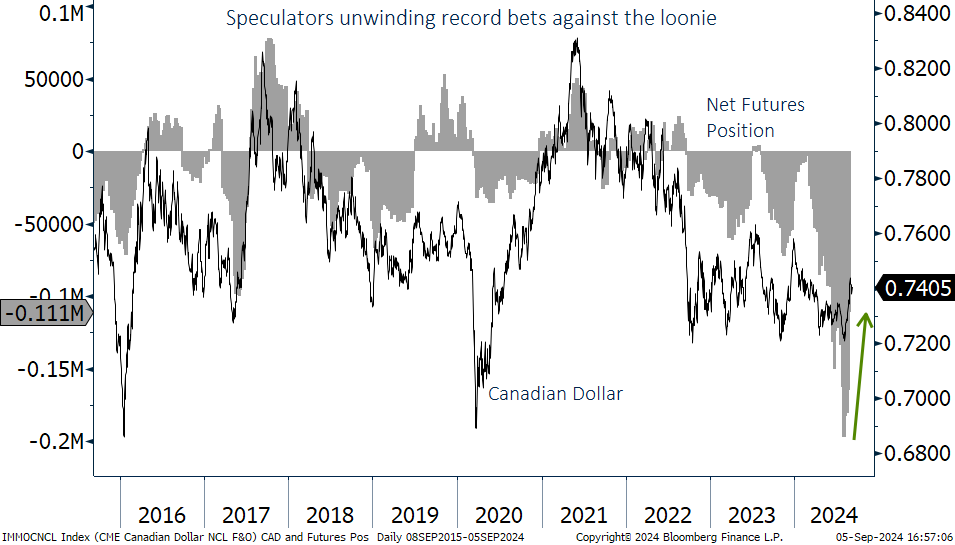

Speculators leaning too far to one side of the boat

For the Canadian dollar in particular this has been exacerbated by speculators betting heavily against the loonie for most of this year. We track this by looking at net long and short positions in the futures market (where investors can make leveraged bets on and against currencies), and they are currently coming off a record short position. When everyone is betting one way and the facts change, the unwind can be sharp. We have seen this many times over the past decade, and with speculators’ positions against the loonie at a record going back to 1995 it is natural to see some upward movement as it appears there was no one left to sell!

What is RBC’s view?

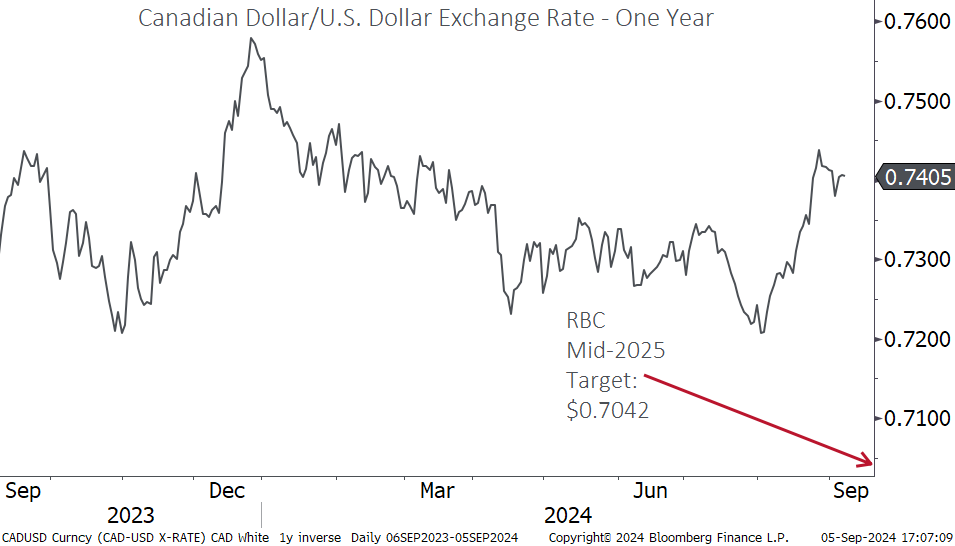

RBC’s forecast for mid-2025 is for the USD-CAD exchange rate to hit $1.42 to buy a U.S. dollar, or a Canadian dollar worth a bit more than 70 cents U.S. Their reasoning is similar to what we have discussed above – the Bank of Canada is likely to cut rates more aggressively than the Federal Reserve and if we do see a recession the loonie tends to underperform. We will note that just as records were made to be broken, foreign exchange strategists’ targets were made to be revised and if the Canadian dollar maintains current levels for a while longer they could soften their targets somewhat.

Bottom Line

Given what we know about the economic outlook and respective central bank expectations, we think it makes sense to maintain or add to U.S. dollar exposure on this burst of Canadian dollar strength. While it is possible that the Federal Reserve will embark on a more aggressive interest rate cutting policy and catch up to the Bank of Canada, this is most likely to happen in a recession. History tells us that during U.S. recessions and the associated equity market volatility, the U.S. dollar has been one of the most attractive assets we as Canadians can own, and we don’t think that will change this cycle, whenever it may turn.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.