- For most investors, the best time to invest is simply when they have the funds available.

- Many others will try to time the market, rushing in when timing seems opportune, or holding off when volatility hits.

- History shows that the chance of an investor guessing right is little better than a coin flip.

- It also shows that the cost of guessing wrong can be significant.

- In our experience, dollar cost averaging strikes a good balance between opportunism and regret.

- Being out of markets when they are at their best can have a material impact down the road when it comes to fulfilling the potential of one’s financial plan.

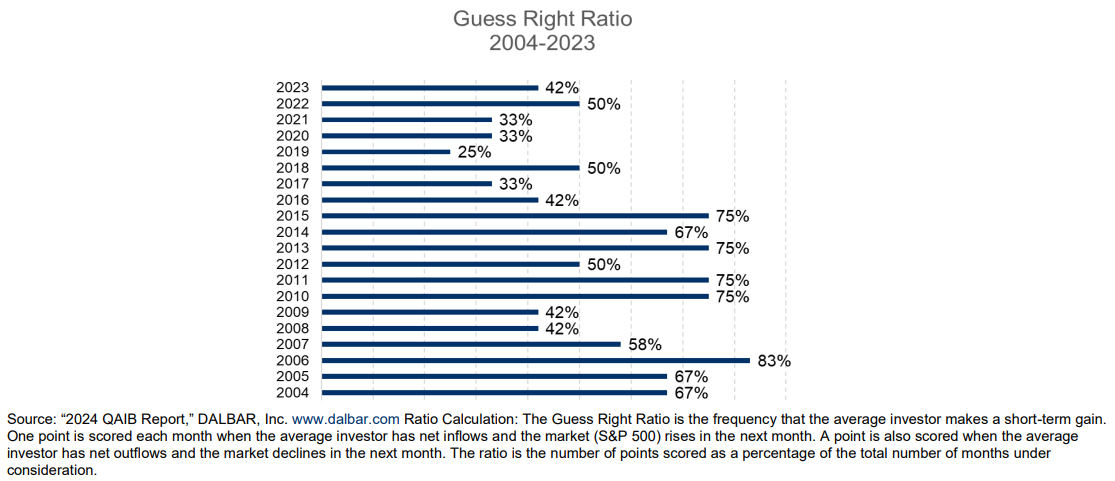

The age-old debate of when to put a substantial (or not so substantial) sum of money to work in markets is one we have all had many times. It is human nature to try to get the timing exactly right, and when it works, it is a thing of beauty. Just as often, however, investors get the timing wrong, and in some instances it can be rather costly – buying before a large move down in markets or just as painful, selling ahead of a significant move higher. Luckily we now have some data to quantify this, as seen in the chart below. The study below calculates what is called the “Guess Right Ratio”. This is how often the average investor puts money into the market and the S&P 500 rises the subsequent month, or takes money out and it falls the subsequent month.

The average investor’s track record of buying and selling in a timely fashion is close to a coin flip…

As seen above, investor success in this endeavour varies greatly, from as low as 25% success in 2019 all the way up to 83% in 2006. For the whole history above, the average investor has gotten it right 54% of the time, suggesting market timing isn’t much more reliable than a coin flip. It is tempting to look at this data and think “so what? 50/50 isn’t too bad!”, but we need to look one step further. The cost of being out of the market when it does well can be significant, and missing just 10 of the best days can have a meaningful impact over time.

… but calling the flip wrong can shave multiple percentage points off returns…

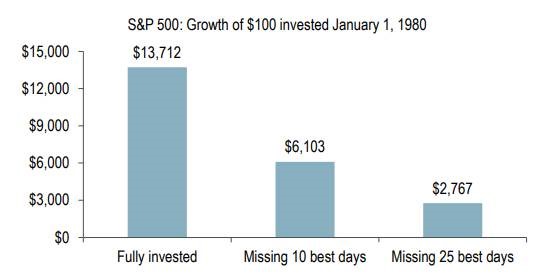

As seen above, an investor fully invested in the S&P 500 from January 1980 to the end of 2023 would have compounded capital at a 11.8% rate. Over that 44 year period there were approximately 11,000 trading days. Missing just the 10 best days, or less than 1 in 1000, resulted in the return dropping to 9.8%, a two percentage point decline. Missing the best 25 days took another two percent out of return, down to 7.8% annualized. Two percent per year doesn’t sound like much, but it adds up meaningfully over time.

…which can add up more than one might think over time

As seen above, that 2% per year over an investing lifetime has a massive impact on the end value of a portfolio. $1,000 invested at 11.8% over 44 years grows to $13,712, but cutting that growth rate by only 2% results in the end value being cut by more than half to $6,103. Missing the best 25 days and bringing the return down another 2% slashes the ending value by more than half once again. The end value in this case is worth 80% less than the fully invested portfolio, even though the annual return is only 34% lower. Even after all of these years of dealing with these numbers every day, the massive impact of relatively small differences in compounded annual growth rates never fails to amaze us.

Dollar cost averaging is a regret-minimization vehicle

Amazon founder Jeff Bezos has described his decision making process as a “regret-minimization framework”, meaning that when he makes a decision he asks himself what he would regret more when he is 80 years old. He frames it in the context of trying new and ambitious projects with a possibility of failure, but we think it also applies to investing. When putting capital to work in markets, the binary call of going all in or waiting for a correction that may or may not come entails risks, and as detailed above they can be quite large. Dollar cost averaging involves investing money in smaller, regular increments rather than all at once. This approach balances out purchase prices over time, as some purchases will be at higher levels and others will be lower, but the end result should avoid extreme highs and lows. This may not be all that exciting, but it reduces the risk of guessing in the wrong direction. We believe it also increases the likelihood of achieving the return expectations embedded in our financial plans, and falling short here would undoubtedly lead to regret!

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.