- As interest rates have surged in the past two years, dividend strategies have been among those most impacted as bond yields pose real competition for investor dollars for the first time in 15 years.

- This has come alongside a resurgence in technology stocks, leading to shades of 2000 when investors wondered why to bother with dividend stocks at all.

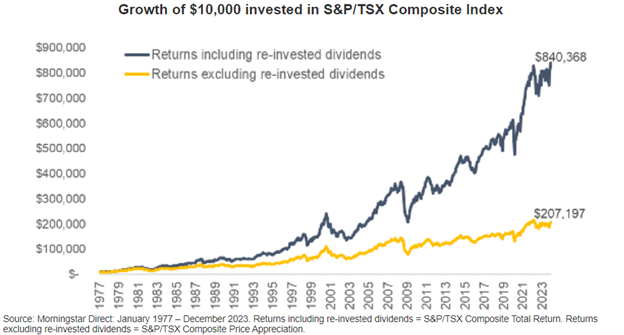

- In Canada in particular, reinvested dividends have been a significant driver of total return, and we don’t expect that to change.

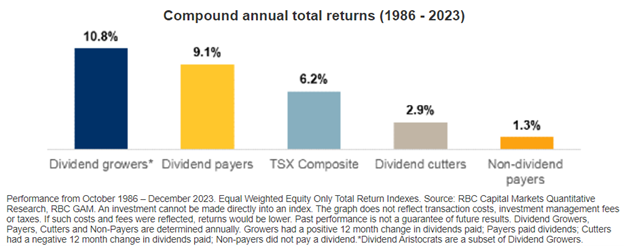

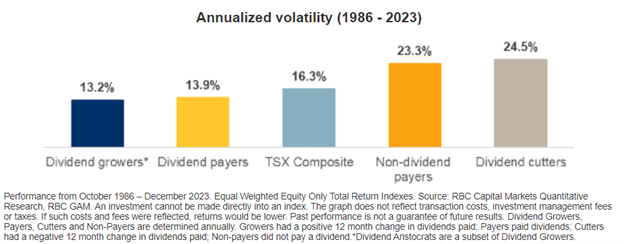

- Dividend payment is great, but dividend growth is better, and these companies continue to lead with lower volatility.

- Today’s TSX dividend yield is largely in line with history, providing a boost to return over and above capital appreciation.

- We expect dividend stocks to see renewed interest when interest rates fall, and until then we are getting paid handsomely to wait.

Why do we care so much about dividends, anyway?

We have been discussing the merits of dividend investing on these (digital) pages for north of a decade, but in the past few years there is no doubt that investor attention has turned to the more exciting prospects of growth stocks, particularly south of the border. We think this is a good opportunity to go back to first principles – why are dividends so important, particularly for Canadian investors? Aside from being more tax efficient than interest income, dividends and the gains upon their reinvestment have accounted for the majority of the TSX’s long-term return, as illustrated below.

Dividends have been a powerful differentiator for Canadian stocks…

It is worth remembering that historically dividend paying stocks (and particularly those that grow their dividend) have significantly outperformed the TSX and have left companies that cut or don’t pay a dividend in the dust over the long term. In fact, the long-term return of non-dividend payers in Canada has more in common with Treasury Bills than the TSX’s return.

… and have outperformed with less drama

At the same time, this performance has come with lower volatility than the TSX, and much lower volatility than those stocks that reduce or don’t provide any cash flow to investors. Higher performance with lower volatility is something of a holy grail for equity investors, and is the main reason we have been attracted to dividend growth stocks in Canada.

Eventual rate cuts will be key for dividend stocks

The simple reason that many dividend stocks have lagged of late is that there is now material competition from bonds. Back when yields were 1-2%, a 4-5% dividend (tax-advantaged) looked terrific and investor dollars chased these cash flows. With bonds today in the 4-5% range themselves, investors are demanding a higher yield from dividend stocks, particularly those without a lot of growth. In our view, many of these cash-flow focused investors will come back to dividends when bond yields start to fall below their targeted yield, making the yields on dividend stocks more attractive. We may find that some of these dividend stocks even outperform bonds as yields fall and in the meantime we are being paid handsomely to wait.

It is not unusual for some investors to question the purpose of dividend investing in an era where growth is ascendant, but we would like to make note of some interesting recent developments. In case there was any doubt to the value of dividends, two of the world’s largest technology companies initiated a dividend for the first time this year. This means that since the start of 2024, we have gone from two of the “Magnificent 7” technology stocks paying a dividend to four of them, a majority. So don’t take our word for it – the titans of technology seem to be on board the dividend train as well!

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.