With Canadian tax season winding down, all of us are likely looking for ways to reduce our contributions to CRA. We thought now would be a good time to remind people what options are out there for saving on a tax-deferred or tax-exempt basis, and their various features and best use cases. There are a number of tax-efficient options for Canadians to save for the future, but the question is often which one to prioritize. Many if not all of you are likely well familiar with RRSPs and TFSAs, but there is a new kid in town in the form of the First Home Savings Account (“FHSA”) and while current homeowners don’t qualify, many of us likely have family members that would.

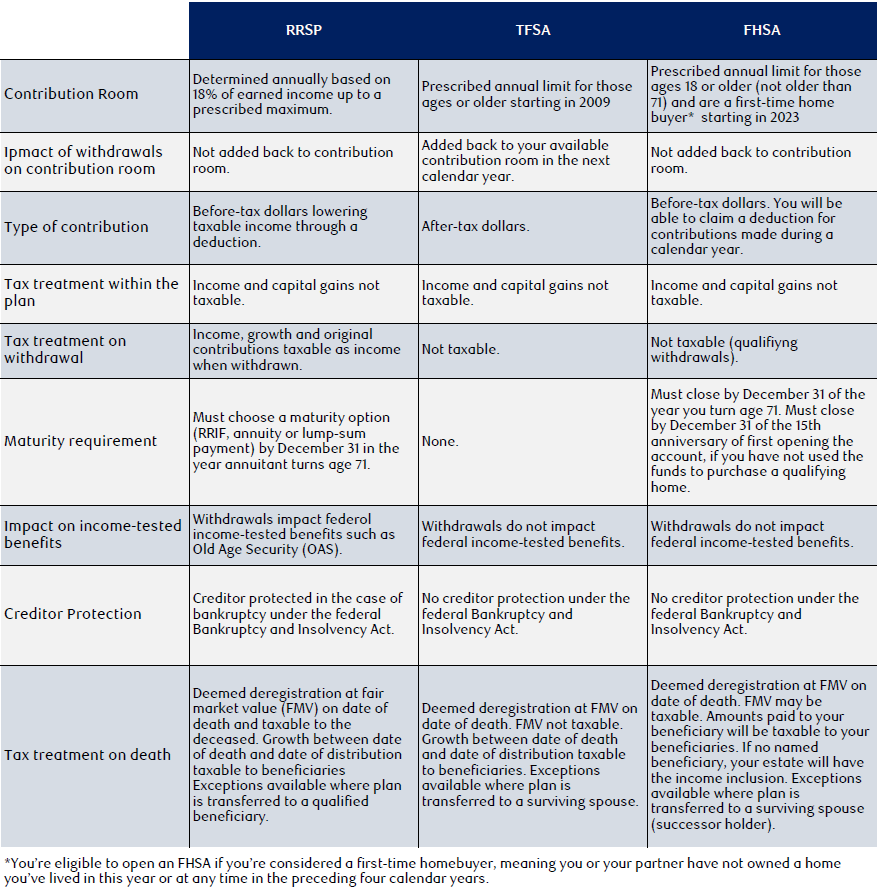

The table below summarizes the key attributes of each of these accounts, and your Harbour Group advisor can provide you with more information on all of these plans.

Many of you may be looking at the list above and think “I’ve maxed out my RRSP and TFSA, and I don’t qualify for the FHSA”. Some of you may have already even started to gift funds to adult children to fund their TFSA. Given it is new and less well-known, we would suggest readers (or those with adult children) who qualify get to know the FHSA. It combines the most attractive features of the RRSP and TFSA with a tax deduction for contributions and tax-free withdrawal for a qualified real estate purchase. If not used to purchase real estate, it can be rolled into an RRSP. Frankly we are having a hard time thinking of a reason not to open one if you are qualified and have the excess funds to do so.

What about those looking to prioritize? The short answer is “it depends”. Choosing the best savings program for you will depend on various factors such as:

• Interest rates and expected rate of return on investments

• Risk tolerance

• Marginal tax rates

• Flexibility

• Personal habits

• Income-tested retirement benefits

We at The Harbour Group stand by ready to help by evaluating all of these variables and more between you and your advisor and our dedicated financial planning team.

Making a decision about where to save can give rise to a lot of competing priorities and variables. We find it is best to start by giving some thought to your personal goals and objectives to determine the best savings vehicle for you. Things to consider could include, what are these savings for and when will you need them? Do you want to minimize tax today or smooth tax over your lifetime? Where do your priorities lie? Once you've determined your goals and objectives, you can look at which considerations are the most important to you.

Typically, funds which are required on a shorter-term basis are best served by a TFSA, while longer-term retirement goals can be achieved in both RRSPs and TFSAs. FHSAs are unique in that they have a limited life and are designed for the eventual purchase of a home, but the flexibility to convert into an RRSP certainly widens the use case for those who qualify.

As you can see from the information above, there is often not a clear answer as to the “best” plan to focus one’s savings on, but we are here to help guide you toward the plan(s) that make the most sense for you and your family.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.