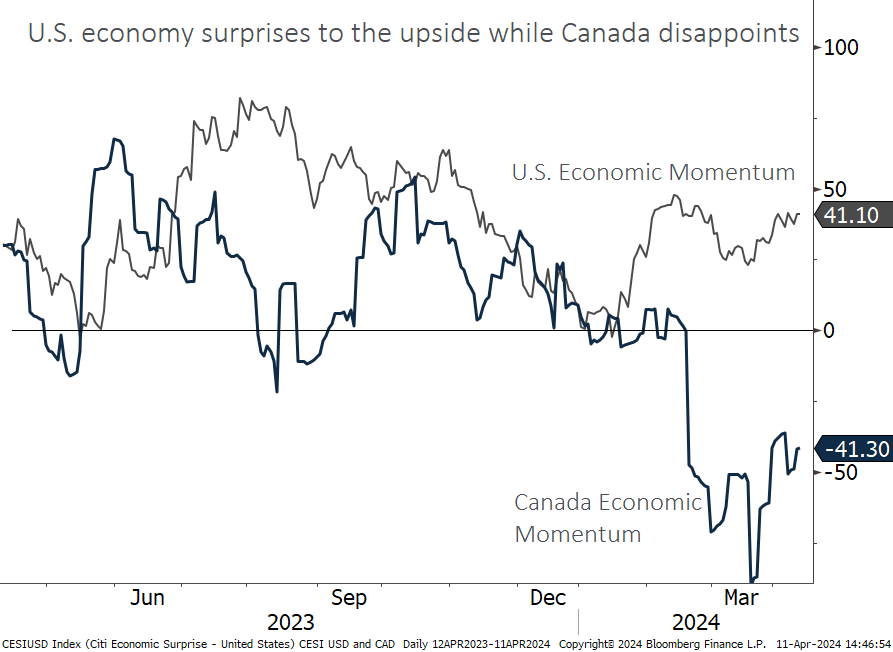

- Continued healthy readings for the U.S. economy are in sharp contrast to Canada.

- Markets now finally pricing in the Bank of Canada cutting interest rates ahead of the Fed.

- This has led the Canadian dollar to shed 3% so far this year.

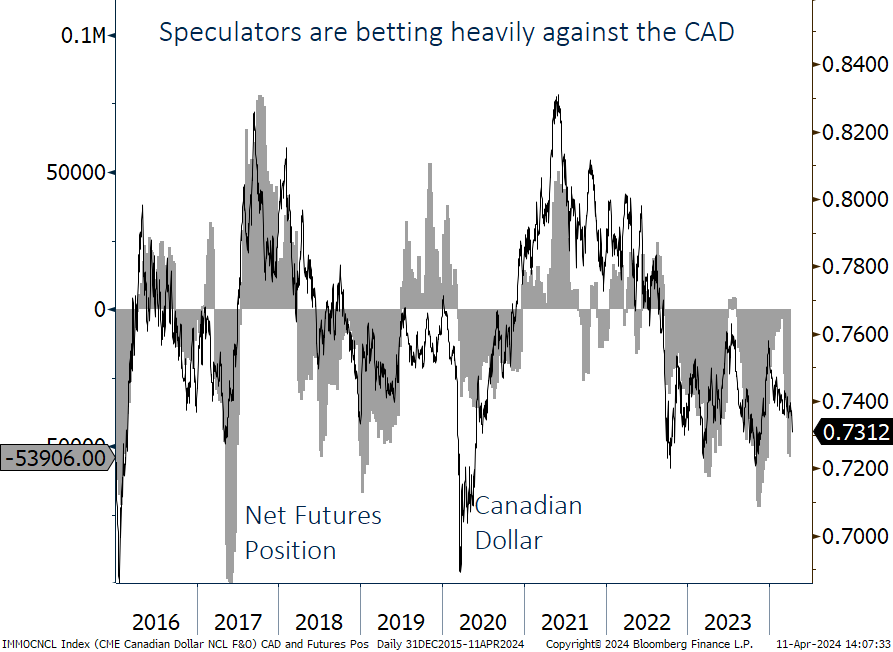

- In the near term, speculators are betting heavily against the Canadian dollar, historically a good contrary indicator.

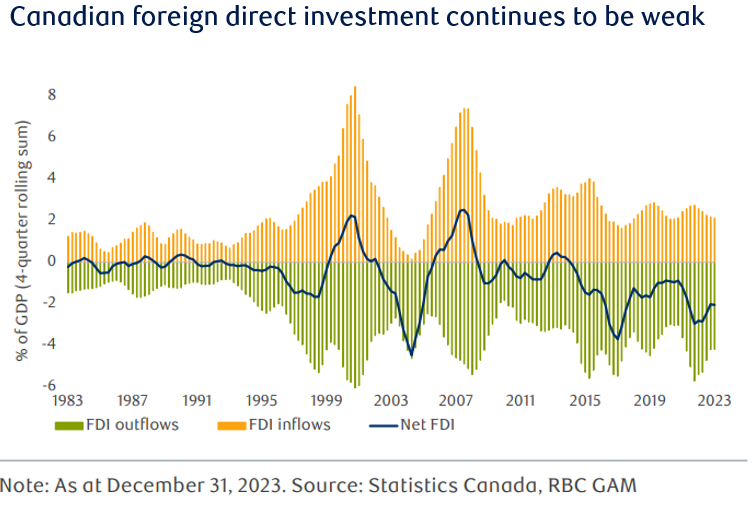

- Longer term, Canada continues to bleed foreign direct investment (i.e. external demand for Canadian dollars) and unless that shifts it is difficult to see the Canadian dollar breaking significantly north of $0.80.

- We continue to believe holding U.S. dollars is a powerful portfolio diversifier, particularly if the Canadian economy continues to underperform.

For the past few years, we have seen the U.S. economy and stock market’s performance cast a significant shadow on Canada. The U.S. continues to eclipse Canada in one other important factor, and that is in the currency market. The Canadian dollar has lost about 3% versus the U.S. dollar in a little over three months this year as the U.S. economy continues to outperform. The chart below measures economic momentum, with readings above zero indicative of an economy outperforming expectations, and readings below zero the opposite. A stark gap has opened up in 2024, with the U.S. doing quite nicely while Canada has seen some more troubling signs.

Bank of Canada on rate cut watch, Fed expectation pushed out to late 2024

This has changed the outlook on interest rates, with markets now expecting the Bank of Canada to cut rates before the Federal Reserve. RBC now sees only one Federal Reserve rate cut this year, coming in December, while June remains a possibility in Canada. As oil prices have had less of an impact on the Canadian dollar, expectations for interest rates have taken over, and this shift in expectations has worked in the U.S. dollar’s favour this year. If Canada’s economy continues to underperform the U.S., we would expect to see further weakness in the loonie in the medium term.

Speculators are leaning against the Canadian dollar, often a contrary short-term signal

In the short term, however, there is one factor in the Canadian dollar’s favour – everyone knows the facts laid out above, and therefore sentiment toward the Canadian dollar is very weak. We measure this by looking at how investors are betting on or against the Canadian dollar in the futures market, which is where currency speculators often ply their trade. As seen below, the level of bets against the Canadian dollar (when the grey line is below zero) is nearing levels where we have typically seen sellers get exhausted and the Canadian dollar stage a relief rally.

For more sustainable Canadian dollar gains, we need investment into our economy

Longer term, we think it will be difficult for the Canadian dollar to get significantly north of $0.80 unless something changes on the foreign direct investment front. As seen below, the last cycle of glory days for the loonie was during the early 2000s when foreign capital was flooding into the buildout of the oil sands and related infrastructure. In the past few years, we have seen a steady stream of foreign oil companies selling their assets to Canadian companies. Simply put, there is not a large degree of demand for Canadian dollars from foreign investors at the moment. It is no surprise that the Canadian dollar gave up parity for good right around the time that foreign direct investment turned negative. Canada remains a country rich in natural resources and has produced a technology champion or two in the past, so that is not to say that we couldn’t see another boom, but it does not appear to be imminent.

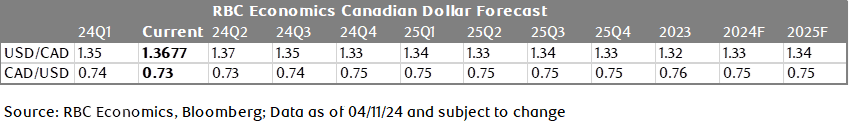

RBC’s official forecast calls for more of the same

If we look at RBC Economics’ official forecasts, they seem to reflect a similar view. They see the loonie trading in a range of $0.73-$0.76 to the end of 2025, with no large moves in either direction forecasted. With that said, economist forecasts are subject to revision, and if an event takes place which has a major impact on the currency we would expect an updated forecast.

Maintain U.S. dollar exposure in portfolios

With consensus expectations now matching our long-held view that the Bank of Canada is more at risk of cutting rates than the Federal Reserve, we have seen a repricing of the Canadian dollar. In the short term, sentiment may have run too far, but over the medium term we believe that U.S. dollar exposure is beneficial for Canadian investors. Canada’s economy seems set to continue underperforming the U.S., and more importantly, the U.S. dollar remains one of the only things that tends to go up when everything else is going down.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.