- Canada saw the second month of a row of softer than expected inflation, a sharp contrast to the end of 2023.

- Recent comments from the Bank of Canada and the Federal Reserve suggest they are ready to cut interest rates later this year.

- This confirms what markets have been pricing in for some time now, but nonetheless is a welcome development.

- Markets have put up strong year to date performance even as rate cut expectations have been pushed out.

- Confirmation from central banks that they are ready to provide some interest rate relief is another potential catalyst.

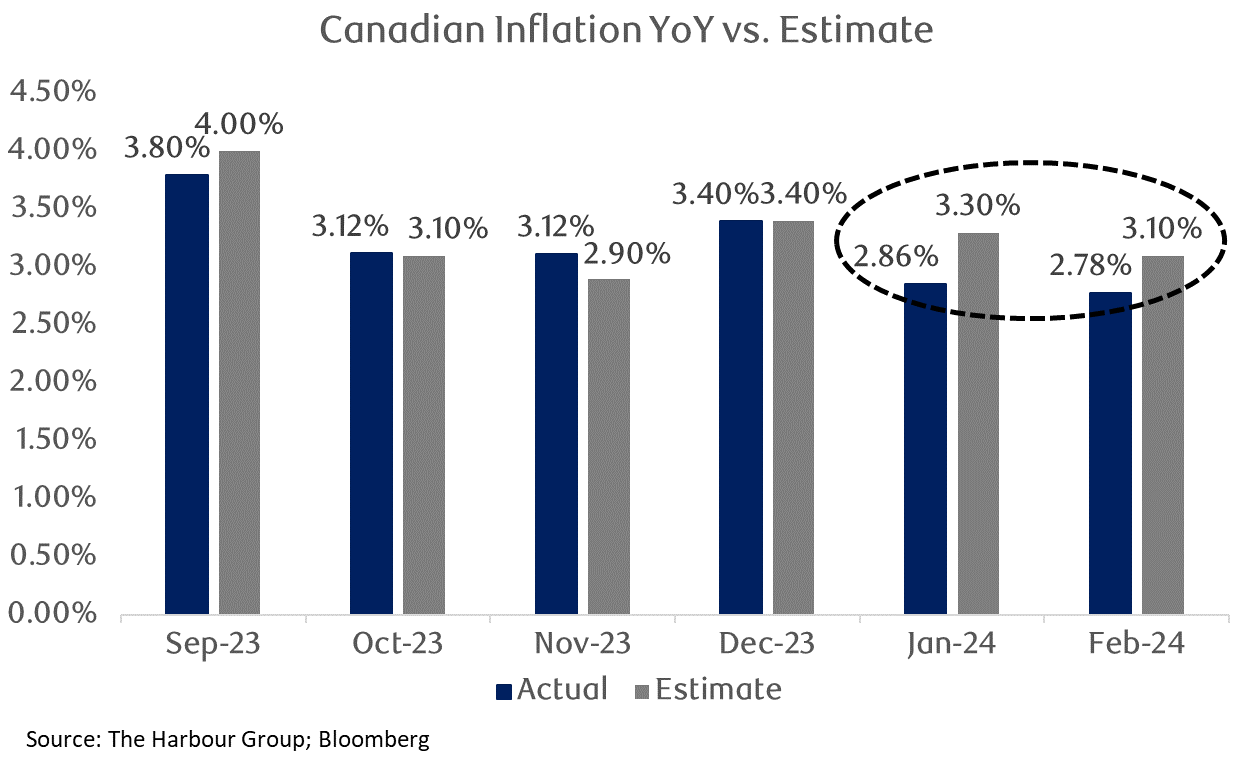

Canadian inflation trending lower…

The past week saw a number of important developments for investors on the inflation and interest rate front. In Canada, inflation had spent three of the past four months disappointing investors, either rising from the month prior or coming in higher than expectations. We are happy to report that for the second month in a row, headline inflation in Canada has declined, and also came in healthily below economists’ forecast, which is what tends to be the real market mover. Markets have already priced in the economists’ forecast, and typically any reaction in the aftermath of a release is due to the deviance from expectations as opposed to the overall number.

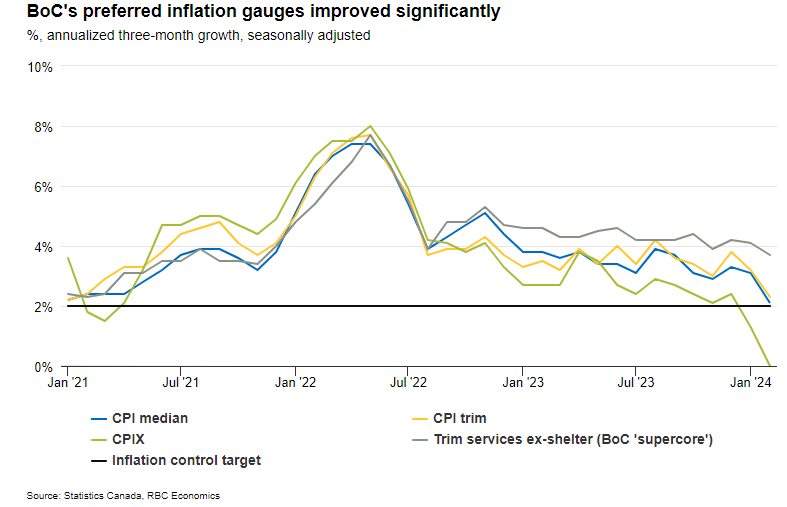

… with “core” prices improving sharply…

More importantly for the officials at the Bank of Canada, the so-called “core” inflation measures that strip out the most volatile components have decelerated sharply. While the media often focuses on the main inflation reading, the central bank’s decisions on interest rates are guided by these readings, which they believe give a truer reading of price pressures. As seen below, these the majority of these readings are now at or through the Bank’s implied 2% target on a three-month basis, suggesting the window is opening for interest rate relief to begin shortly should these trends persist.

…setting up central banks to offer interest rate relief as early as the summer

We received confirmation that this good news is being recognized in Ottawa, as the Bank recently released a summary of their deliberations for the March 6 interest rate decision. While they are worried about cutting interest rates too soon and causing a repeat of last spring’s brief housing market frenzy, they have admitted that should the economy evolve as expected, “the conditions for rate cuts should materialize over the course of this year.” Similarly, at the Federal Open Market Committee meeting earlier this week, Fed Chair Jerome Powell said “it will likely be appropriate to begin dialing back policy restraint at some point this year.” In case you don’t speak central banker-ese, that is code for “we will likely be in a position to cut interest rates later this year.”

We expect beaten-down dividend stocks to be prime beneficiaries of a lower-rate environment

As expected, markets took this news quite well, with stocks in Canada and the U.S. rising in the aftermath of the Fed meeting, with the S&P 500 putting in yet another all-time high. Back in February, we discussed how lower interest rates should benefit dividend stocks. This messaging from the central banks is the first step to eventually lowering interest rates. Presuming current inflation trends hold and the economy evolves according to plan, markets are pricing in the first rate cut for this summer, and given that stocks are always looking forward we would expect these beaten down sectors to react ahead of an eventual move lower in rates.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.