- While it has come with little fanfare, the S&P 500 traded to new all time highs this year.

- Investors fully allocated to equities likely feel this is something to cheer, but it can draw more mixed emotions for those looking to put cash to work.

- It certainly does not feel natural to enter the market at the “highest level ever”.

- Data shows that investor outcomes aren’t materially different than investing at any other time, making the case for dollar cost averaging.

- Markets are a forward looking indicator, suggesting that investors are discounting continued economic growth.

S&P 500 at new all-time high has not made nearly the news that it typically does

The U.S. stock market has been off to a strong start in 2024 with investor enthusiasm over artificial intelligence taking a lot of the headlines. What has been less well-reported is that the S&P 500 recently broke to a new all-time high, fully erasing the inflation and interest rate challenged market of 2022. For investors fully allocated to U.S. equities, this is no doubt something to cheer, but for those who are just putting money to work today it may feel a bit disheartening. After all, who wants to pay the highest price ever for anything?

Over the long term, the S&P 500 spends a lot of time trading near record highs

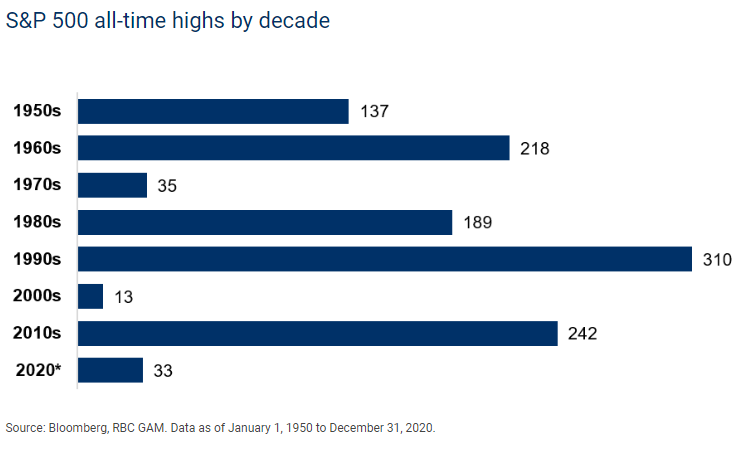

As it turns out, markets trading at or near an all-time high is fairly normal for the S&P 500. As seen below, it has not been uncommon to see the number of all-time highs per year at a dozen or more during sustained bull markets. Since 1948, the S&P 500 has spent 42% of the time within 5% of its all-time high, and anyone invested for that long (granted there aren’t many who have been invested for the entire period!) has done phenomenally well!

What is the impact on returns?

In our view, the more important factor to consider is what do the returns look like? Intuitively, we may think that an investor that only invests on days the market is at an all-time high is doomed to significantly underperform. After all, they are buying only at the peak! The results below may be a bit surprising. Sure enough, buying only at all-time highs does underperform over time, but not to a material degree. We would also note this is an extreme example – we haven’t had anyone come into our office and insist that we only put money to work on the days the market is at a new high. If anything this data reinforces the power of dollar cost averaging, whereby money is put to work over time and reduces the risks involved in market timing.

An important reminder that markets are a forward looking indicator

One of the key features of equity markets is that they are relentlessly looking forward – today’s news is already accounted for in the price, and any changes to prices reflect shifts in the future outlook. As the S&P 500 crests new highs this would suggest that the collective wisdom of the market is looking for better economic days ahead, and in fact has been since the fall of 2023. Recall that back then, the 10-year Treasury yield hit 5% and the fear was 6% was next, but the markets did what they always do and did their best to fool most of the people most of the time and rallied strongly. Lo and behold, U.S. economic data has been coming in better than expected over the past couple of months, validating the move higher in stocks. We don’t know what the future holds, but so long as equity markets are rising, the odds are that the economy will keep growing.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.